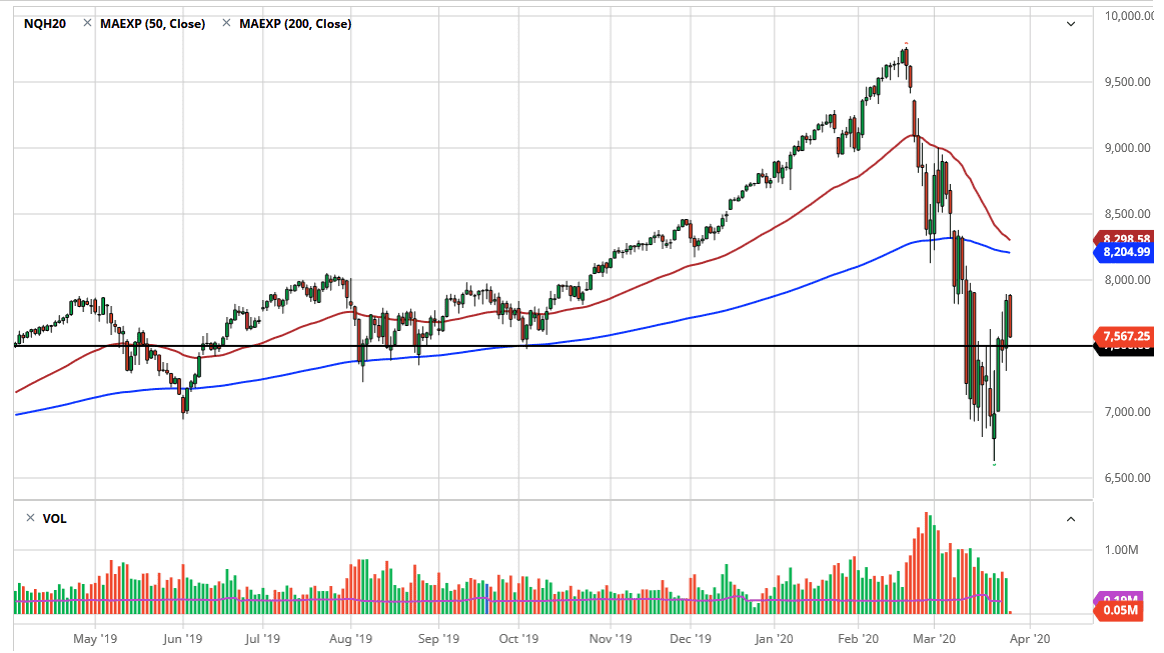

The NASDAQ 100 basically just fell immediately during the trading session on Friday, reaching down towards the 7500 level. At this point, the market continues to struggle in general and the fact that we pulled back at the very first sign of serious resistance after the breakout tells you just how little people believe in this rally. Furthermore, I think that people won’t hold onto risk of the weekend and that tells you exactly what they feel about this market. I know that the pundits are telling you one thing, but don’t pay attention to what they say, rather what they do.

Even if you are bullish in this market, there is more likely than not a pullback needed in order to stabilize and form a bit of a bottom underneath the turn things around. Because of this, the pullback should probably be expected by most traders. The question now is whether or not the 7000 handle will hold. If it doesn’t, then it opens up the door down to the 6500 level, possibly down to the 6000 level. Furthermore, the 8000 level above I think continues to offer psychological and structural resistance so it’s not until we break above there that I would think we have the “green light” to go higher.

The 200 day EMA sits at the 8205 level, but at this point I think it’s going to continue to go lower, perhaps trying to reach towards the 8000 handle. 8000 is a large, round, psychologically significant number and a number that will attract a lot of attention on the news shows. That being said, even though we’ve had a nice rally for most of the week, when you look at the overall move, it’s but a blip on the radar. We have a lot of work to do to turn things around longer-term, and I don’t think that things have changed that much, with perhaps the exception of all of the cheap and free money coming out. However, this isn’t necessarily the same as cheap money in a strong market, this is more or less trying to protect the overall economy. The fact that we had to do that did cause a little bit of a relief rally, but the question is whether or not it will work. That being the case, I think at the very least we have some back and forth between the high and the low of the last couple of weeks in order to try to decide where we go next.