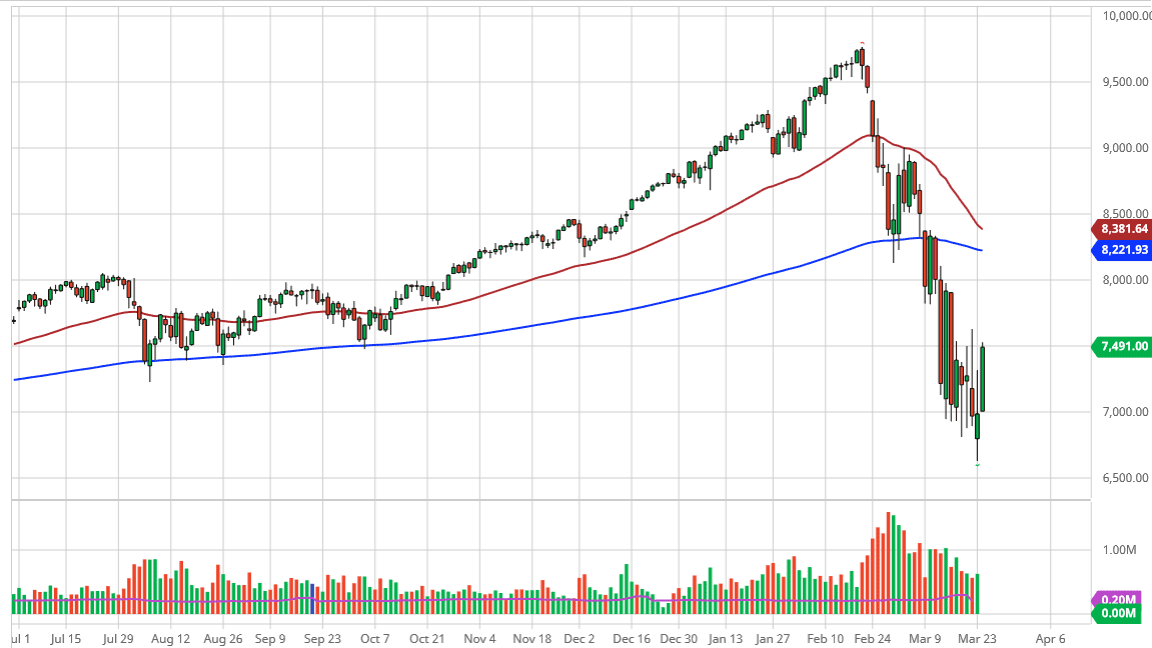

As traders digest the idea of a potential stimulus package, stock markets in the United States have skyrocketed. Gaining over 7%, the NASDAQ 100 finds itself smashing into the 7500 level to show extreme bullish pressure. At this point, the market is likely to find plenty of buyers on dips, unless of course we get some type of major shock. The question now is whether or not we get a larger relief rally or if we try to build up a bit of a basing pattern.

Looking at this candlestick, it’s obviously a very bullish, but there has been a significant amount of resistance near the 7500 level so it would not be surprising at all to see this market pull back just a bit. If we were to break above the Friday candlestick, then it’s likely that the market will continue to go looking towards the 8000 handle after that, perhaps even the 8300 level. Because of this, I do believe that we could get a sudden push higher if we do get that breakout, as it is a bit of an air pocket just above there.

Pullbacks at this point will probably find plenty of support near the 7000 level underneath, as it has been important more than once. The question at this point is whether or not we will continue to build up a massive amount of support in this area. Quite frankly, I think that we are getting relatively close to forming a bit of a bottom, but it’s going to take some time to build up enough confidence for the market to simply skyrocket to the upside. I would not be surprised at all to see this market reached towards the 200 day EMA initially, pulling back, forming a “higher low”, and then turning things around longer term.

Remember, markets are a forward looking instrument, and they are currently paying attention to whether or not the world is going to completely shut down, or if it is simply a temporary issue. At this point, one would have to think that we are at just about “peak doom”, which is typically when things change. At this point, one would have to think that a lot of traders out there are looking for bits and pieces of value, and almost certainly will find it. I am mildly constructive, but I also recognize we have a lot of work ahead of us.