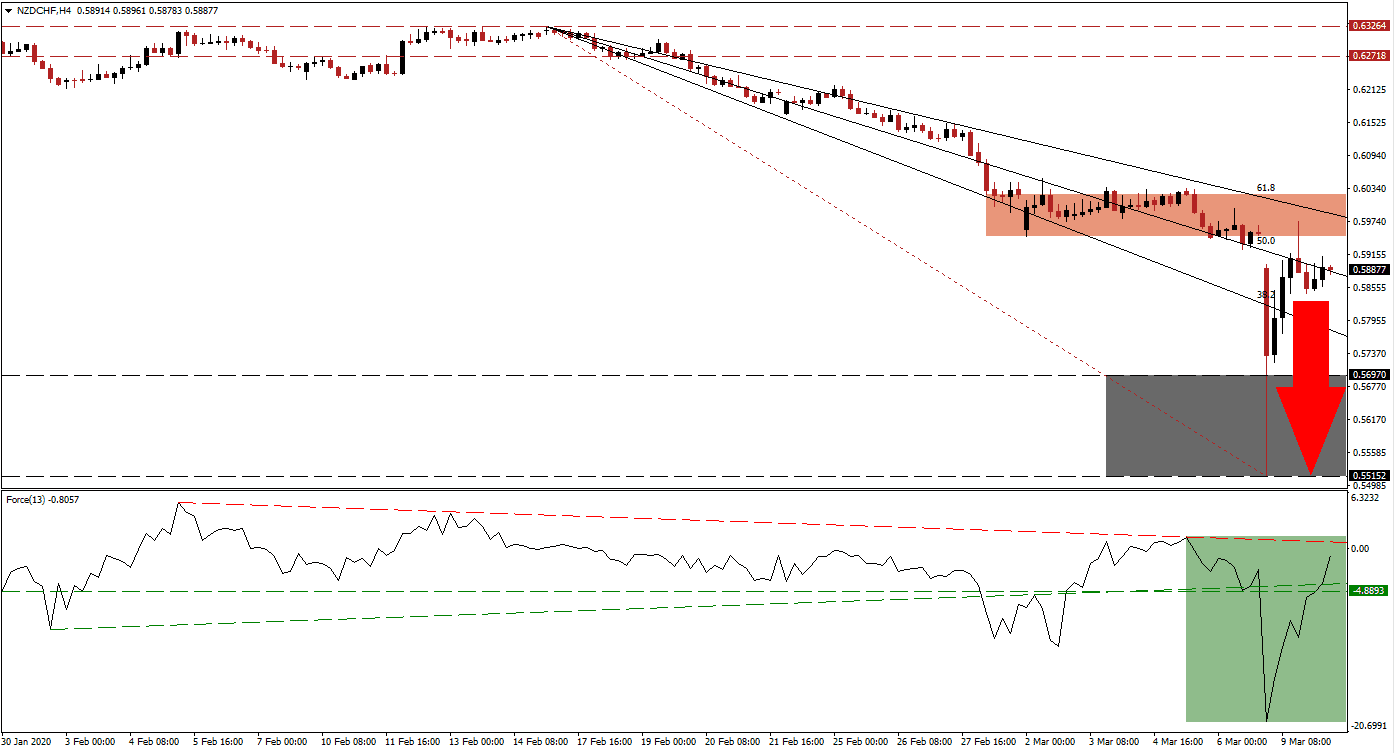

After a violent sell-off yesterday due to the most significant collapse in oil prices, this currency pair recovered off of a support zone dating back to March 2009. Financial markets now anticipate a massive stimulus package out of the US as soon as today. Oil prices are recovering amid a short-covering rally, but risks to the global economy continue to expand. Therefore, safe-haven demand for the Swiss Franc is favored to keep bearish pressures in the NZD/CHF intact. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, points towards a recovery in bullish momentum after collapsing to a new 2020 low. It resulted in the conversion of its horizontal resistance level into support and elevated the Force Index above its ascending support level, which acted as temporary resistance. This technical indicator is now approaching its descending resistance level in negative territory, as marked by the green rectangle. A rejection is anticipated to lead the NZD/CHF into a renewed contraction.

New Zealand manufacturing data for the fourth quarter surprised to the upside but was overshadowed by dismal logistics data for February, confirming economic disruptions related to Covid-19. After the NZD/CHF was rejected by its short-term resistance zone located between 0.59471 and 0.60236, as marked by the red rectangle, the descending Fibonacci Retracement Fan sequence is expected to guide price action to the downside. The Swiss National Bank, known for direct market manipulation, remains a wildcard as it prefers a weak currency to support its export sector.

One essential level to monitor is the intra-day low of 0.58449, the low of the most recent rejection in this currency pair. A breakdown is likely to result in the addition of new net short positions. It will also clear the NZD/CHF to accelerate into its support zone located between 0.55152 and 0.56970. While more downside cannot be ruled out, a significant fundamental catalyst will be required. The Swiss central bank is unlikely to allow Swiss Franc strength to threaten its domestic economy, without an attempt to weaken it.

NZD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.58850

- Take Profit @ 0.55350

- Stop Loss @ 0.59750

- Downside Potential: 350 pips

- Upside Risk: 90 pips

- Risk/Reward Ratio: 3.89

A sustained move in the Force Index above its descending resistance level is favored to inspire a breakout in the NZD/CHF. It will end the dominant bearish chart pattern and allow this currency pair to recover. Due to the existing fundamental scenario, the long-term resistance zone located between 0.62718 and 0.63264 is expected to provide a principal challenge for price action.

NZD/CHF Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.60550

- Take Profit @ 0.62850

- Stop Loss @ 0.59750

- Upside Potential: 230 pips

- Downside Risk: 80 pips

- Risk/Reward Ratio: 2.88