The gold markets initially gapped higher to kick off the week, but then turned around to fill that gap. By pulling back to fill that gap, we found buyers which is quite typical with a gap to the upside. Beyond that, we exploded to the upside as the Federal Reserve announced that it was going to enter a new phase of quantitative easing, buying corporate bonds and the like. By doing so, in theory this should continue to drag on the US dollar, sending gold market higher. That being said, gold and the US dollar seem to be rising simultaneously which of course can happen as well. Remember, there is a lot of concern out there when it comes to credit markets and perhaps, they will cause that situation to at least calm down. However, there is still extraordinarily high demand for the US dollar general which of course hasn’t changed due to something the Federal Reserve did in the US corporate debt markets. Sovereign debt still needs those greenbacks.

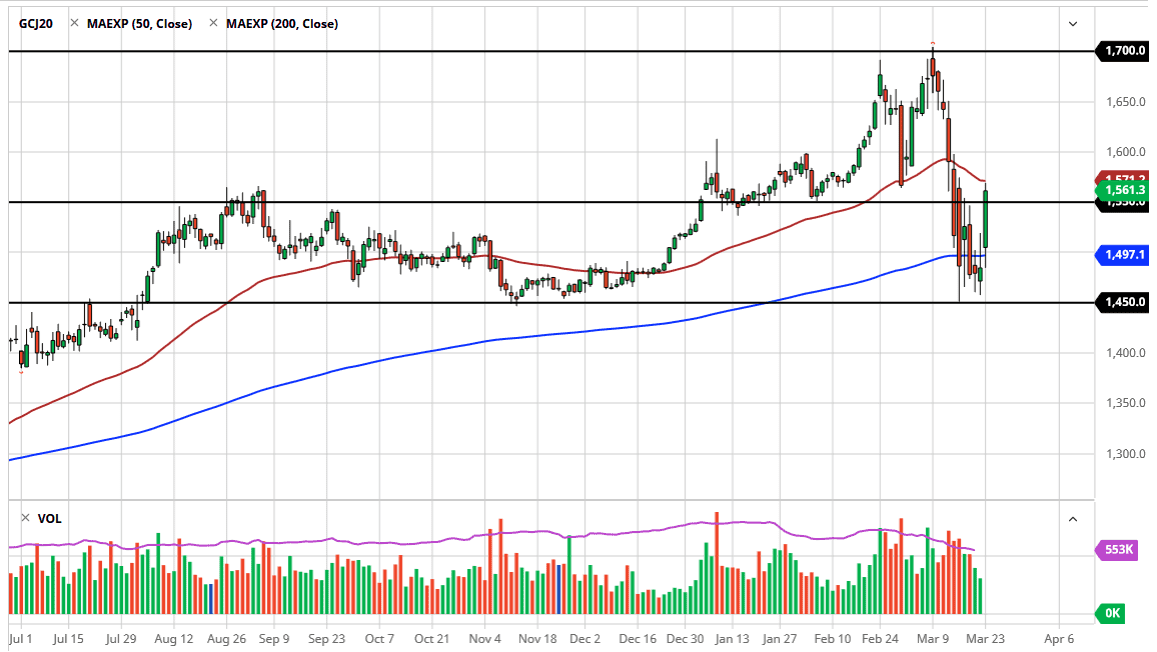

With the very high likelihood that central banks are going to continue easing monetary policy, it makes quite a bit of sense that gold gets bought as it is a hedge against what is probably going to be inflation down the road. It’s also a safety play, but at this point I think it is somewhat limited to the upside. I also recognize that we are currently trading in an area that has been resistance in the past, and as we find ourselves out the 50 day EMA, it makes quite a bit of sense that certain traders will come in and try to either take profit or short this market. Furthermore, if the markets calm down it’s very possible that gold markets settle back down as well.

The size of the candle is of course very interesting, and it does show a significant change in attitude, but these moves, assuming that the markets celebrate the idea of further liquidity coming out of the Federal Reserve, will probably abate. Even if we do break out to the upside it’s very likely that we need to pull back a bit in order to break out and go back towards the highs. I do think eventually that happens, but you need to be very cautious between now and then if you are using high amounts of leverage as gold markets do tend to be very volatile and with these headlines on an almost daily basis, that should only continue.