The NASDAQ 100 has broken down rather significantly during the trading session on Thursday, as we continue to see a lot of panic when it comes to the coronavirus situation. The idea of the economy standing still of course has a major influence on what happens next, as it will certainly cause major economic pain for a lot of companies around the world. At this point, the market will continue to be very jittery, and quite frankly I think it’s difficult to start buying heading into the weekend. At the very least, I think you should probably wait until Monday, because of the possibility of massive amounts of headlines coming out over the weekend. After all, you don’t want to be holding one of these contracts on Monday if it gaps limit down again. There are futures traders out there that have taken horrific losses due to this, as there simply nothing you can do until the markets open back up.

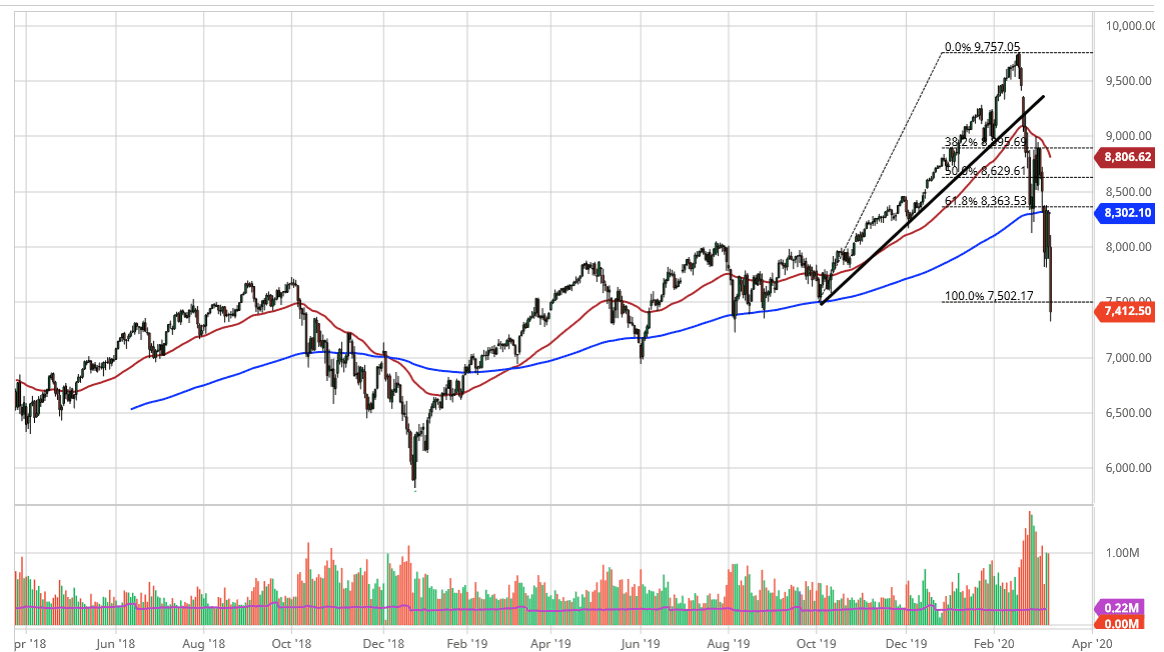

Looking at this chart, you should also point out that the 7500 level is an area that will attract a certain amount of attention, as it is a large, round, psychologically significant figure. Furthermore, it was also where we had seen the 100% Fibonacci retracement level, so at this point it looks like we are going to continue extending this lower unless of course we get some type of good news. Unfortunately, good news will probably be faded unless it is a massive amount of stimulus coming out of the government. While that is possible, it should be noted that if we were to turn around you will more than likely get several attempts to buy the market on dips. The massive amount of issues that we see in the marketplace continue to be there, so I think it is probably more likely to fall from here more than anything else.

If we break down below the 7000 level, that would be a truly negative sign, and opens up the door down to the 6500 level. Friday is going to be interesting regardless, so if you do feel the need to trade this market, I would ask you to do so in a small position simply because the volatility could be rather wild as we did see during the trading session on Thursday. Ultimately, the markets continue to be very difficult to deal with and therefore you should keep in mind that staying on the sidelines is also possible.