Over the past few trading sessions, doubts over the interconnectivity of the cryptocurrency market, and the global financial system, were eliminated. Bitcoin failed to follow the uptrend in gold as a safe-haven asset during financial turmoil. A collapse across the sector in response to yesterday’s oil price crash followed. The LTC/USD opened with a massive price gap to the downside, which took it into its next support zone before stabilizing. You can learn more about a price gap here.

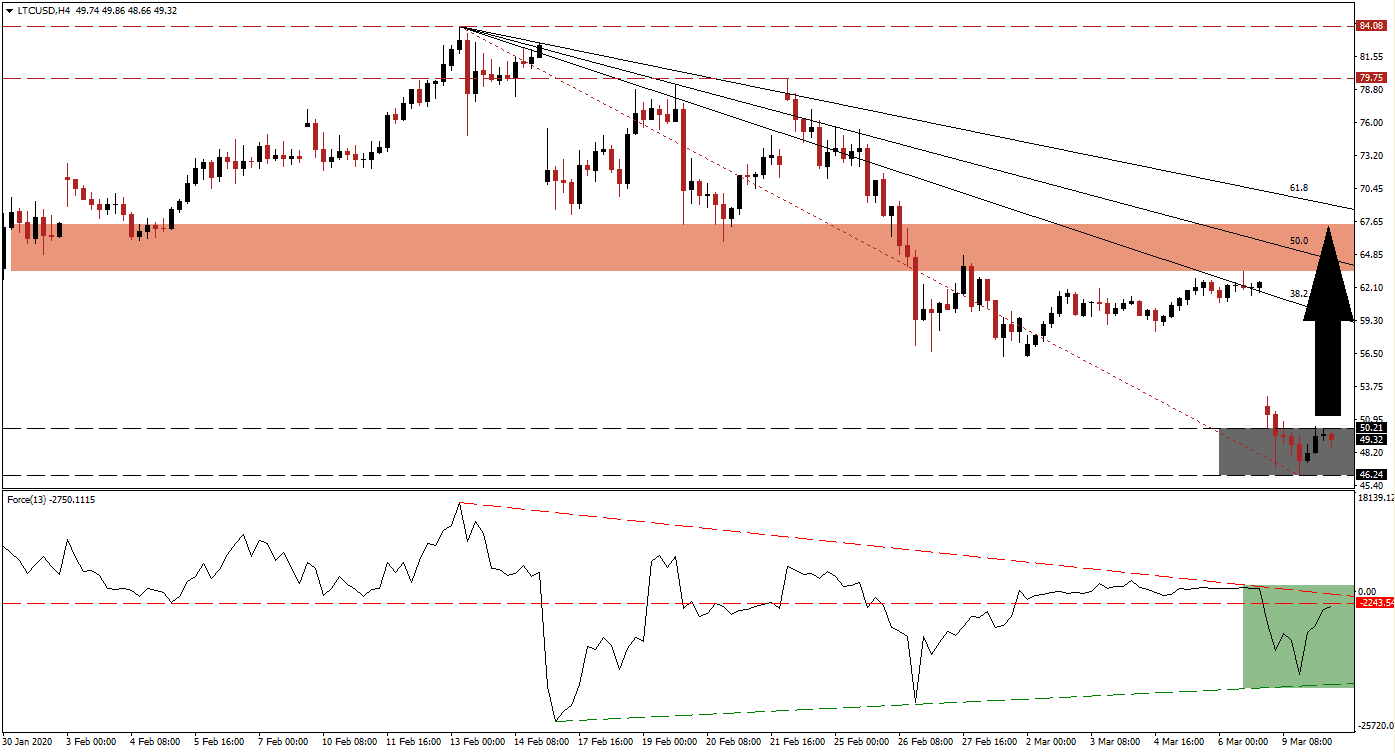

The Force Index, a next-generation technical indicator, generated a first bullish indicator with the emergence of a positive divergence. While this cryptocurrency pair contracted into its support zone, the Force Index recorded a higher low. The ascending support level provided a bullish momentum boost, and this technical indicator is now nearing its horizontal resistance level, enforced by its descending resistance level, as marked by the green rectangle. A breakout is expected to place bulls in charge of the LTC/USD, leading a recovery.

Bullish momentum is expanding with price action inside of its support zone located between 46.24 and 50.21, as marked by the grey rectangle. A breakout is anticipated to ignite a short-covering rally, closing the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Traders are recommended to monitor the intra-day high of 52.94, the bottom range of its price gap. The LTC/USD is likely to accelerate to the upside, powered by new net buy orders, following a breakout above this level. You can learn more about the Fibonacci Retracement Fan here.

Underlying fundamentals for this cryptocurrency pair are increasingly bullish, with the ability to withdraw Litecoin from over 13,000 ATMs in South Korea, adding a significant catalyst. The launch of the MimbleWimble privacy and fungibility protocol as soon as this summer further increases the appeal of the LTC/USD. A recovery into its short-term resistance zone located between 63.44 and 67.45, as marked by the red rectangle, is favored to result in the emergence of a new bullish trend and breakout sequence.

LTC/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 49.30

Take Profit @ 67.30

Stop Loss @ 45.00

Upside Potential: 1,800 pips

Downside Risk: 430 pips

Risk/Reward Ratio: 4.19

In the event of a push in the Force Index below its ascending support level, the LTC/USD will be pressured to extend its sell-off. With the distinct bullish fundamental outlook in this cryptocurrency pair, any breakdown attempt should be considered an excellent buying opportunity. The next support zone awaits price action between 35.47 and 38.27, which includes three price gaps to the upside.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 42.40

Take Profit @ 37.00

Stop Loss @ 45.00

Downside Potential: 540 pips

Upside Risk: 260 pips

Risk/Reward Ratio: 2.08