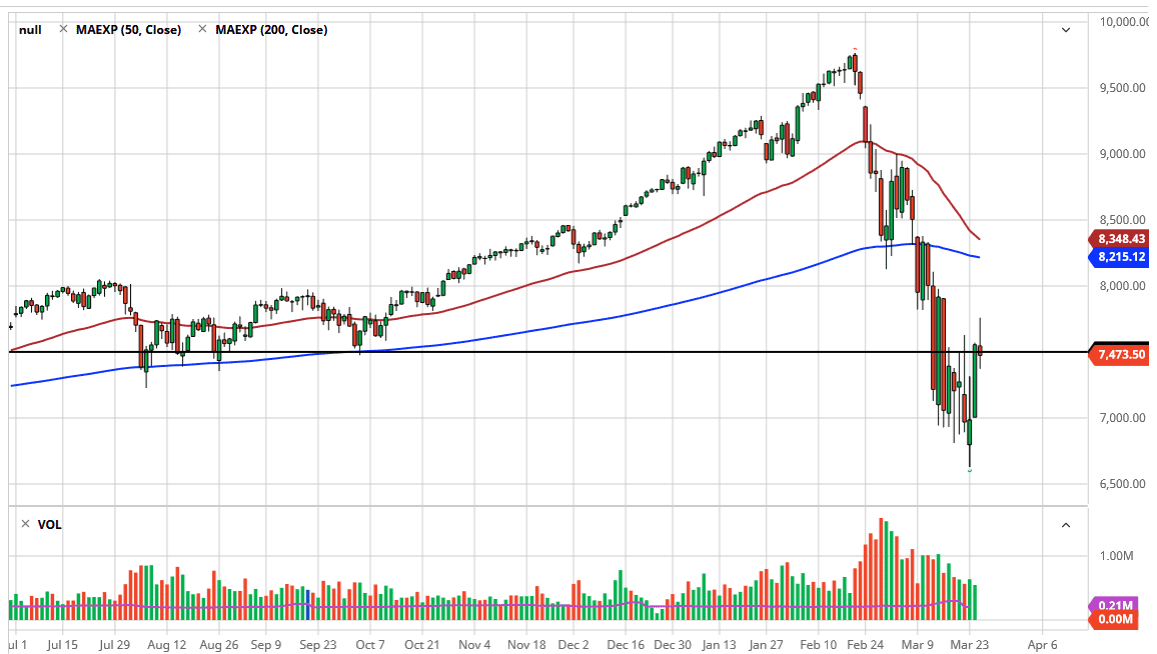

The NASDAQ 100 had an interesting session on Wednesday, as it initially fell but then turned around to spike well above the 7500 level. However, by the end of the day the market found itself going negative again and forming a shooting star. The shooting star of course is a negative candlestick and it’s likely that we will see a bit of a pullback from this area. When you look at the chart, the 7500 level of course is a large, round, psychologically significant figure, but it is also an area that previously had been supported. Remember, “what was once support becomes resistance” according to technical analysts, and this is a perfect example of that.

While we have had a nice run higher over the last couple of days, it certainly seems as if we are struggling to continue that move. I think a pullback could send the NASDAQ 100 down towards the 7000 level, but I’m not necessarily looking for another massive meltdown. At the very least, even if we were bullish, I would assume that the market would have to retest the bottom again to make sure that there truly is a “bottom” down there. The 7000 level is the epicenter of that, which makes quite a bit of sense as it is a large, round, psychologically significant figure.

The alternate scenario would be that the market breaks above the top of the shooting star for the trading session on Wednesday and continues to go higher. That would most certainly be a very bullish sign and probably has the NASDAQ 100 looking very likely to go looking towards the 8000 handle. A break above there then it opens up the door to the 8250 handle. That being said though, I am much more comfortable shorting rallies and try to buy a breakout at this point. That’s not to say that we won’t break out and go higher some time, but clearly there are plenty of reasons out there to think that markets will still be very skittish, and typically a nervous market is much more likely to go lower than higher. Having said that, there are a couple of clear parameters to pay attention to, and therefore the signals to trade the NASDAQ 100 are somewhat straightforward for once, as we had made such a nice range of the last several trading sessions.