Before the announcement of the most important US economic data for this week, the price of gold fell to the $1598 level after recent strongest gains, which amounted to $1640, the price of the yellow metal stabilizes around the $1600 level at the time of writing. Optimism prevailed for financial markets and investors from the approval of the massive US rescue plan to support the largest economy in the world in the face of the effects of the deadly Corona epidemic, which spread quickly in the United States of America and with its spread in more than 170 countries around the world, the epidemic became a strong and direct threat to global economic growth and caused increasing expectations for a global crisis to outpace the last global crisis in 2008-2009. As is well known, confidence in the markets and investor appetite for risk will not be in favor of gold, the ideal safe haven in times of anxiety and crisis.

In Europe, Italy remains the epicenter of the outbreak, as data show a disappointing recovery in the number of infections after a pronounced slowdown earlier this week. From the UK, there are news of Prince Charles, the heir to the throne, testing positive to the virus. In Asia, India has become the latest country to order its citizens to stay in their homes, resulting in the closure of 1.3 billion people. In Mexico, President Andres Manuel Lopez Obrador is increasingly critical of his insistence that life should continue as usual. In Brazil, the far-right president, Jair Bolsonaro, continued to reduce the risks, leaving Rio de Janeiro and São Paulo in quarantine in an attempt to stem the spread.

In the United States, the total number is 55,243 infections and at least 802 deaths.

The US Senate approved a stimulus package worth about $2 trillion. The bill includes provisions to extend the loans granted to companies, enhance the duration and size of unemployment benefits, and provide tax deductions, among other benefits. The law will be passed to the House of Representatives to vote, which will try to pass it through a procedure called unanimous approval. And if any member of the House of Representatives objects, then the entire parliament will have to meet, which is not easy since most legislators have returned to their states amid precautionary measures to prevent an epidemic.

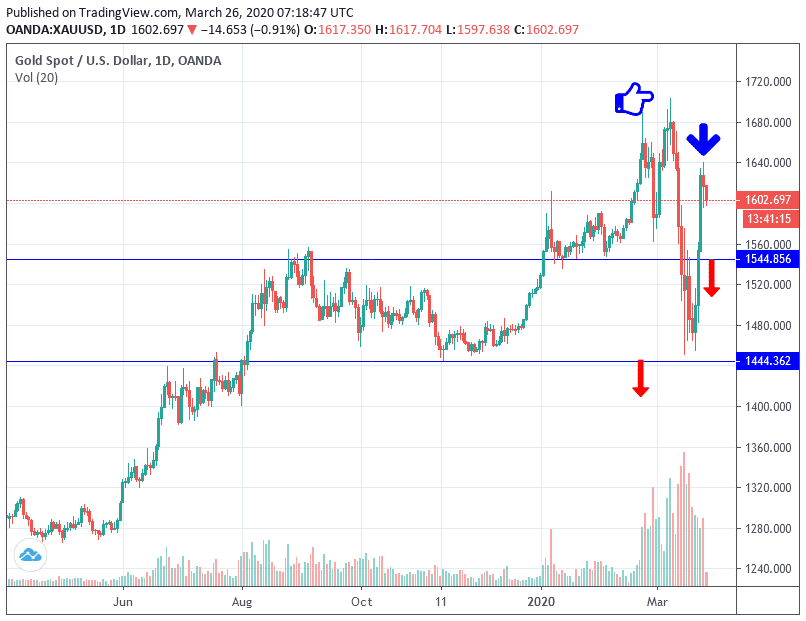

According to gold technical analysis: the stability of the gold prices around and above the $1600 psychological resistance will continue to support the strength of the upward correction, especially if markets and investors continue to be concerned about the increasing human and economic losses globally from the outbreak of the Corona pandemic. The nearest levels of resistance to gold are currently 1620, 1645 and 1700, respectively. The resumption of the USD strength may prevent reaching these goals. In general, I still prefer to buy gold from every lower level. The closest support levels for gold are now 1590, 1575 and 1555 respectively.

The gold price will react strongly to the announcement of the Bank of England's monetary policy decisions and then the US economic data, GDP growth rate and weekly jobless claims.