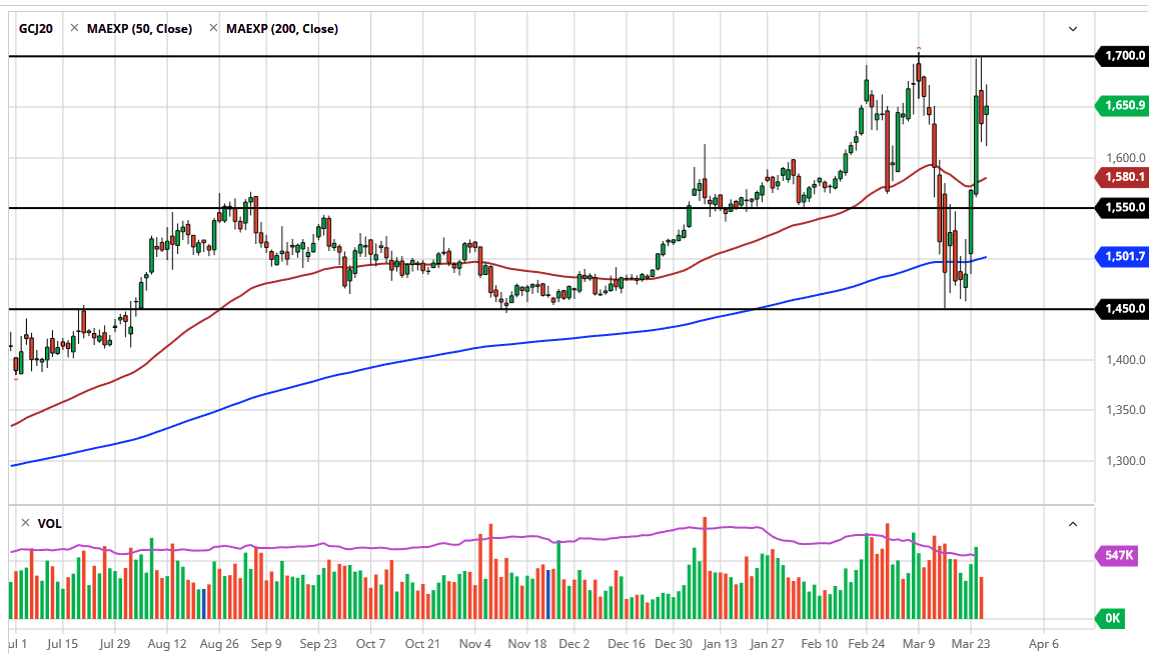

Gold markets have gone back and forth and choppy trading during the trading session on Thursday, as we try to figure out where we are going next. The $1650 level of course is an area that seems to be a bit of a magnet for price, as we have swung towards the $1700 level above and the $1600 level below, forming some type of short-term range. The $1600 level should be rather supportive, and it does look like the 50 day EMA is trying to reach towards that level, offering a bit of dynamic support as well. Obviously, the $1700 level has been massive resistance, so if we were to break above there then it would be a significant move.

On a move above the $1700 level I would be looking for the $1800 level almost immediately, followed by the $2000 level given enough time. I believe that the $2000 level makes quite a bit of sense, considering that central banks around the world are printing money like it’s going out of style to fight the coronavirus situation. This and the geopolitical concerns around the world all work in favor of gold as a safety asset as well.

If we do break down below the $1600 level, then I think the next fight is closer to the $1550 level, an area that has been significant support in the past, so give it enough time I think that we are going to continue to see buyers pick up dips. After all, we had slammed into the $1700 level and now or simply treading water. This is a typical phenomenon when you are looking at a market that has shot straight up in the air, because traders do need to either see a pullback in order to offer value, or the markets calm down a bit and seem to be “comfortable” at those higher levels just printed.

Longer-term, I believe that gold has a bright future ahead of it, as the printing presses have been accelerated in the United States, Europe, and the United Kingdom, as well as many other banks. It’s not until we break down below the 200 day EMA that I would be concerned about the uptrend, which is currently sitting at roughly $1500. That is a long way away, so obviously it would take a significant turnaround in overall sentiment in order to see that happen.