New Zealand announced that it is prepared to jump-start $12 billion worth of infrastructure projects to indirectly stimulate the economy, providing a buffer from Covid-19 related disruptions. The country only recorded three cases to date, but its close trading relationship with China pressured its currency to the downside. Singapore emerged as the most successful country in containing the spread, with a high recovery rate and no death. The government announced a healthy aid package to assist businesses and consumers. After the NZD/SGD advanced out of its support zone, a renewed sell-off is expected.

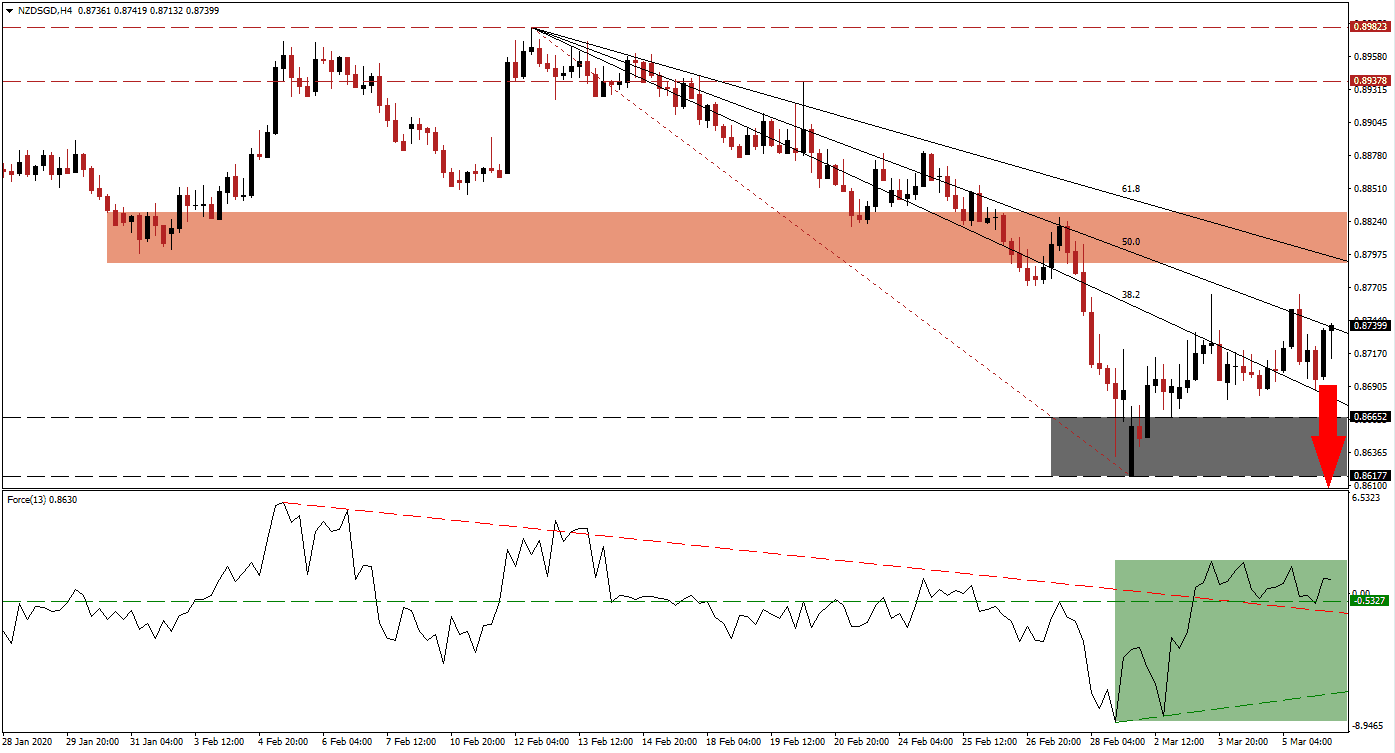

The Force Index, a next-generation technical indicator, spiked higher after a lower high allowed the emergence of an ascending support level. It converted its horizontal resistance level into support, as marked by the green rectangle. The Force Index additionally eclipsed its descending resistance level, pushing into positive territory, and temporarily placing bulls in charge of the NZD/SGD. This technical indicator started to lose momentum, and a triple breakdown is pending. You can learn more about the Force Index here.

With a clouded economic outlook, the Reserve Bank of New Zealand may announce an interest rate cut. S&P Global Ratings released its latest economic assessment for the Asia-Pacific region, noting a combined economic loss of $211 billion is currently anticipated due to the coronavirus. Singapore was singled out in a small group of highly impacted economies, but New Zealand’s net exposure to China create a bearish bias in the NZD/SGD. The descending 50.0 Fibonacci Retracement Fan Resistance Level is likely to enforce the long-term downtrend, resulting in a lowering of the short-term resistance zone located between 0.87904 and 0.88318, as marked by the red rectangle.

A breakdown in this currency pair below its 38.2 Fibonacci Retracement Fan Support Level will provide sufficient downside pressure to force an extension below its support zone. This zone is located between 0.86177 and 0.86652, as marked by the grey rectangle. It will clear the path for a more massive correction into its next support zone, which awaits the NZD/SGD between 0.82750 and 0.83700, dating back to November 2008, as the global financial crisis ravaged the economy. You can learn more about a breakdown here.

NZD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.87350

Take Profit @ 0.83100

Stop Loss @ 0.88350

Downside Potential: 425 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 4.25

Should the Force Index advance off of its descending resistance level, currently acting as short-term support, the NZD/SGD is favored to attempt a breakout. Due to the emerging fundamental outlook for this currency pair, the upside appears limited to its next long-term resistance zone located between 0.89378 and 0.89823. Forex traders are advised to consider this a good short-selling opportunity unless fundamental conditions change significantly.

NZD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.88850

Take Profit @ 0.89650

Stop Loss @ 0.88450

Upside Potential: 80 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.00