New Zealand and Singapore announced initial economic stimulus measures, the latter leading the fight against Covid-19 related disruptions. A global economic recession is now anticipated. Singapore is rumored to prepare a second stimulus ranging between S$14 and S$16 billion. The most significant difference is that Singapore can fund the package from this term’s remaining budget surplus of S$7.7 billion, plus additional capital from currency reserves. Other developed countries have to increase debt substantially. Following the technical recovery in the NZD/SGD, a fresh breakdown sequence is expected.

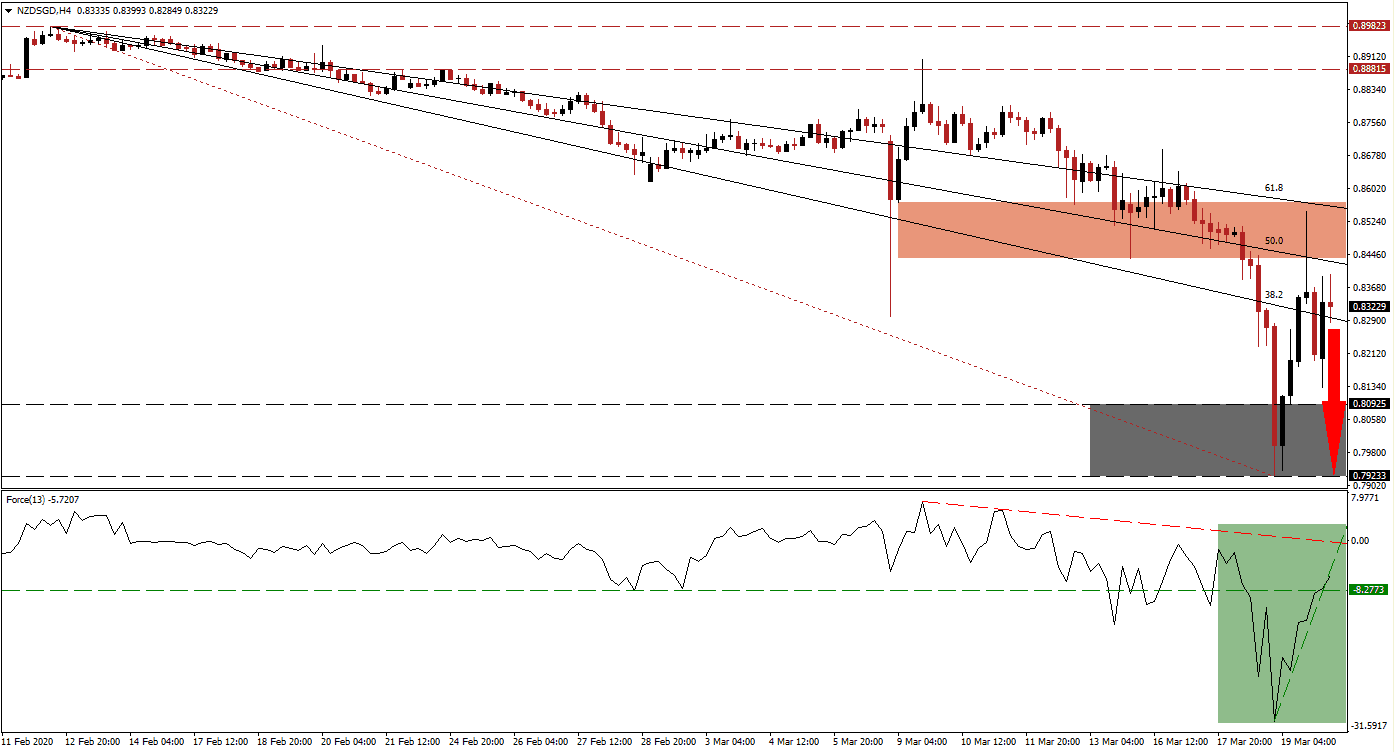

The Force Index, a next-generation technical indicator, shows the recovery in bullish momentum after plunging to a new 2020 low, but the steep ascending support level is unable to sustain the recovery. It sufficed to convert the horizontal resistance level into support, as marked by the green rectangle. Bears are in control of the NZD/SGD with this technical indicator below the 0 center-line. The descending resistance level is adding to breakdown pressures.

After the descending 61.8 Fibonacci Retracement Fan Resistance Level rejected this currency pair, enforcing the dominant bearish chart pattern, a renewed push to the downside is anticipated. The 50.0 Fibonacci Retracement Fan Resistance Level crossed below its short-term resistance zone located between 0.84369 and 0.85689, as marked by the red rectangle, adding to bearish developments in the NZD/SGD. Singapore’s fiscal situation adds a fundamental catalyst to price action, suggesting a weaker exchange rate moving forward.

Forex traders are recommended to monitor the intra-day low of 0.82989, the low of a previously reversed breakdown. A push lower is favored to invite the next wave of net sell orders and provide the necessary catalyst for this currency pair to retreat into its support zone. It is identified between 0.79233 and 0.80925, as marked by the grey rectangle. More downside in the NZD/SGD cannot be ruled out. You can learn more about a support zone here.

NZD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.83250

Take Profit @ 0.79250

Stop Loss @ 0.84550

Downside Potential: 400 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 3.08

In case of a sustained breakout in the Force Index above its descending resistance level, the NZD/SGD is likely to attempt an extension of its current recovery. With the dominant fundamental outlook suggesting more downside pressure in price action, the upside potential is limited to its next long-term resistance zone. This zone is located between 0.88815 and 0.89823, presenting Forex traders an exceptional selling opportunity.

NZD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.86400

Take Profit @ 0.89000

Stop Loss @ 0.85400

Upside Potential: 260 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 2.60