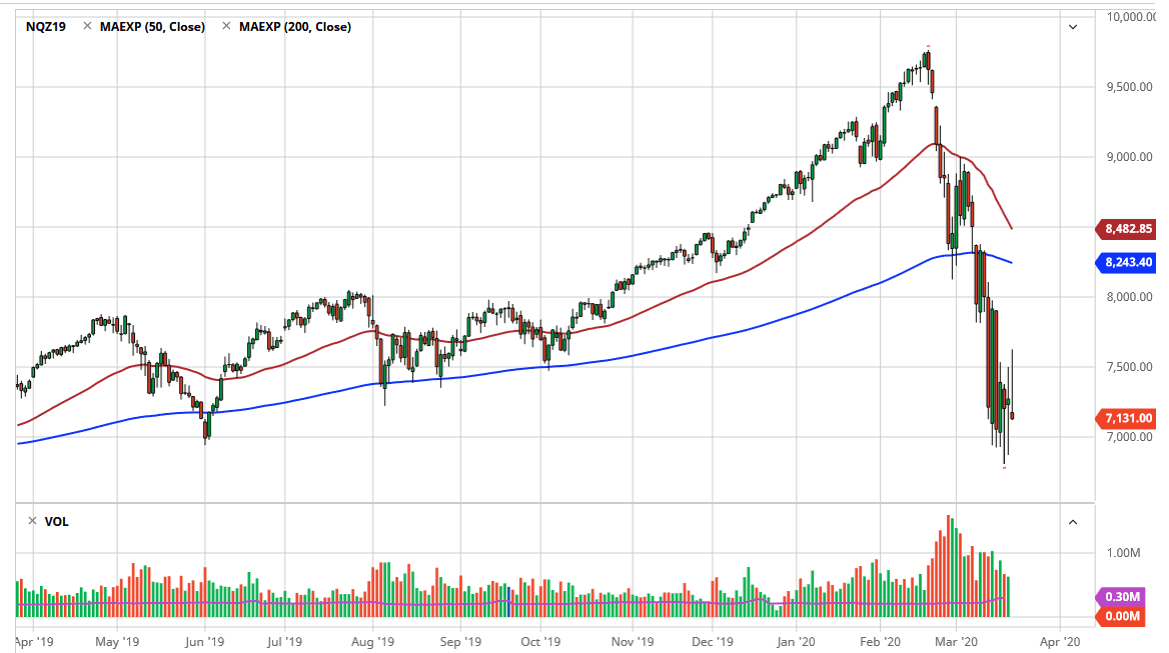

The NASDAQ 100 shot higher during the trading session on Friday but gave back the gains as the market get closer to the 7600 level. That being said, you can’t put too much faith into the Friday candlestick due to the fact that the day was also the “quadruple witching” session, meaning that for different major options markets were having expirations at the same time. In other words, there is a lot of force buying and selling in the market, thereby making the candlestick one that you can throw out.

Looking at the rest of the week, we continue to see buyers underneath the 7000 level and there’s nothing on this chart that suggests we won’t be able to do that again. Having said that, if we were to break down below the Wednesday session then it opens up the 6500 level, and then possibly the 6000 level. I don’t necessarily think that we are at the bottom of the market yet, but it would not surprise me at all to see this market bounce a bit from these extremely oversold conditions. After all, the market has been pretty resilient most of the week, despite the fact that it feels like we been punched in the face on a daily basis.

I do believe that if the market goes higher, given enough time. In the meantime, the NASDAQ 100 does get a little bit of a boost due to the fact that a lot of the solutions for the coronavirus “social distancing” issues can be solved through technology companies through things like teleconferencing. At this point, I believe that if the market breaks above the 7500 level, then the market goes looking towards the 8000 level above. The 200 day EMA is at the 8250 handle. In other words, there are several areas above that could cause more selling but if we can get a sudden “rip your face off rally” in this pair market, that could clear out a lot of the sellers which is the first step in turning things around. We will also be paying attention to the headlines coming out about the virus, because they will most certainly have a big influence on what happens in stock markets overall. One thing is for sure, we have already priced in a pretty significant recession. With that being the case, the question is whether or not we get another leg down, or we start to get constructive?