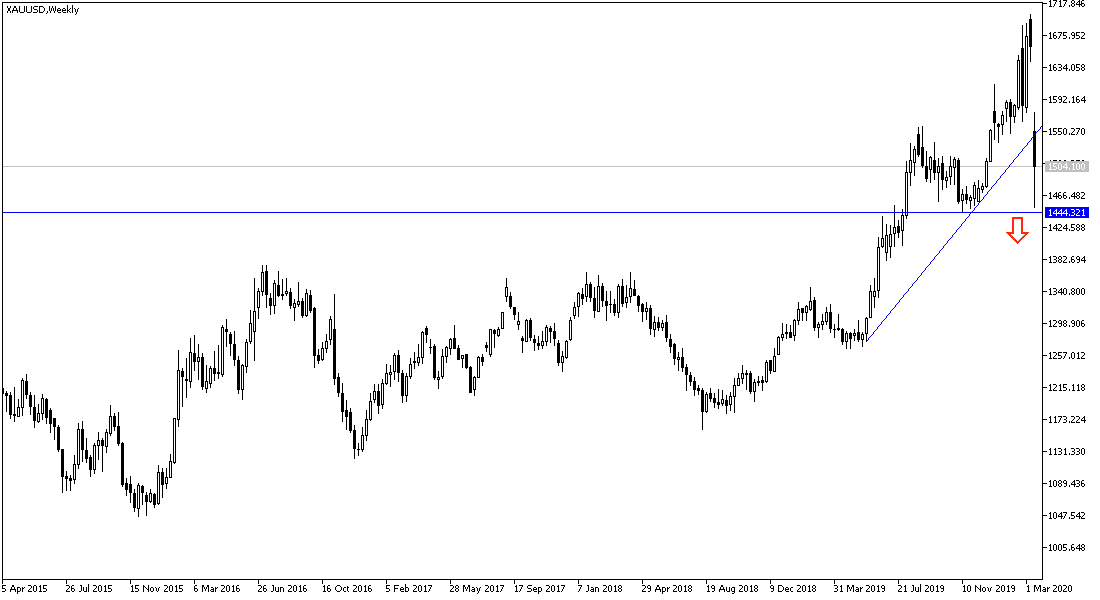

Some optimism has returned to the financial markets after the recent actions by the United States of America to face the consequences of the Coruna epidemic and its threat to global economic growth. This supported the return of investors’ gold purchases after the recent collapse, which reached the $1451 support yesterday, the lowest level in more than three months. The recent purchases pushed the price of an ounce of gold to move towards the $1553 level before returning to stability around the $1507 level at the time of writing. There is a clear reflection of the general trend of gold since the beginning of sales from the $1700 psychological resistance, the highest level in seven years.

Among the US measures to stimulate the world's largest economy in the face of a possible recession resulting from Coronavirus, the Trump administration announced that individuals and businesses will be allowed to delay paying their 2019 tax bills for 90 days after the usual April 15 deadline. The extension is an attempt to pump up to $300 billion into the economy at a time when the coronavirus is emerging as a major cause of recessions.

US Treasury Secretary Stephen Mnuchin said individuals would be able to delay payment of up to $1 million in payments, while companies will be able to postpone payments of up to 10 million dollars. Taxpayers will still have to file their tax returns by the April 15 deadline, but they will not have to pay their taxes for an additional 90 days. During that time, individuals and companies will not be subject to payment of interest or fines. "All you have to do is submit your tax return," said Manuchin.

The Treasury secretary added that President Donald Trump agreed on the final details of the scheme, including the possibility of allowing taxpayers to keep $300 billion in the economy at the present time. Last week, Mnuchen estimated that the deferred payment would be $200 billion.

The latest measures by the US government and the Federal Reserve were extremely necessary to maintain the performance of the US economy until finalizing a vaccine that eliminates the Covid-19 virus which killed nearly 8,000 people and infected more than 190,000 people and spread almost all over the world. This epidemic is causing an economic recession that exceeds the recession caused by the global financial crisis during 2008-2009.

According to technical analysis of gold: The downward pressures of gold remain with the weak liquidity in global financial markets, which is the strongest explanation for the recent collapse of gold prices, despite the Coronavirus continued panic in the world and financial markets. Therefore, gains may remain selling targets at the present time, as returning to the natural liquidity of the markets after the recent heavy losses may take more time. Therefore, resistance levels at 1545 and 1600 may be selling targets if gold reaches there. What will increase the bears' control over the performance is the move towards the $1400 psychological support. From there below, there will be serious thinking of strong purchases.

Gold price will react to the announcement of inflation figures from the Eurozone, US building permits and Canadian inflation data.