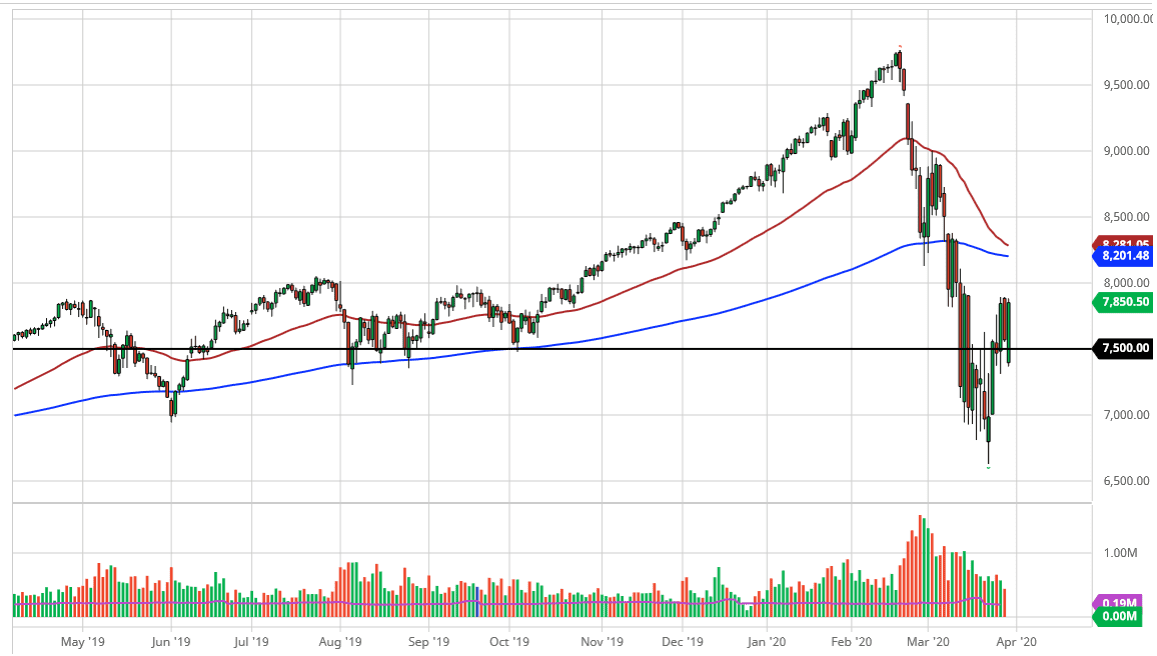

The NASDAQ 100 has had a strong session on Monday, after initially gapping lower. In fact, the market has closed towards the very top of the range, showing signs of strength yet again. We are closing just below the 8000 handle, near the 7850 region. If we can break above the 8000 level, it’s very likely that the market continues to go higher, perhaps breaking towards the 200 day EMA at the 8200 level.

The alternate scenario of course is that we pullback, but that pullback probably has buyers coming back near the 7500 level. Breaking down below the bottom of the range for the trading session would be a very negative sign, opening up the door for a pullback to the 7000 handle. All things being equal, I do think that the market is going to see a significant pullback sooner rather than later, but in the short term we may have a slight pop still coming.

The Federal Reserve is doing everything you can to keep the market alive, and that of course has a certain amount of influence. The question really isn’t so much as to whether or not there are economic issues but whether or not this is simply a “bear market rally” or not. When you get a massive selloff like we have had, markets almost always come back to retest the lows, or at least get close to it. I think that is what a lot of people are waiting for before they throw a ton of money at the market, and most buying at this point is probably more or less from a longer-term value proposition standpoint.

In general, I believe that this market will be a leading indicator, but one thing that you may want to pay attention to is the Russell 2000 as it is even more of a leading indicator than the NASDAQ 100. If that market starts to rollover it would be a very bad sign for various indices in the United States. To the upside, if we can break above the 200 day EMA, then we could start to see an attempt to fill that gap which would mean a move towards the 8500 level. I do think that happens given enough time, but we need to see the market clear the 8000 hurdle first, and then have a little bit of follow-through. I would keep my position size somewhat small.