At about 60 dollars in one go, the price of an ounce of gold rose during the trading session on Tuesday to the $1650 level after the yellow metal started to correct by selling towards the 1590 support at the beginning of the session. The strongest gains were supported by the sudden decision to global financial markets and investors by the US Federal Reserve to cut interest rates by half a point, with the formal meeting to determine its monetary policy is two weeks away. The reaction was negative on the US dollar, which saw declines and US stock indices, which lost their gains recorded on Monday. The bank’s decision added to market fears that the response to the Coronavirus outbreak would be disastrous for global economic growth. This increased investor appetite for gold to hedge against potential risks.

We have noticed a shift in consensus among global central banks to provide more stimulus to avert a potential recession from the Covid-19. Australian central bank preceded the US central bank by cutting interest rates to a record low as well. Officials said the European Central Bank and the Bank of England are preparing for the same. Nevertheless, investors believed that the situation was more dangerous than previous expectations. This general environment reminds us of the global financial crisis in 2008-2009.

The move by the US Federal Reserve came after it was confirmed that 117 people in the United States had been infected with the COVID-19 and nine people died. These numbers are expected to increase rapidly with the expansion of detection and monitoring. The epidemic has affected 92,187,000 people worldwide and has caused 3,160 deaths so far. Of course, China, the source of the epidemic, has the lion's share of those numbers. The new Coronavirus was first detected in December 2019 in Wuhan, a city in China's Hubei Province. The virus has reached 60 countries around the world. The most prominent losses after China for COVID-19 outbreaks still persist in Iran, with 2,366 cases and 77 deaths; Italy has 2,502 cases and 79 deaths; and South Korea has 5,186 cases and 28 deaths.

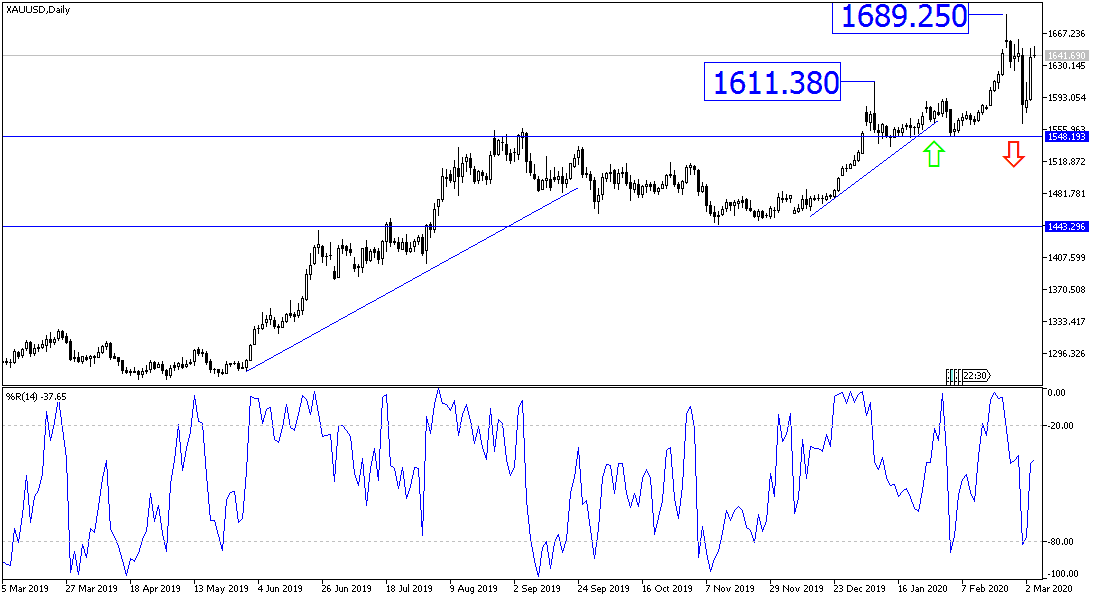

According to the technical analysis of the gold price: It is expected that the price of gold will bounce back higher strongly again and the increasing global fears of the Coronavirus may increase the purchases of gold bars, pushing prices to the resistance levels at 1654, 1663 and 1700, respectively. With the markets absorbing the plans of international central banks, which are trying to calm the world markets, the price of gold may be subjected to profit-taking sales that pushes it to the support levels at 1630, 1619 and 1600, respectively. I still prefer to buy gold from every bearish level.

The gold price will react today with the announcement of the services PMI for Britain, the Eurozone, and the United States, along with the first release of US jobs data from the ADP survey to measure the change in the number of non-farm jobs.