Last Friday's trading session saw the most fluctuating performance of gold in the recent period, with increasing concerns about the exposure of the largest economy in the world to what happened in China after increasing cases of death and infection in the United States. Recently, Gold prices rushed towards the $1690 resistance, the highest in seven years, and with the announcement of better-than-expected numbers for US jobs, the price of gold soon fell to the $162 support, but soon returned again to the ascending channel, and pushed from this support towards a higher resistance level at $1692 before closing the week's trading around $1674. At the beginning of this week's trading, the price gapped higher towards the $1703 resistance, before settling around $1665 at the time of writing. The yellow metal is still the biggest gainer since the COVID-19 epidemic broke out globally. The US stock markets did not benefit much from the positive US job numbers because investors want to know the numbers for the month of March, which reflects more the beginning of the epidemic in the country.

The global number of coronavirus infection has reached more than 107,000, with more than 3,600 dead. With companies announcing their earnings reports the biggest risk they face comes from two sides: On the supply side, for example, Apple said the slowdown in iPhone manufacturing in China would hurt its overall sales. On the demand side, the International Aviation Association announced that the aviation industry could lose up to $113 billion in revenue due to the outbreak.

So the Federal Reserve surprised the markets last week by cutting interest rates by half a percentage point. Investors expect other global central banks to follow suit, hoping to support the markets. In this context, Eric Rosengren, President of the Federal Reserve Bank in Boston, said on Friday that the Federal Reserve may start using new tools to combat deflation, such as buying a wide range of financial assets. At the same time, there are great doubts about the impact of lower interest rates on the support of the economy. Cheaper loans may encourage individuals and companies to make large purchases, but they cannot bring back workers to factories if they are in a quarantine.

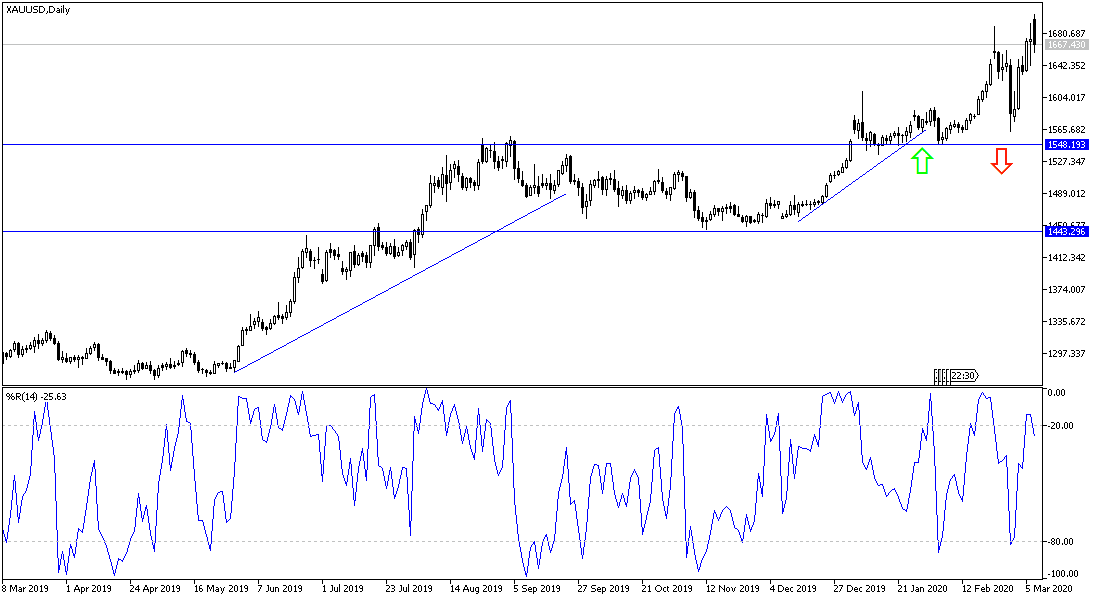

According to the technical analysis of gold: Gold prices general trend is getting stronger towards the rise and may test important and historical record resistance levels if Coronavirus concerns persist with its strong and direct threat to global economic growth. Gold price is indifferent to technical indicators reaching strong oversold areas, but it should be borne in mind that the downward correction will be violent and strong. The $1700 Psychological resistance remains a vital goal for bulls to crown recent gains. The worsening situation in the U.S due to the epidemic will be a powerful catalyst for gold to move aggressively higher. The closest support levels for gold are now 1663, 1645 and 1630, respectively.

As for the economic calendar data today: There are no important US economic data. From Japan the GDP will be announced. From the Eurozone, German Trade Balance and industrial production will be released.