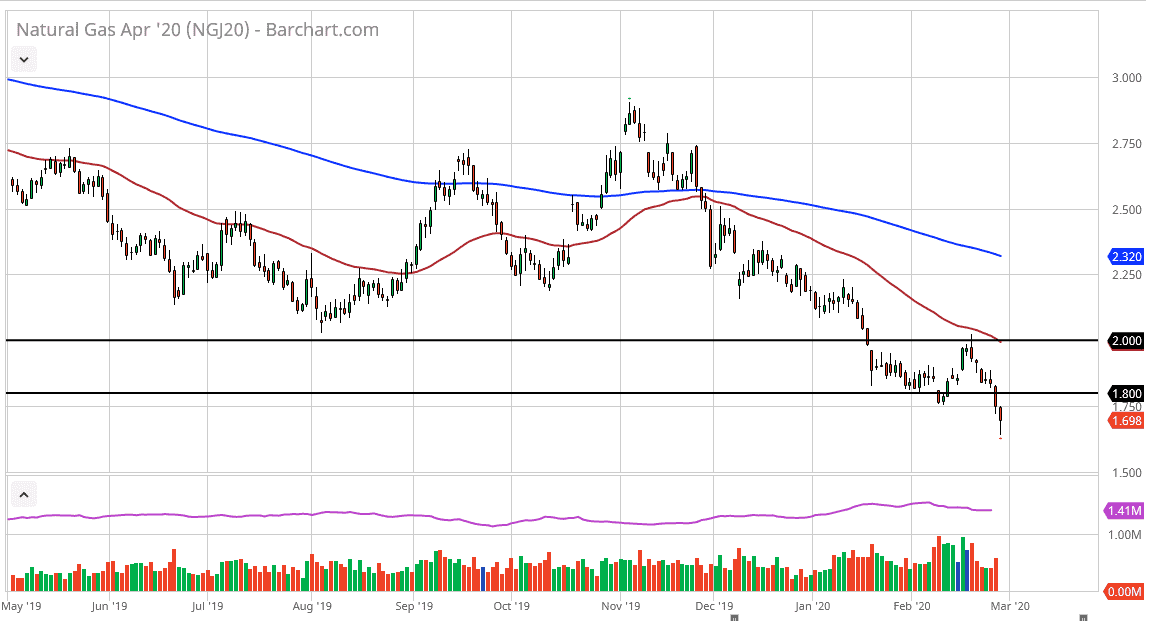

The natural gas markets broke down a bit during the trading session again on Friday, as we continue to see a lot of weakness in this market. The oversupply of natural gas continues to be a major concern and as far as I can tell, it’s very likely that the market will try to bounce back a bit, but the $1.80 level above will probably offer resistance as it was previous support.

Looking at the shape of the candlestick, it does suggest that we are going to form a hammer like candle but more than likely this is going to be a bit of profit-taking going into the weekend. After all, the last thing traders want to do is have a bunch of risk on heading into the weekend as there will certainly be major headlines coming out. At this point, the market is a bit oversold so don’t be surprised at all to see profit-taking.

The $1.80 level was previous support so it’s very likely to offer a bit of “market memory.” Overall, if the market breaks above there then I think we enter a $0.20 area that could offer a significant amount of resistance that extends all the way to the $2.00 level. The 50 day EMA is breaking down below the $2.00 level and that should offer quite a bit of resistance as well. Ultimately, it’s only a matter of time before sellers come back in due to the extreme oversupply of natural gas and of course the warmer temperatures coming to the northern hemisphere. Ultimately, the market is likely to see a lot of downward pressure due to the fact that people simply don’t have demand out there. Beyond that, the oversupply is going to continue to be an issue for the foreseeable future as the structural situation continues to be very bearish. We had gotten an inventory number that was very dovish indeed, so I think that continues to work against the value of this market. Regardless though, markets cannot go in one direction forever, so it makes sense that we will get the occasional rally that can be sold into. The $2.00 level will continue to show a lot of psychological importance, and I think breaking above there would attract a lot of attention. However, I don’t see that happening anytime soon. I continue to fade rallies going forward.