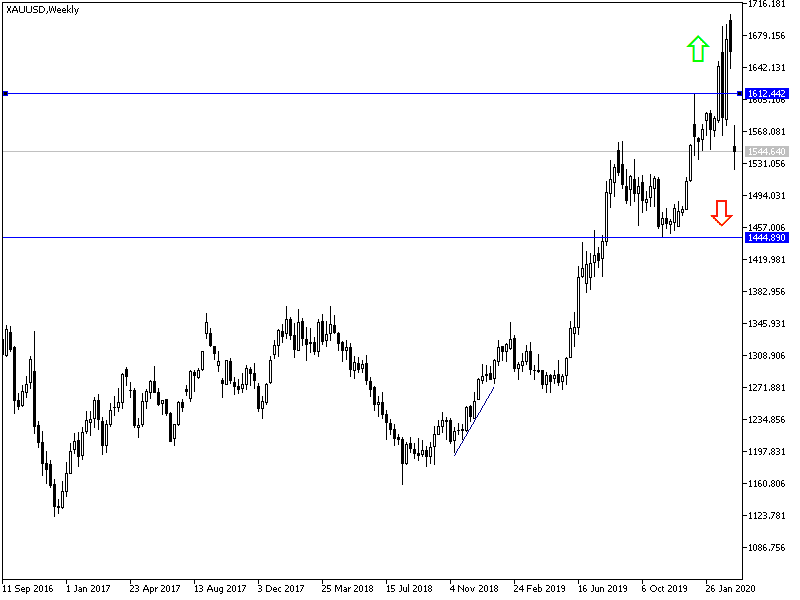

The strength of the US dollar after recent decisions by the US Federal Reserve and the government under Trump's administration increased sales of gold bars, as gold prices tumbled to the $1505 level, as the yellow metal lost about $200 of its value during the past week, closing the week's trading around the $1529 level. Gold prices may witness a price gap in the beginning of trading this week after the surprising announcement by the US Federal Reserve to reduce US interest rates to near 0% in a historic step, as part of successive plans to stimulate the US economy in the face of expected disasters due to the deadly Corona pandemic, which caused Trump to announce a national emergency. Gold prices rose sharply in the beginning of trading to the $1577 top before settling around the $1545 level at the time of writing.

US stock markets suffered their biggest one-day drop in more than 30 years last week, amid concerns that a COVID-19 epidemic would hit the global economy hard.

US President Donald Trump on Sunday evening praised the Fed's sudden move to cut interest rates to almost zero, just one day after he said he had the authority to downgrade or dismiss US Central Bank President Jerome Powell. Just minutes after the Fed announcement, Trump said he was "very happy" with the measure and that people in the market should feel "overjoyed."

The Federal Reserve cut interest rates by a full percentage point and launched a package of programs to help solve the problems on Wall Street that emerged in the wake of COVID-19. This epidemic has infected nearly 160,000 people globally, killing nearly 6,000 people and spread in 135 countries.

Trump has put constant pressure on the Federal Reserve to cut interest rates more sharply, and criticized Bank Governor Jerome Powell. On Saturday, Trump confirmed that he could fire Powell, whom he chose for this important position.

According to gold technical analysis today: Gold prices may receive support from the surprising recent decision of the Federal Reserve to cut interest to almost zero, especially if liquidity in the financial markets increased again. Resistance levels at 1575, 1600 and 1660, respectively, may be stronger targets for bulls to return to controlling performance. In return, there is a desire by the bears to take the price below the $1500 psychological support and that will drop prices to new buying levels. Whatever happens, gold will remain a safe haven for investors and markets in times of uncertainty, and of course, the Corona virus is still the first and last factor affecting investor sentiment at the present time.

Gold will also interact with markets and investors’ reaction to the decisions that were made before the opening of this deal, in addition to interacting with the announcement of Chinese economic data results.