After the Reserve Bank of New Zealand announced NZ$30 billion worth of domestic bond purchases, the NZD/CAD was able to complete a double breakout. The central bank’s quantitative easing program equals roughly 10% of GDP and is welcomed by markets during the Asian trading session. Tourism and agricultural exports represent critical sectors of the economy and are hard hit by Covid-19. Canada’s economy is suffering potentially its most significant challenge in recent history. Over 500,000 employees applied for benefits in one week alone, Covid-19 and the plunge in oil prices are depressing economic activity, which already suffered from railroad blockades. The government announced C$82 billion in federal aid while the Bank of Canada slashed interest rates.

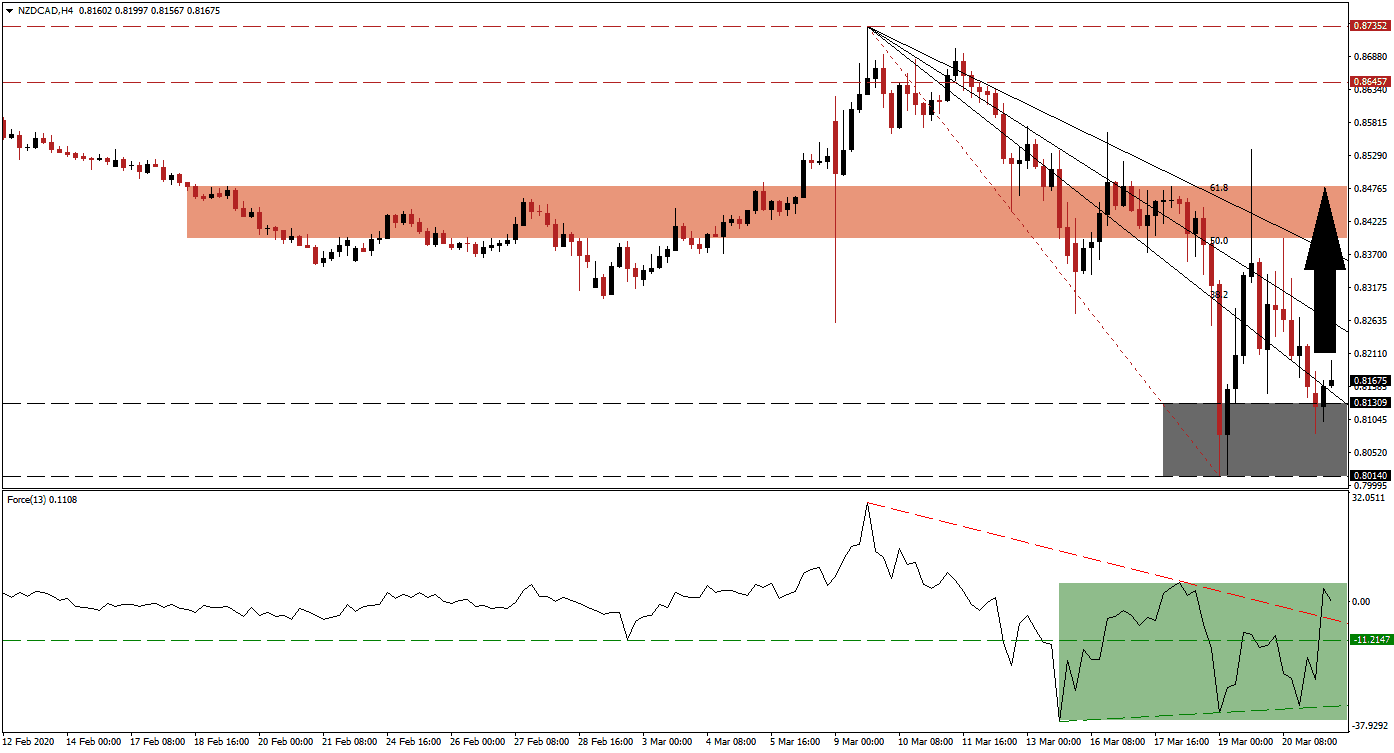

The Force Index, a next-generation technical indicator, shows the presence of a positive divergence after the emergence of three higher lows. The Force Index recovered off of its ascending support level and quickly converted its horizontal resistance level into support. A breakout above its descending resistance level followed, as marked by the green rectangle. This technical indicator is now positioned to cross above the 0 center-line, placing bulls in control of the NZD/CAD. You can learn more about the Force Index here.

Price action completed a double breakout above its support zone located between 0.80140 and 0.81309, as identified by the grey rectangle, and its descending 38.2 Fibonacci Retracement Fan Resistance Level. New Zealand is in a stronger fiscal position than Canada to maneuver through the next few months and a potential global recession, creating a distinct long-term bullish fundamental driver for the NZD/CAD. China may exit the crisis first, adding to the economic recovery potential if New Zealand.

Given the built-up in bullish pressures, this currency pair is favored to push through its 50.0 Fibonacci Retracement Fan Resistance Level, providing the necessary catalyst to spark a short-covering rally. The NZD/CAD is likely to challenge its short-term resistance zone located between 0.83960 and 0.84797, as marked by the red rectangle. More upside cannot be ruled out due to the extreme oversold nature of price action. You can learn more about a short-covering rally here.

NZD/CAD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.81650

Take Profit @ 0.84650

Stop Loss @ 0.80750

Upside Potential: 300 pips

Downside Risk: 90 pips

Risk/Reward Ratio: 3.33

A double breakdown in the Force Index below its descending resistance level and its horizontal one is anticipated to pressure the NZD/CAD to the downside. The next support zone awaits this currency pair between 0.78070 and 0.78700. It represents an outstanding buying opportunity for Forex traders to consider, with the fundamental outlook turning increasingly bullish.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.79850

Take Profit @ 0.78650

Stop Loss @ 0.80350

Downside Potential: 120 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.40