Volatility in the NZD/CAD spiked after OPEC+ determined to end their agreement to limit supply and stabilize prices. Russia decided on a strategy change, prompting Saudi Arabia to announce aggressive supply expansion. The New Zealand and Canadian Dollars are both commodity currencies, with the latter more massively exposed to the oil markets. Price action initially collapsed in a flash crash, mirroring the Japanese Yen, but quickly recovered into its resistance zone. A minor corrective phase is likely to precede more upside.

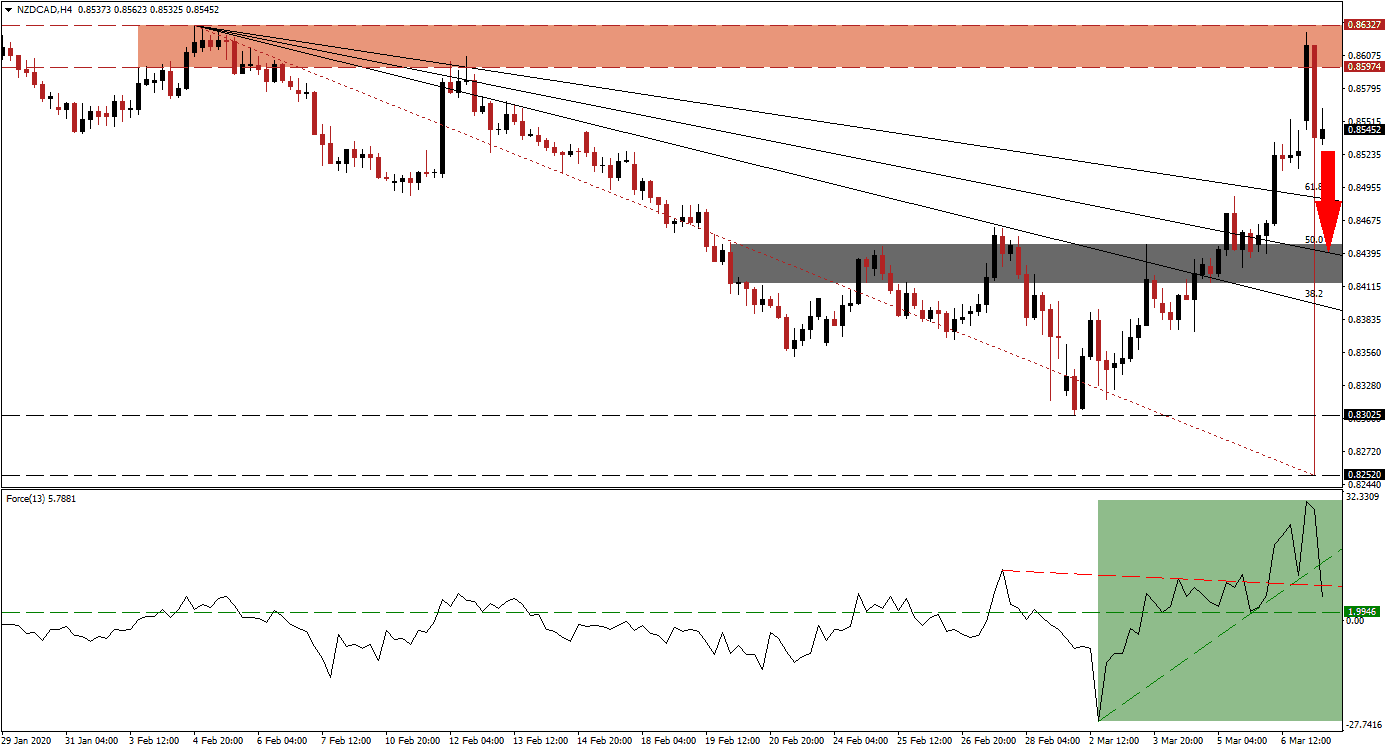

The Force Index, a next-generation technical indicator, accelerated to a new 2020 peak. Bullish momentum is now fading, suggesting an extension of the rejection in this currency pair. A double breakdown, below its ascending support level and its descending resistance level, materialized. This technical indicator remains in positive territory with bulls in control of price action. Conversion of its horizontal support level into resistance is anticipated to place bears in charge of the NZD/CAD. You can learn more about the Force Index here.

Canada’s economy was struggling before the outbreak of Covid-19. Rail strikes added additional stress, with roughly 25% of businesses reporting a negative impact as of last week. The pending production increase in oil, slated to take effect on April 1st, will further threaten the fragile domestic economy. It creates a distinct long-term bullish bias for the NZD/CAD, but a move into its short-term support zone is likely before price action may resume its breakout sequence. This zone is located between 0.84147 and 0.84471, as marked by the grey rectangle.

Bill Morneau, the Canadian Finance Minister, claims the treasury is well-prepared to handle Covid-19. Those claims were made before the collapse in oil prices, while critics slam reckless spending by the Trudeau government. New Zealand faces economic difficulties of its own but is fundamentally in a more stable position. Following the rejection in the NZD/CAD by its resistance zone located between 0.85974 and 0.86327, as marked by the red rectangle, a move in the NZD/CAD into its descending 50.0 Fibonacci Retracement Fan Support Level is expected.

NZD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.85450

Take Profit @ 0.84400

Stop Loss @ 0.85700

Downside Potential: 105 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 4.20

Should the Force Index push above its ascending support level, converting it into temporary resistance, the NZD/CAD is likely to attempt a breakout above its resistance zone. With the long-term outlook increasingly bullish, skipping a minor correction will position this currency pair for a more massive sell-off in the future. The next resistance zone awaits price action between 0.86759 and 0.87001.

NZD/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.86100

Take Profit @ 0.87000

Stop Loss @ 0.85750

Upside Potential: 90 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.57