Singapore is expected to face a 0.6% contraction in the first quarter of 2020, the first one since the 2009 recession following the global financial crisis. Government ministers will take a one-month pay cut in their salaries, an unprecedented move by the trading hub to display solidarity with fellow citizens in response to Covid-19. The proposed GST tax will additionally be delayed, but finance minister Heng stressed the importance of it to build new healthcare facilities for its aging population. Singapore is well-positioned to maneuver through the difficulties posed by virus-related disruptions. The SGD/JPY found stability inside of its support zone from where a short-covering rally is pending.

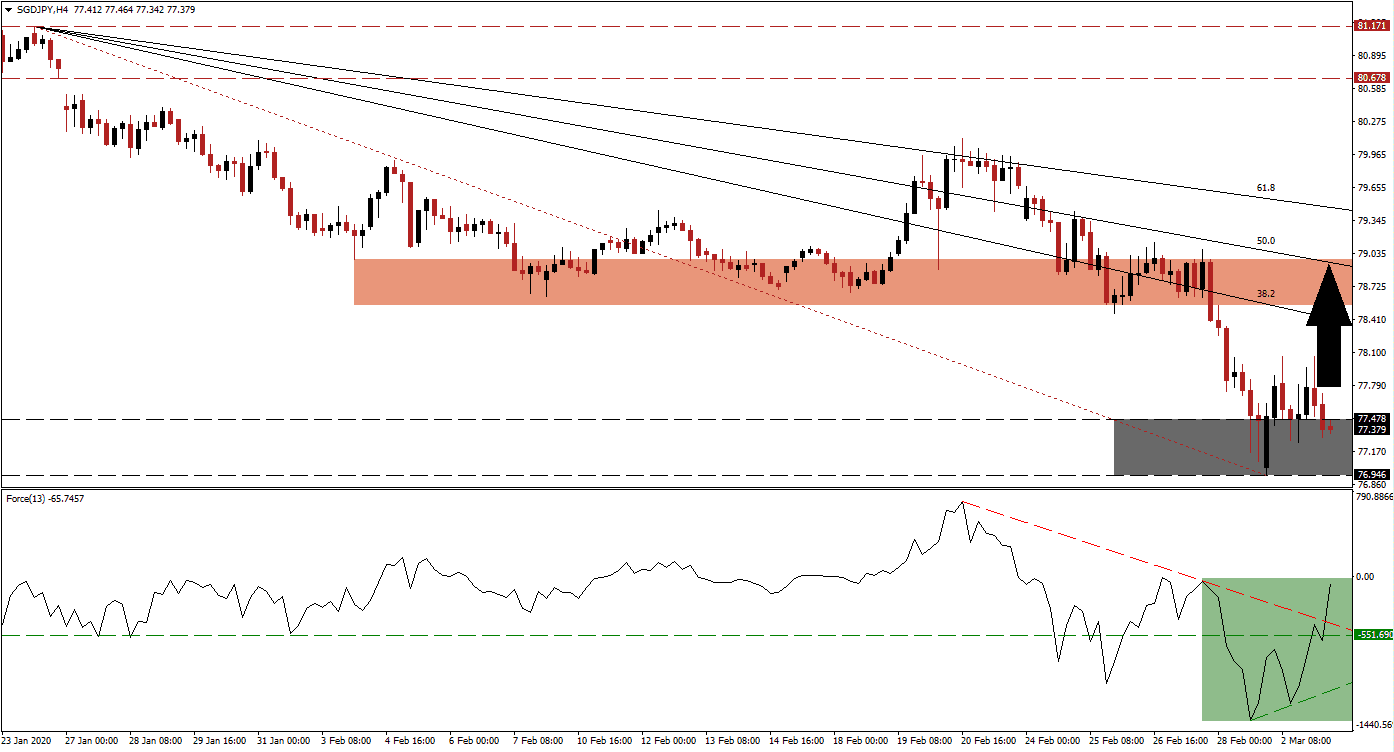

The Force Index, a next-generation technical indicator, points towards the sharp built-up in bullish momentum off of a fresh 2020 low. Following a lower high, an ascending support level materialized, anticipated to limit future reversals. The Force Index quickly converted its horizontal resistance level into support, as marked by the green rectangle. Adding bullish pressures is the breakout above its descending resistance level. This technical indicator is likely to push into positive territory, ceding control of the SGD/JPY to bulls.

After price action initially corrected into its support zone, a breakout followed but was unable to expand to the upside. Forex traders are now presented with a second buying opportunity as the SGD/JPY entered its support zone again. This zone is located between 76.946 and 77.478, as marked by the grey rectangle. Due to the increase in bullish pressures, a short-covering rally is favored to close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level.

Developing technical conditions, supported by fundamental developments, suggest a breakout extension in the SGD/JPY into its short-term resistance zone located between 78.547 and 78.977, as marked by the red rectangle, will follow. While calls for an interest rate cut by the Monetary Authority of Singapore (MAS) rise, it is likely to remain the last resort but a risk that should not be ignored. The 50.0 Fibonacci Retracement Fan Resistance Level. Is passing through the short-term resistance zone, marking the potential end of the pending advance. You can learn more about a breakout here.

SGD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 77.350

Take Profit @ 78.850

Stop Loss @ 76.900

Upside Potential: 150 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.33

A breakdown in the Force Index below its ascending support level is expected to lead to a breakdown attempt in the SGD/JPY. Safe-haven demand for the Japanese Yen remains in place, but the downside potential remains limited unless the MAS does announce an interest rate cut. Price action will face its next support zone between 75.910 and 76.270, offering a great buying opportunity.

SGD/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 76.650

Take Profit @ 76.000

Stop Loss @ 76.900

Downside Potential: 65 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.60