Gold markets have gone back and forth during the trading session on Thursday, as we continue to see a lot of confusion about what to do next. Keep in mind that a lot of the gold selloff has been due to forced liquidations as traders are trying to cover margin calls in other parts of the markets. Because of this, gold has taken a bit of a wrap that it should not have, especially considering that the central banks around the world are flooding the markets with cheap money. Longer-term, that is very bullish for gold but that doesn’t necessarily mean that we need to rise straight up in the air from here.

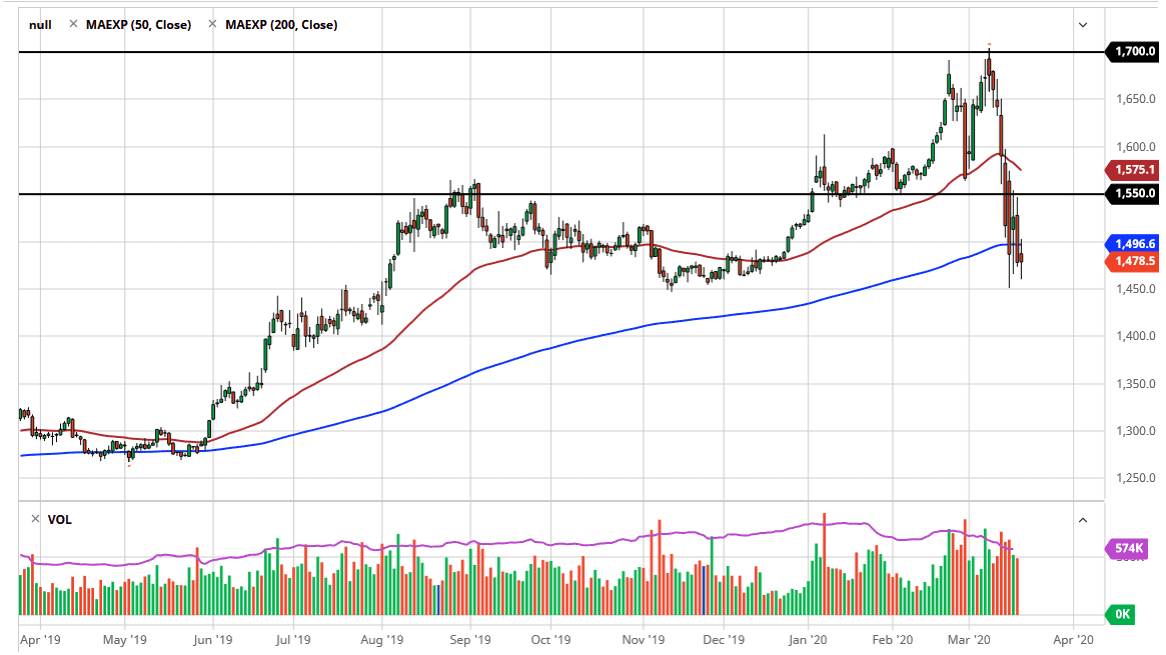

I believe that the more likely of scenarios that we continue to bounce around this 200 day EMA in order to build some type of base. The $1450 level has offered significant support over the last couple of days, and I think it will continue to be the case going forward. If that is in fact going to be the case, the market is likely to break back above the $1500 level again, and then perhaps reach towards the $1550 level after that. A break above their opens up the door to the $1600 level.

If we do in fact break down below the $1450 level, it’s likely that the gold markets will drop down to the $1400 level at that point. This would coincide with the US dollar strengthening yet again, which is quite often the natural enemy of gold itself. I think that gold markets will eventually bounce significantly in the end, but it’s going to be a very bumpy ride to say the least. If you have the ability to hang onto a big move, then it’s possible that this might be a nice trading opportunity.

At this point in time, it’s very likely that we will see a lot of noise, but if you jump in very slowly and build up a position over time, you should be able to take advantage of this potential movement. That being said though, the market was to break down below the $1400 level, you would almost have to get out and reset, looking for an opportunity it much lower levels. The next couple of weeks will be crucial for the future of the gold markets going forward, so by all means it is certainly worth paying attention to.