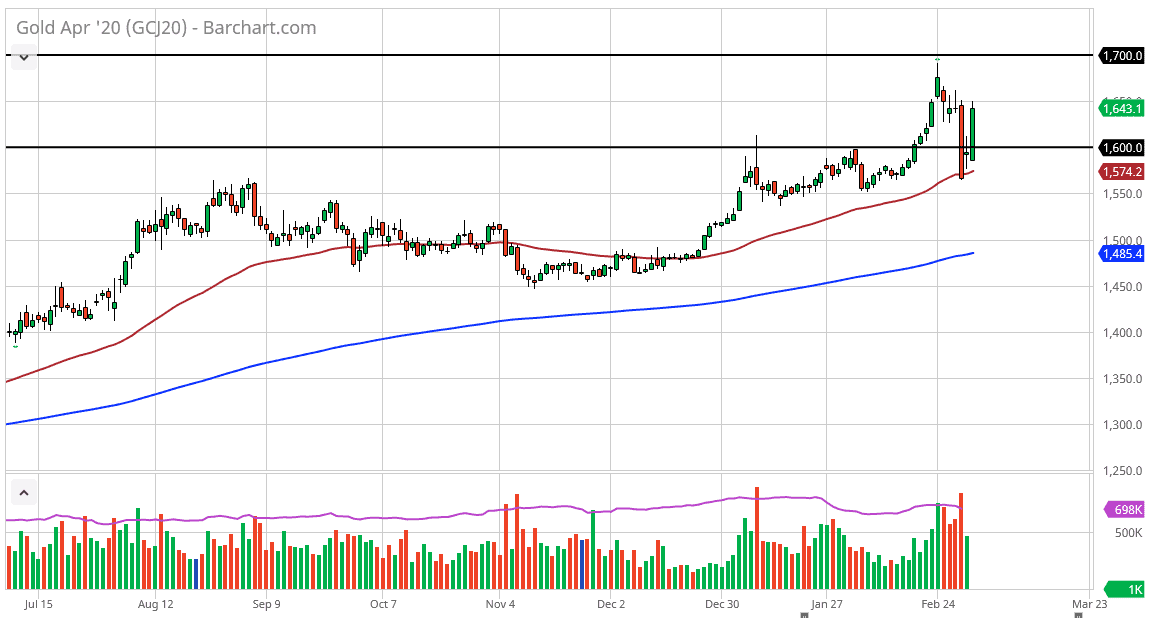

Gold markets rallied a bit during the trading session on Tuesday as the Federal Reserve stepped in and cut interest rates by 50 basis points in a surprise move. That being said, gold spiked all the way to the $1650 level before turning back around which makes sense considering that it is a resistance barrier. As long as that area offers resistance, the short-term pullbacks are a possible buying opportunity, but I think it’s likely that the uptrend continues, based upon the technical analysis. The 50 day EMA sits underneath and continues to curl to the upside. The $1700 level above is a large target that people will pay attention to, and ultimately, I think the market will find plenty of resistance there, but it does act as a bit of a magnet for price as it was the most recent high.

If the market can break above there, then it’s very likely that we could go even further, and I do think that is the case for the longer term. I have a target of $1800 at the very minimum, if not the $2000 level. I have no interest in shorting this market, because the market will be exposed to a lot of different forms of volatility, not the least of which will be whatever next global loosening happens around the world. Ultimately, I do think that the market will see more central banks around the world do things to move markets, so gold of course will be influenced by that. If the US dollar strengthens a bit, you may see gold dips, but at the end of the day it will move right along with the rest of the central banks, as loosening monetary policy helps the idea of holding hard assets such as gold.

To the downside, if we were to break down below the $1550 level, we could go looking towards the $1500 level after that. The 200 day EMA sits right in that same area, which is an area that could be massive as far as support is concerned. If we break down below there, then the trend will change but I find that very unlikely to happen. In fact, I like the idea of buying dips going forward in order to take a bit of value as gold continues to be bought on dips along the way over the longer term.