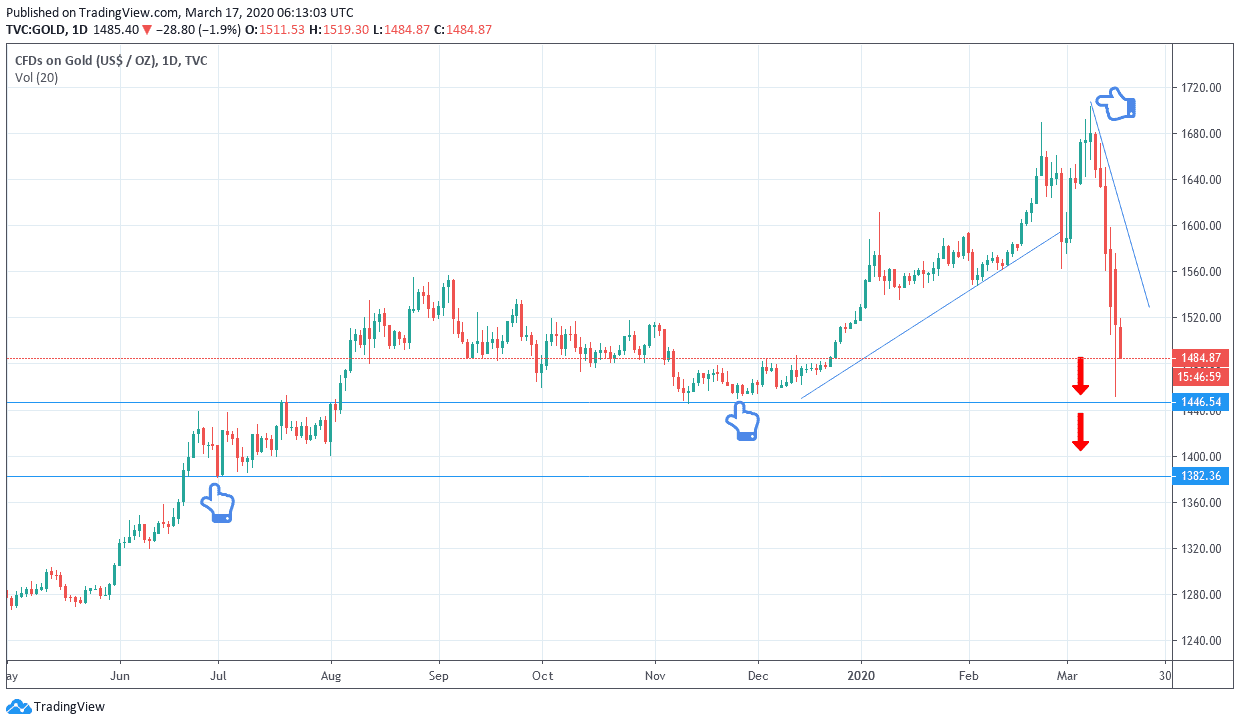

Despite world concern and record losses for global stock markets led by Wall Street, gold prices continue to decline sharply. At the beginning of this week’s trading, the price of gold plunged to the $1451 support, the lowest level in 3 months. With the continued sharp losses in the US stock indices despite the emergency and sudden measures taken by the Federal Reserve Bank, the price of gold got the support, and therefore moved towards the $1520 level, before returning to stability around the $1488 level at the time of writing. In the beginning of last week’s trading, the price of gold exceeded a new record high at $1700 an ounce before the price collapsed to the last decline, as gold lost the advantage of an ideal safe haven for investors in times of uncertainty, with liquidity severely weakening in financial markets and among investors, after the evaporation of trillions of dollars from the markets in the sharp decline in the markets and the ineffectiveness of global central banks’ plans recently.

The Corona epidemic (COVID-19) quickly spread beyond the Chinese borders and affected 135 countries around the world and killed more than 6000 people. Europe became a fertile epicenter of the epidemic and second only to China in the number of cases and deaths. With the disease turning into a global pandemic, it requires the intervention of global central banks, as well as governments, to prevent US economic growth to enter a period of stagnation that may outpace the global financial crisis of 2008-2009.

The United States and its prominent economic allies have pledged to share important information about the coronavirus, the availability of medical equipment, job support, and global trade and investment. They also pledged to enhance science, research and technology, and to restore public confidence in the epidemic that threatens the global economy.

U.S. President Donald Trump and other members of the G7, which includes Canada, Germany, Italy, Japan, Britain and France, held a conference call to coordinate efforts to counter the coronavirus and reduce tension between the United States and Europe over Trump's travel ban to Europe and to discuss reports that the White House was in talks with a German company to develop a vaccine to eliminate the virus.

According to the technical analysis of gold: Gold prices are still moving inside a bearish channel that got support from bears pushing prices below the $1500 level, which is the neutral level between the continuation of the rise, or the return to the decline strongly. Stability below that level would support the gold price move to the support levels at 1485, 1445 and 1400 respectively, especially if global liquidity remained in trouble. On the upside, there may be an attempt for an upward correction if the price of gold moves towards the resistance levels 1525, 1560 and 1600, respectively. Despite the recent performance, I still prefer to buy gold from every bearish level.

Gold prices will react today to the announcement of British job and wage figures and then US retail sales. As well as update on the human and economic losses of the Corona epidemic.