Sharp sales in global stock markets and the USD, along with continues fears regarding the Corona virus are all factors that motivated the price of gold to launch towards the $1703 resistance, the highest level for gold in seven years, before the price stabilized around the $1680 level in the beginning of today’s trading. Global financial markets are in free fall, in part due to a sharp drop in crude oil prices and mounting concerns about the spread of COVID-19. Last week, gold prices gained 6.79%, which represents the largest weekly increase for the yellow metal since 2011.

Because of the Corona pandemic, global markets were in turmoil which peaked after Russia and the Organization of the Petroleum Exporting Countries (OPEC) failed to reach agreement on further cuts in crude oil production. In response, Saudi Arabia has taken measures including increasing production, a move aimed at boosting market share, which has prompted investors to worry about a price war that could actually lead to shock waves in all markets.

On Wall Street, the S&P500 fell 7.4% in the first minutes of trading, which forced market officials to stop trading for minutes, which didn’t happen since the collapse of October 1987. After a 15-minute pause, the S&P pared its losses but was still down 6.9%. The Dow Jones fell by 1802 points, or 7%, to 2,462 points. The Nasdaq gave up 6.4%. The Wall Street fear index reached its highest level since the 2008 global financial crisis.

European markets were not far from dropping, as the biggest losses since the darkest days of the global financial crisis in 2008 were recorded, as the damage caused by the Coronavirus contributed to the closure of factories, schools and stores and led to an unprecedented travel ban and quarantines. Italy, the most affected region in Europe, has imposed a ban on 16 million people in the north of the country, which represents a quarter of the country's population, and the unrest is expected to push Italy into recession and affect the European economy.

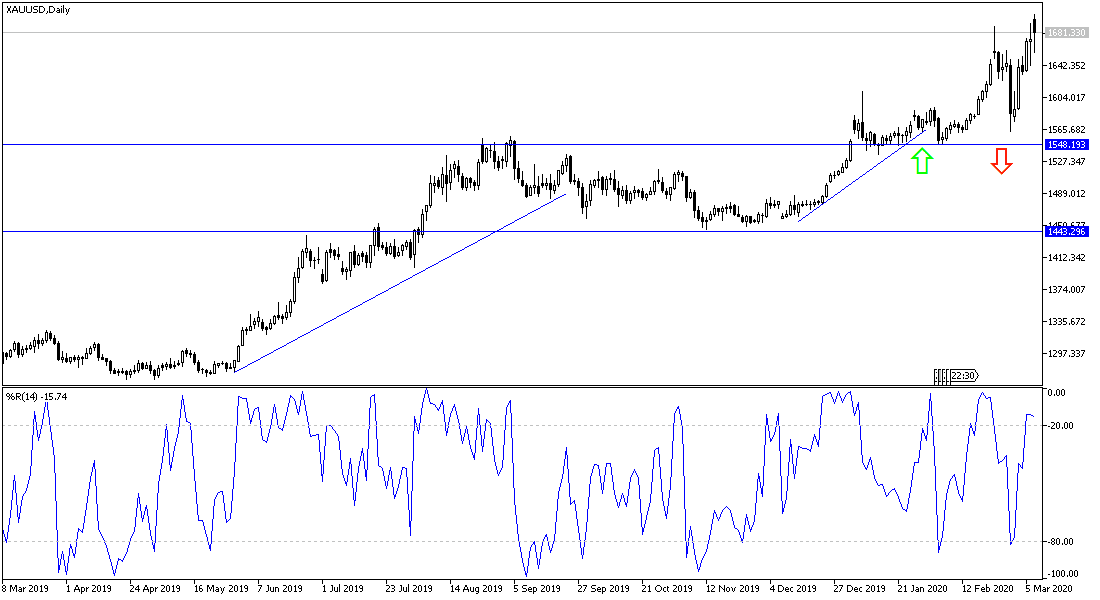

According to the technical analysis of gold: Gold will continue to reap more gains as long as global Corona pandemic concerns persist, and stability after the strong rise above the $1700 resistance does not mean that gold will begin a strong decline soon. The yellow metal is still supported by stronger factors that give it chances of achieving stronger gains. Closest resistance levels are currently at 1692, 1712 and 1730, respectively. Global markets lack calming factors to stop their bleeding, and global Corona updates and its losses are still the most powerful factor in pushing gold prices in the path of its current bullish channel. The support levels closest to gold are currently at 1669, 1655 and 1640, respectively, and I still prefer buying gold from each lower level.

As for the economic calendar data today: From China, inflation figures will be released. From the Eurozone, GDP growth and rate of change in employment data will be announced. There are no significant US economic releases today.