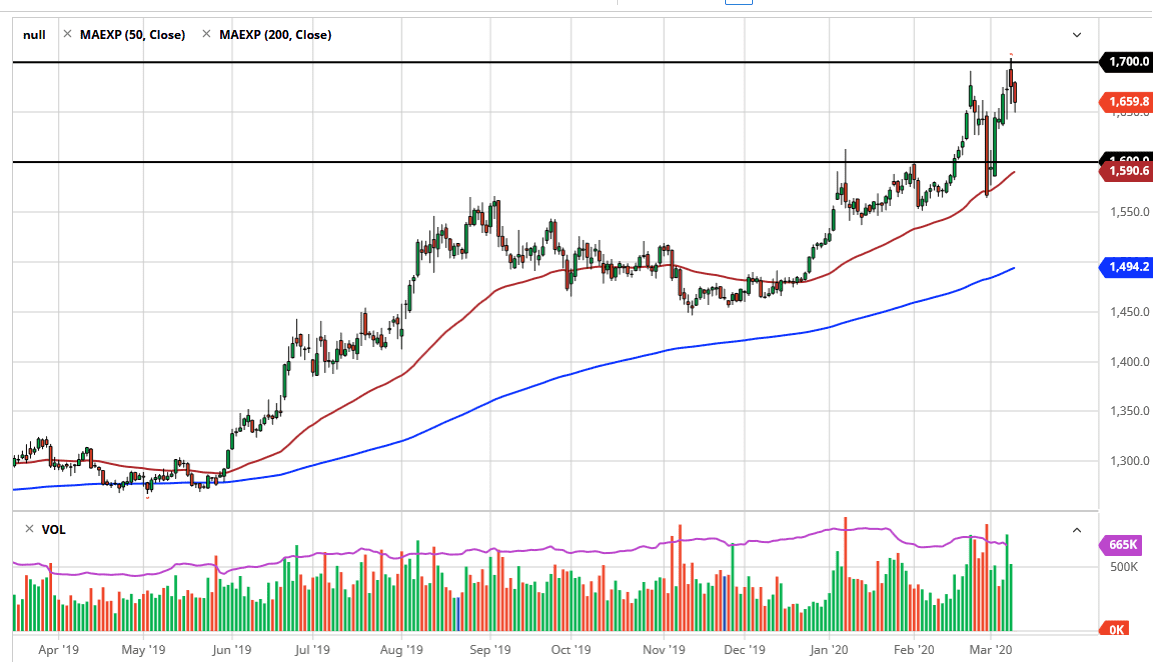

The gold markets dropped somewhat significantly during the trading session on Tuesday as we are taking a bit of a break from the massive “risk off” feel that the markets had. That being said though, the $1650 level should offer plenty of support for short-term traders, as it has been important on the short-term charts. That being said, if the market were to break down below the $1650 level, it would then go looking towards the $1600 level where I would expect to see even more support based upon the recent action there, and of course the 50 day EMA that is reaching in that general vicinity. All things being equal, this is a market that should continue to see a lot of volatility due to the fact that the markets are so uncertain when it comes to a host of different things.

The first thing of course the comes to mind is going to be risk appetite as the coronavirus is certainly going to cause major issues when it comes to traffic. If there is less traffic in the world, there is going to be less economic activity. There are large portions of various countries that are starting to get shut down now, and as a result it will certainly have a short-term shock to the economy coming. I think that gold will get a little bit of a “risk off rally” given enough time, but I also think that the global situation is going to be to and fro, so your best bet is to simply take some time to build up a position, not necessarily jump in with both feet.

The $1600 level underneath will be massive support, so if we were to break down below there it’s very likely that we would see a move down to the $1550 level next. That is an area that by the time we would get there, it’s very possible that the 200 day EMA would be in the same area as well, offering even more support. I do not have any interest in shorting gold, at least not at the moment. We would need to see an explosion in the value of the US dollar for me to start shorting again. At this point, one would have to think that was central bank action around the world it’s only a matter of time before gold gets a bit of a rally going.