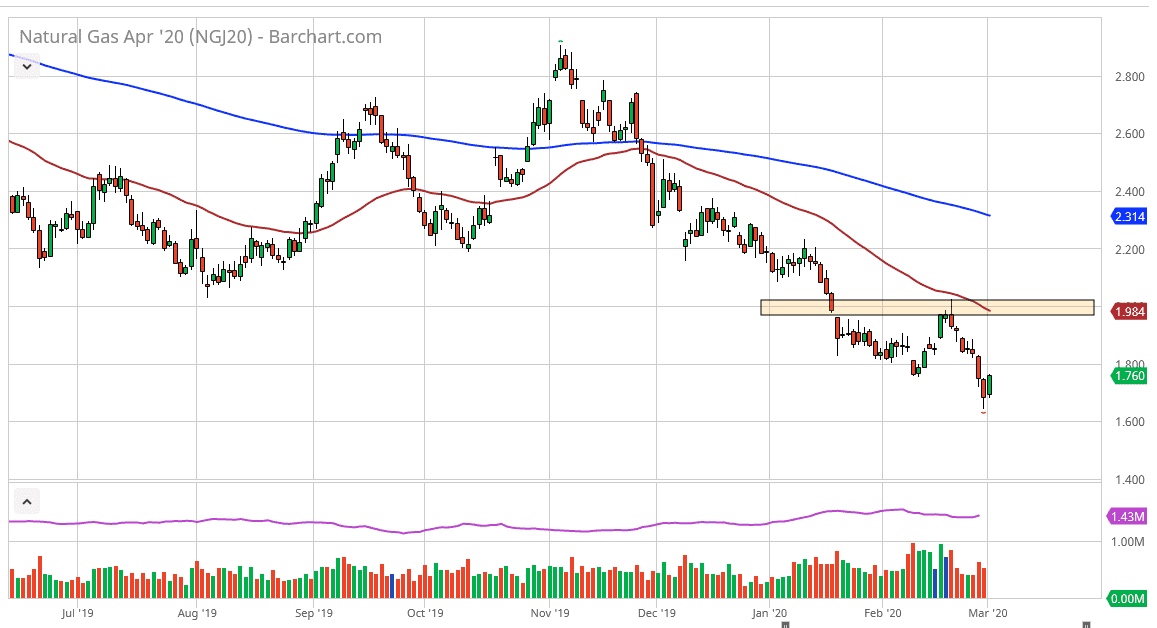

The natural gas markets have rallied significantly during the trading session on Monday as traders came back to work, as we reached as high as the $1.76 level. The $1.80 level above should be resistance, but I think there’s even more resistance near the 50 day EMA. The 50 day EMA is starting to slip through the $2.00 level, and therefore it’s very likely that we continue to see selling. Ultimately, this is a market that should continue to find plenty of people looking to short this market as it makes no sense for natural gas to rally for a longer term.

The candlestick for the trading session on Monday has closed towards the top of the range, so that does suggest that one would probably see a bit of continuation, showing signs of a bit of a relief rally. Quite frankly, the US dollar has rolled over a bit and that could give traders the reason to go long of commodities in general. Furthermore, there are a lot of people out there anticipating that central banks around the world are looking to cut rates, and people are even starting to speculate that the Federal Reserve will cut 75 basis points during the month of March.

While that is probably going to be very unlikely, the reality is that the market believes it for the moment. A cheaper dollar suggest higher commodities, but it also could drive the idea of a market that should see the economy stretch a bit, as they flood the economy with money, the idea is that more economic expansion happens. That then in theory should drive up demand for natural gas. Obviously, this won’t actually work but it is the correlation that a lot of traders will look towards. At this point, we are oversold so a bit of a bounce makes quite a bit of sense also. Looking at the natural gas markets, they have major issues, not the least of which is going to be the fact that they are oversupplied. Furthermore, the weather isn’t going to be working in favor of higher natural gas prices either, as we have seen far too much in the way of supply to think that any type of demand is going to wipe it out. We need to see some type of major slew of bankruptcies in the United States when it comes to natural gas suppliers and drillers to see a real surge for a longer-term move.