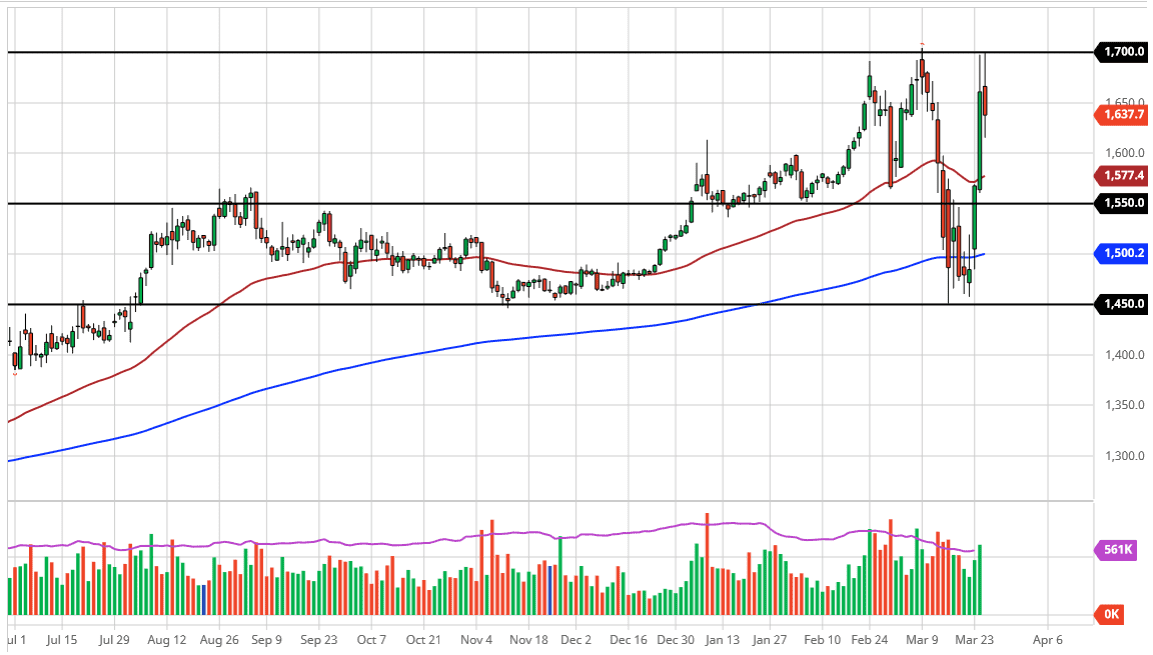

Gold markets of course have been very volatile during the trading session on Wednesday, as we approached the $1700 level. That’s an area that has been resistance before, so it’s not a real stretch to see this market struggle here again. The $1700 level looks to be very resistive, so it’s not until we break above that level on a daily close that I would be comfortable buying gold up here, but I am very keen to buy it on pullbacks.

As far as levels that I would be looking to purchase a contract door two at would be the $1600 level, and the $1550 level. Looking at this chart, I do believe that there is enough interest in gold to continue to lift it, especially considering that the global uncertainty is clearly out of control at times. Having said that, the US dollar has a significant amount of influence on gold, so if the US dollar suddenly spikes, it could work against the value of gold, assuming that it isn’t some type of massive disruption to the market. All things being equal, the gold markets will continue to be extraordinarily noisy so regardless of what happens, you should probably get involved slowly and only add as the market works in your favor.

If we were to turn around and breakdown below the 200 day EMA underneath, which is currently residing at the $1500 level, that would destroy the uptrend altogether for gold, something that I don’t see happening anytime soon. The most recent move has been so impulsive that it tells me there is a lot of underlying demand for gold, just as there has been previously. Pay attention to the $1700 level, because I do suspect that fresh money will flood into the market after that gets broken. I have a longer-term target of $1800, followed very quickly by $2000 above there. To the downside, if the 200 day EMA gets broken we could find this market looking towards the $1450 level, and then possibly all the way down to the $1200 level next. At this point, it is a bit difficult to chase this trade, and I would fully anticipate that you should get some type of pullback in order to offer the ability to buy gold “on the cheap”, at least in the most recent terms. Furthermore, if you have the ability to buy gold in other currencies, you may be better off doing such a thing.