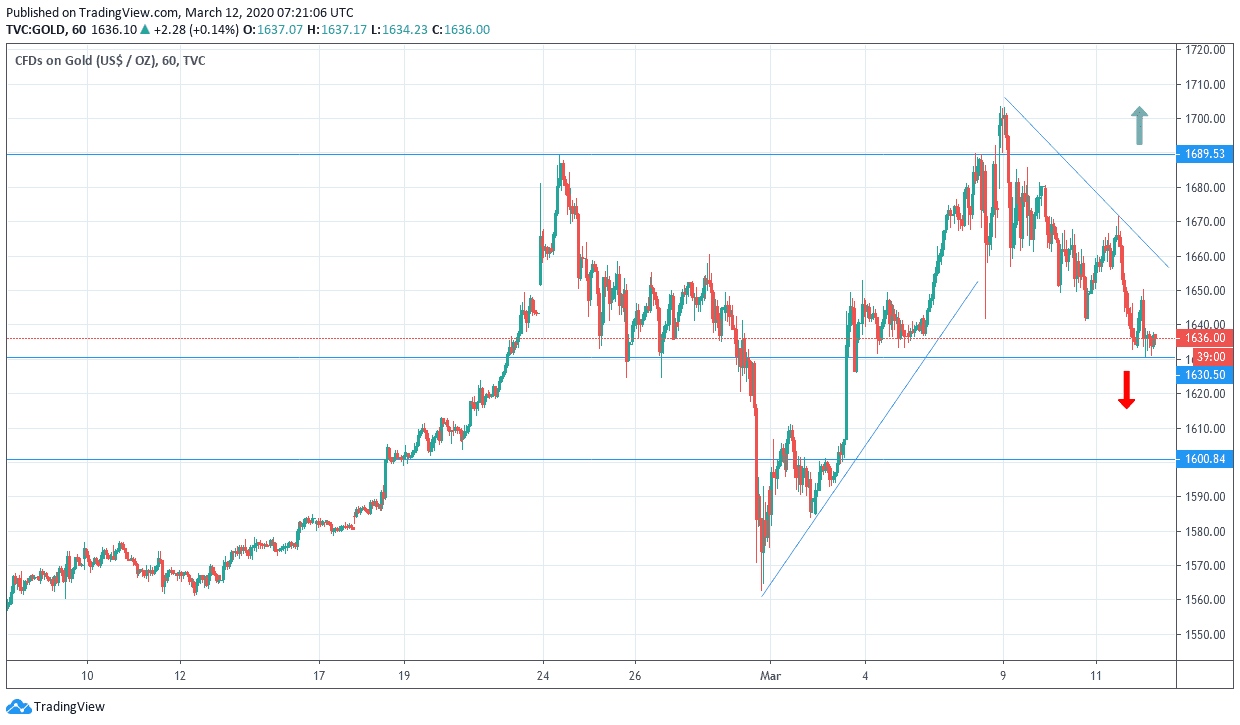

The recent corrections of gold price pushed it towards the $1631 support before settling around the $1636 level at the time of writing, awaiting for the return of buyers. The price of gold fell from the $1703 resistance, which was recorded at the beginning of the week amid growing fears of the global economy entering in a strong recession after the Coronavirus became a global epidemic, and no one was excluded, whether the economy was advanced or developing, although advanced economies were the most affected. Unusually, the path of gold rising was halted by rapid and successive steps and measures by global central banks and governments to stimulate the global economy in the face of Coronavirus consequences.

The negative economic effects of the epidemic are increasing day by day. US President Donald Trump has decided to impose a 30-day ban on most Europeans entering the United States in the latest staggering setback for the aviation industry, which is already suffering from low bookings and an increasing number of people canceling reservations for fear of COVID-19. An industrial business group has warned that airlines around the world could lose up to $ 113 billion in revenue from the virus. With the decision, Boeing shares fell 18% - the biggest drop in one-day since 1974- and the world famous company announced a recruitment freeze.

After the US Federal Reserve, the Australian Central Bank, the Bank of Canada, and the Bank of England all announced a cut in interest rates and more plans to stimulate the economy. Today, markets are awaiting the European Central Bank's announcement of its decisions to stimulate the European economy, which has become the most affected by the outbreak after China, the source of the epidemic. Expectations are that the bank may announce a deeper interest rate cut, greater bond buying plans and lower taxes for SMEs.

According to technical analysis of gold: Despite the recent correction of profit-taking sales, the price of gold still has an opportunity for a bullish correction again as the general trend is still bullish with the support of its stability above the $1600 psychological resistance o. I still prefer to buy gold from every bearish level, and the closest support levels for gold are now at 1627, 1615 and 1590 respectively. The continuing global concern about the Corona epidemic may push the price of gold above the $1700 psychological resistance again.

Gold will react today with the announcement of the US data and monetary policy decisions of the European Central Bank.