The strength of the US dollar has stopped, and confidence has returned, even if temporarily, to the global financial markets. That has contributed to sharp gains in the price of gold, pushing it towards the $1637 resistance, before settling around the $1609 level at the time of writing. The US dollar is underestimated by the fact that the unlimited quantitative easing program recently approved by the Federal Reserve will crush government bond yields, and will radically increase the supply available to the dollar in the markets. This supply could be increased in the coming weeks by the Federal Reserve’s decision last Thursday to extend dollar swap lines - currency swaps - to nine other central banks, and provide them with up to $60 billion that can be loaned to companies or sold on the open market to support their domestic currencies.

As for the deadly Corona epidemic. The number of confirmed infections has risen to nearly 50,000 in the United States amid increased tests, according to Johns Hopkins University. The Center for Disease Control and Prevention said it was aware of only 33,404 cases and 400 deaths on Monday, although its numbers seem to lag behind those of Johns Hopkins University. Coronavirus infection in the United States rose by more than 13,000 on Monday, with the largest one-day increase so far that has translated into a more severe epidemic curve. If this growth rate continues in the coming days, the largest economy in the world may find itself being the epicenter for the outbreak. After the focus shifted from China, the main source of the epidemic to Europe, with an increase in deaths surpassing China itself.

Gold has returned to confirm that gold is the ideal and historical safe haven for investors in times of crises ravaging the global economy.

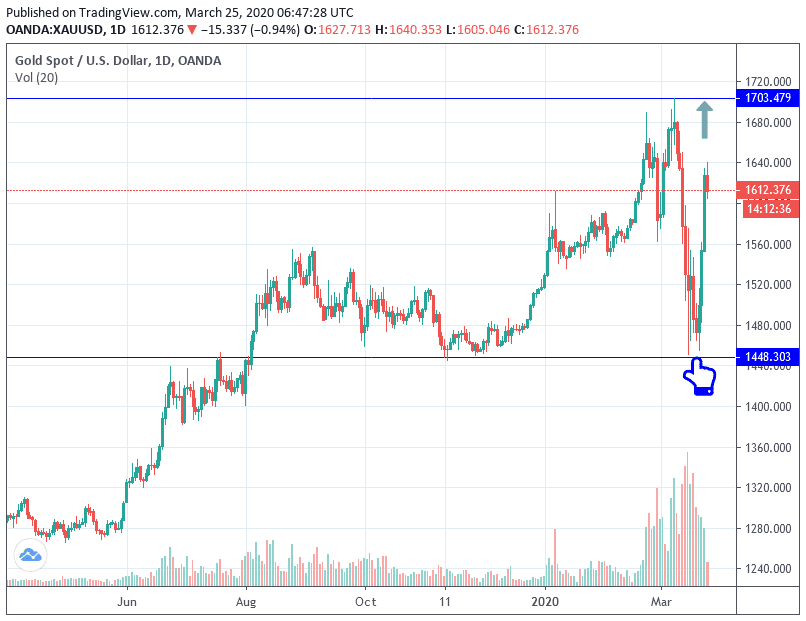

According to gold technical analysis: the recent performance will restore confidence among gold investors, which were shaken by the decline of gold by the end of last week to below the $1500 level. The continued decline of the US dollar will increase the opportunity for gold to move in the same recent bullish channel. The nearest gold resistance levels are now 1665, 1690 and 1735, respectively. I still prefer to buy gold from every downside level, bearing in mind that recent gains may be exposed to profit taking sales, with technical indicators reaching overbought areas. The nearest support levels for gold are now 1610, 1565 and 1510, respectively.

The gold price will react to the announcement of an IFO reading of German business climate, British inflation numbers and US durable goods order numbers.