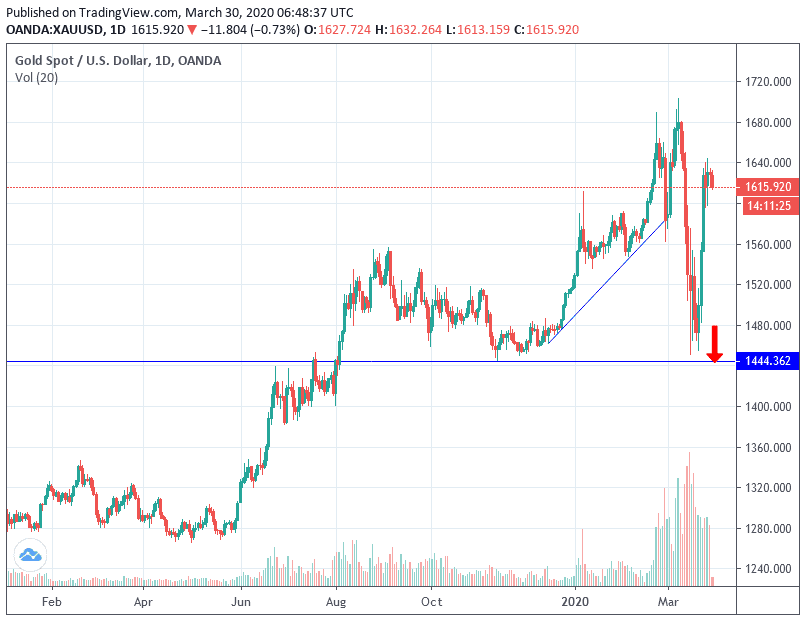

Despite the sharp decline in the US dollar with the formal signature and approval of the massive US stimulus plan, which is estimated at 2 trillion dollars, and the rise of the unemployed claims in the US to more than 3 million claims, gold gains, which moved in opposite to the USD, did not exceed the $1645 resistance, the highest level for the yellow metal in two weeks, and closed the week's transactions around the $1626 level and settle around $1615 at the time of writing. The US stock markets got support from the massive stimulus plan, which may support liquidity in the markets, which was severely weakened by the consequences of the Corona pandemic, which caused strong selling operations because of investor fear from the bleak future of the global economy.

last week. The Standard & Poor's 500 Index achieved its best weekly gain since March 2009. The Dow Jones Industrial Average recorded its biggest weekly gain since 1938. The gains came after the bloodiest two weeks which is compared to the strong selling in 2008, as the US government and the Federal Reserve sought to contain the financial crisis.

Many investors will depend on how bad the corona outbreak will affect the US economy, as the government reported a historic rise in jobless claims last week, more dark figures are expected in the coming weeks. Wall Street has lowered its corporate earnings estimates even though companies say little publicly about the impact on their final profits from the epidemic. Investors have yet to obtain a clear picture of the extent of the damage the crisis has caused to corporate earnings, the ultimate driver of stock prices. Many companies withdrew their earnings forecasts earlier in the year.

Returning to the US damage from the Corona epidemic. The number of cases in the United States of America exceeded the numbers in China and Italy, where it rose to more than 104,000 known cases, the global total number of the epidemic has exceeded 607,000 people, the death toll has risen to more than 28,000, while more than 130,000 have recovered.

According to the technical analysis of gold: Price stability above the $1,600 resistance will continue to support bulls' control of performance. The continued decline of the dollar will continue to be a catalyst for further gains. The nearest resistance levels for gold are currently at 1645, 1675 and 1700, respectively. The return of weak liquidity again may stimulate the return of the demand for buying dollars, and consequently the return of gold sales to correct after the recent gains. The closest support levels for gold are now 1617, 1605 and 1585, respectively. On the daily chart, there are signals to reach overbought levels. We await the reaction of investors on the US rescue plan and the updated figures for human and economic losses from the Corona epidemic.

Today's economic calendar has no important economic releases affecting the price of gold.