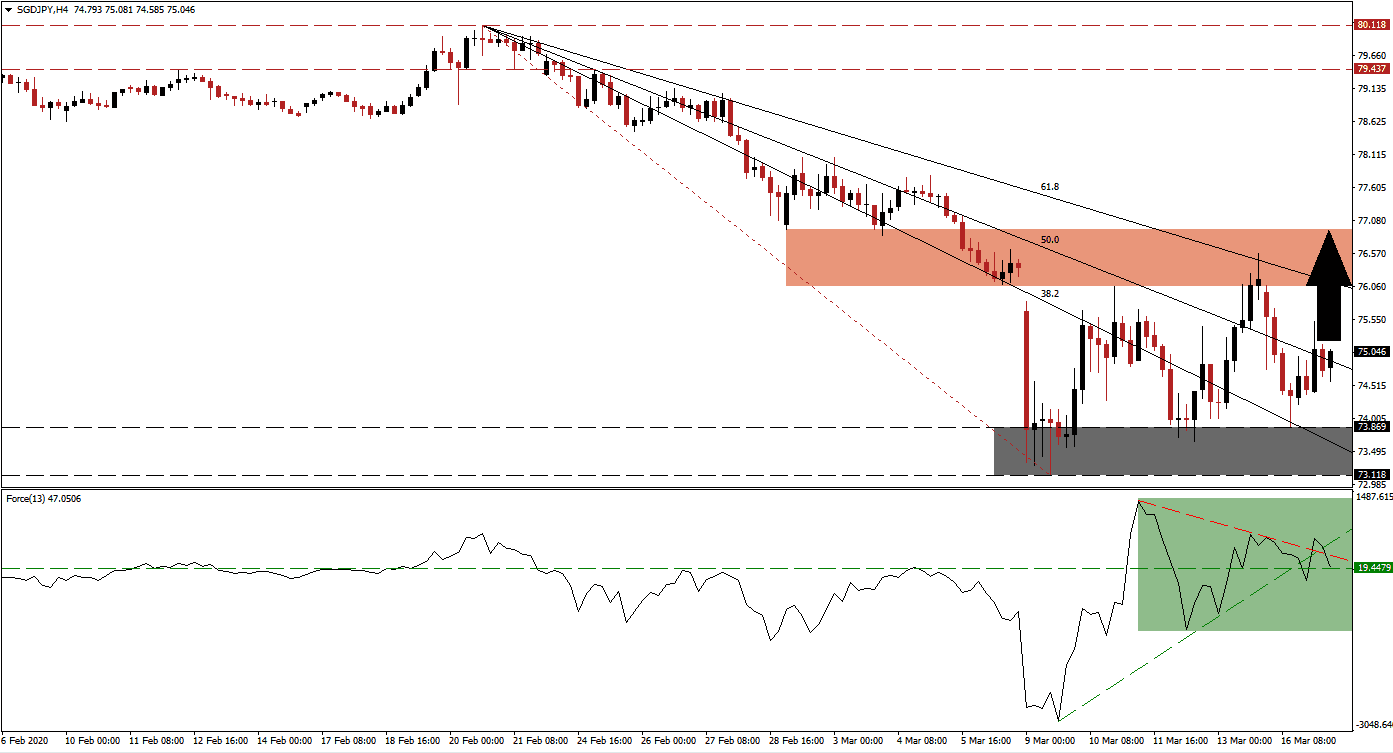

After the Bank of Japan held its emergency meeting yesterday, in response to the US Federal Reserve’s second panic response to Covid-19 this month on Sunday, more asset purchases were pledged. Safe-haven demand has resulted in a strengthening of the Japanese Yen, which is harming the countries export industry. According to the central bank, it will aggressively purchase ¥12 trillion worth of exchange-traded funds (ETFs) annualized and ¥180 billion of Japanese real estate investment trusts (J-REITs). The SGD/JPY was able to convert its descending 50.0 Fibonacci Retracement Fan Resistance Level into support.

The Force Index, a next-generation technical indicator, is hovering above its horizontal support level after retreating from a multi-week high. Following the contraction below its ascending support level, as marked by the green rectangle, the Force Index moved below its descending resistance level. Bulls remain in control of the SGD/JPY, while this technical indicator remains in positive territory above the 0 center-line. A series of higher highs and higher lows suggests more upside is pending.

This currency pair established a bullish chart pattern with three higher highs and three higher lows after descending into its support zone located between 73.118 and 73.869, as marked by the grey rectangle. Adding to short-term bullish developments is the breakout in the SGD/JPY above its 50.0 Fibonacci Retracement Fan Resistance Level. According to the latest quarterly survey conducted by the Monetary Authority of Singapore (MAS), the first-quarter GDP is expected to post a 0.8% contraction, reducing the annualized growth target to 0.6%. Despite the lowered annualized GDP figure, the outlook for this currency pair remains cautiously bullish.

One essential level to monitor is the intra-day high of 75.509, the peak of the current bounce higher off of the top range of the support zone. A sustained advance above this level will clear price action to accelerate through its 61.8 Fibonacci Retracement Fan Resistance Level and into its short-term resistance zone. This zone awaits the SGD/JPY between 76.053 and 76.946, as identified by the red rectangle, which includes a price gap to the downside. An extension of the breakout sequence is favored on the back of likely Japanese Yen weakness enforced by the Bank of Japan. You can learn more about a breakout here.

SGD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 75.050

Take Profit @ 76.950

Stop Loss @ 74.500

Upside Potential: 190 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 3.46

A breakdown in the Force Index, initiated by its descending resistance level, is anticipated to lead to more downside in the SGD/JPY. With Covid-19 expanding globally, safe-haven demand will remain dominant. The next support zone for this currency pair is located between 69.380 and 70.520, including two price gaps to the upside. Forex traders are advised to remain cautious with the Japanese central bank uneasy about its currency.

SGD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 72.600

Take Profit @ 70.500

Stop Loss @ 73.400

Downside Potential: 210 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 2.63