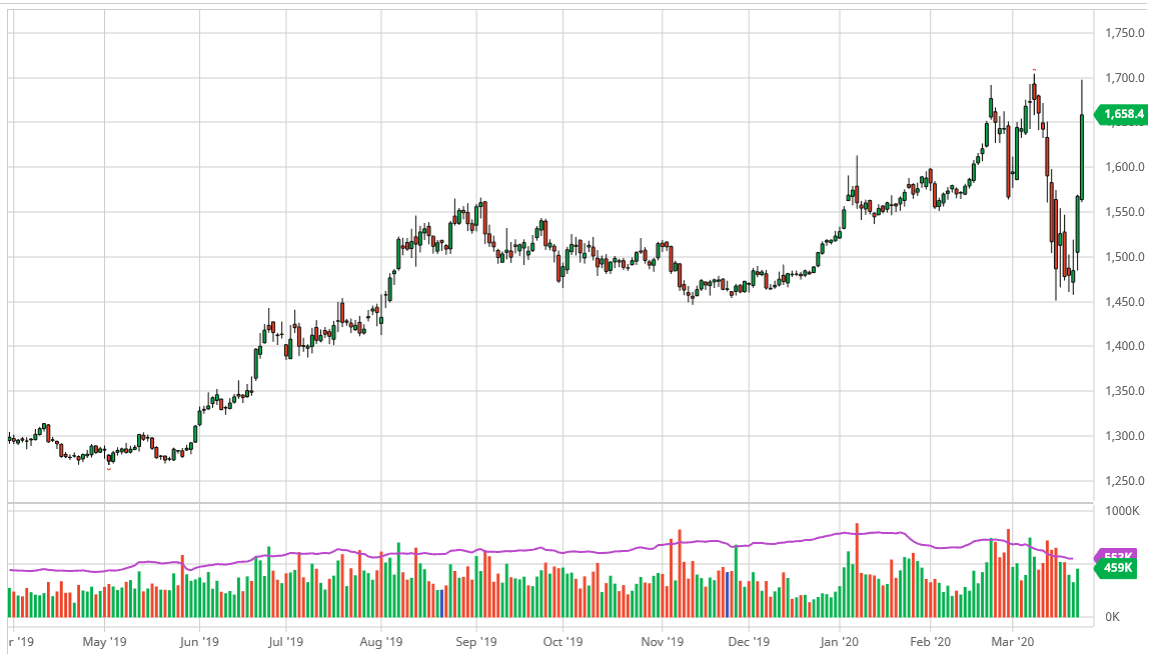

Gold markets have rallied significantly during the trading session on Tuesday, reaching towards the $1700 level. This is an area that has been the recent high, so the fact that we rallied all the way to this level in the blink of an eye is obvious that we couldn’t breakthrough what would be a significant resistance barrier. By pulling back the way we have, losing $40 or so at the top, it’s not overly surprising that some people would be a bit skittish. After all, the market rallied almost $140 at the top of the session, which is an extraordinarily volatile and extreme move for a single session.

If the market was to break above the $1700 level, it would open up the gateway to much higher pricing, perhaps the $1750 level, followed by the $1800 level. I think that it is only a matter of time before this happens, but I would need to see some type of pullback in order to find enough value to start buying gold again. It’s impossible to keep up this kind of momentum for very long, so if we get a pullback that makes quite a bit of sense. That allows people to have more of a reward based upon the risk. Ultimately, I have no interest in selling gold, but I do recognize that we may have a day or two of weakness ahead of us. That will eventually attract enough monetary flow to go higher.

To the downside, the $1450 level is the absolute “basement” of the contract, but I think the $1600 level could be pretty significant support all the way down. I will take this on a day by day basis, because it was almost impossible to foresee this type of move happening this quickly. With that in mind, the market has made its desires clear, but that doesn’t mean that you just jump in and chase the trade. Chasing the trade like this is a great way to lose money and is a sure way to ruin. You must be patient in markets like these, as they do tend to be extraordinarily volatile and noisy but will offer great opportunities for those who are looking for them. Gold should continue to shine overall, but you need to see a better opportunity than the one we are presented with that the end of the session.