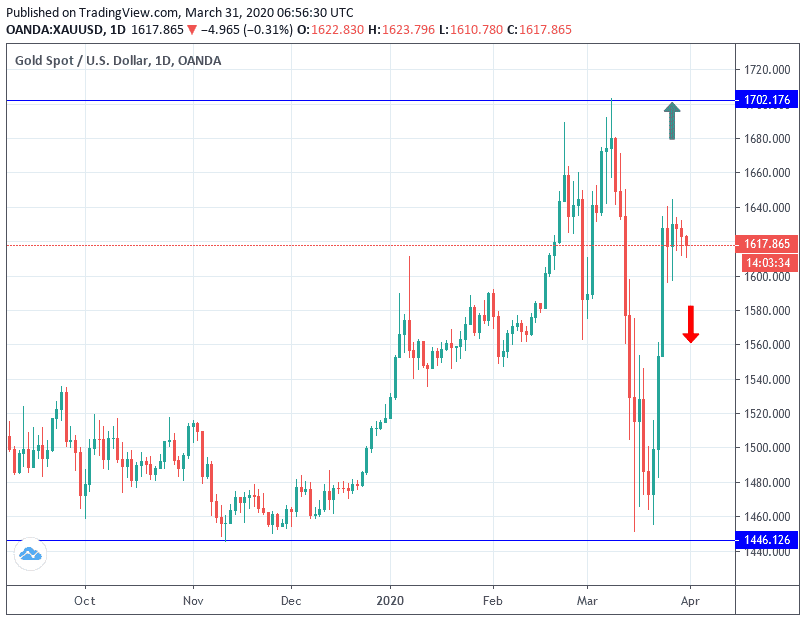

We witnessed a limited movement for gold prices during Monday's trading session in a limited range between $1611 and the $1627, and began trading session today, Tuesday, around the $1616 level. It seems that gold investors are awaiting the actual results of the important US economic data this week to determine the path, because American job numbers may cause surprises to markets, as happened with the weekly jobless claims reading that exceeded 3 million claims, the highest in the history of the United States.

Recently Goldman Sachs recommended buying gold in conjunction with the US Federal Reserve's announcement that it will purchase an unlimited amount of government bonds. The move caused the strong dollar to slide, and pushed precious metals higher by more than 4%. According to Goldman, the gold price is currently at a turning point, and the ounce of gold is likely to reach $1800 over the next 12 months.

In an exciting development for gold investors, when all investors start buying gold as a safe haven, gold industries themselves have been closed due to the crisis that caused weak demand. Three of the world's largest gold refineries announced on Monday that they would be forced to close in light of the COVID-19 epidemic threats. And in Switzerland, where refineries are located, the country has ordered the closure of all non-essential industries in an attempt to stem the spread of the virus in the country. As a result, Argor-Heraeus, Pamp and Valcambi gold refineries were forced to close.

During Monday's trading session, the S&P 500 rose 3.4% to post its fourth gain in the past five days. In contrast, European indicators rose after erasing previous losses. Asian markets have retreated, but to a milder degree than the huge fluctuations that have rocked investors over the past six weeks. The surge in US health care stocks led the market. Where Johnson & Johnson jumped 8% after saying it expects human clinical studies to begin a vaccine candidate for COVID-19 by September. Abbott Labs jumped 6.4% after saying it had a test that could detect a new coronavirus in less than five minutes.

According to the technical analysis of gold: the stability of gold prices around and above the $1600 resistance will remain supportive of the bullish trend, and is awaiting a return to the resistance levels at 1635 and 1660 to move the price to new record areas. The sell-off may increase if the US dollar returns to rise and the price moves towards support levels at 1592 and 1575, respectively. The gold price will react today with the announcement of Chinese manufacturing data, Eurozone inflation figures and US consumer confidence.