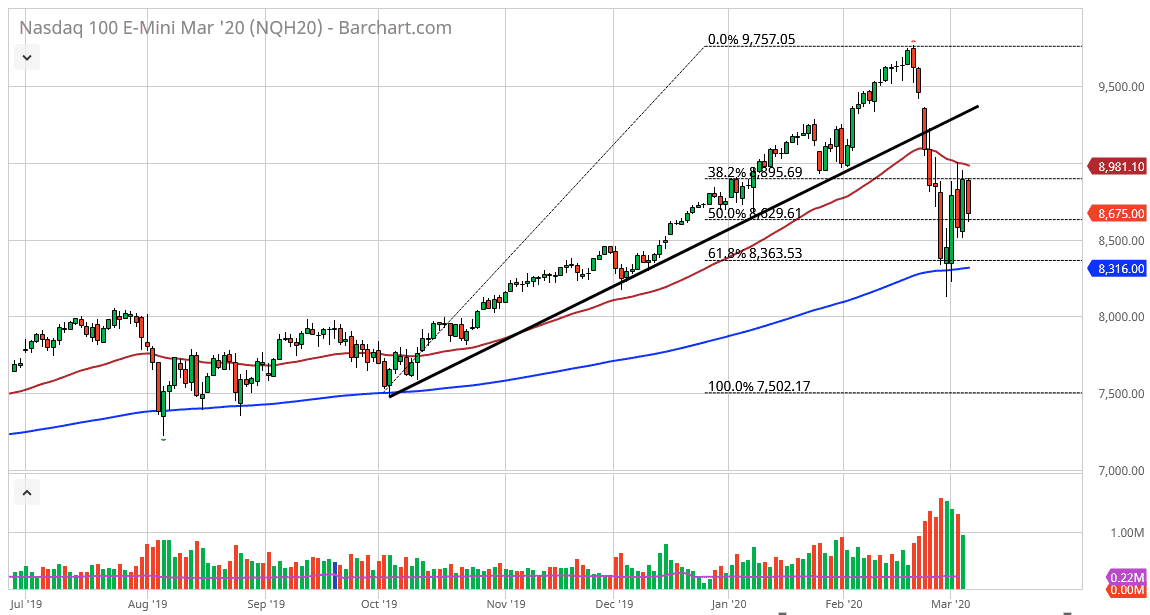

The NASDAQ 100 continues to see a lot of noise as there are concerns about what the rate cuts mean out of the Federal Reserve. After all, the market is showing a lot of volatility and that almost always means negativity in the markets, and at this point, the market looks very likely to continue showing a lot of choppiness and that is a function on just how volatile the news flow has been as well. I believe that the 50 day EMA above will offer resistance, just as the 200 day EMA underneath will offer support. At this point, I like the idea of waiting for a longer-term signal, perhaps on the weekly timeframe. I do think that the trading session on Friday could possibly give a bit of clarity, but I wouldn’t hold my breath on it.

To the downside, the market was to break down below the 8315 handle, that would be an extraordinarily negative sign, and I think at that point the markets will unravel. There are certainly plenty of reasons out there to think that that could happen, because we are starting to see issues with some credit markets as well, which is a very bad sign. However, the Federal Reserve is out there handing out cheap money, so that of course gives the market a little bit of a boost, but one statistic that you should be aware of is that the Federal Reserve has never made an emergency cut like they did the other day without the market breaking down significantly. It normally spooks the market by the time it’s all said and done, because quite frankly the credit situation will continue to be a major issue. Beyond that, there are concerns about the coronavirus slowing down economies around the world, so quite frankly it’s difficult to get overly excited about anything. In fact, it’s starting to look a little bit like a bearish flag being formed.

If the market does in fact break down below the 200 day EMA, the flag would suggest that perhaps we could drop another 1200 points or so. On the other hand, if we do break above the 50 day EMA and close above there on a daily candlestick, then I might be convinced to start going long again. I wouldn’t anticipate that happens though; I think at best were looking at sideways action over the next several trading sessions.