After the UK released disappointing retail sales for February, the GBP/ZAR continued its recovery on the back of weakness in the South African Rand. Covid-19 is spreading across the African continent, where the health system struggles in most countries. South Africa, the continent's second-largest economy behind Nigeria, took swift measures to implement containment protocols. Before the 21-day nationwide lockdown, the economy was forecast to post a 0.2% annualized contraction. The fragile South Africa fiscal condition adds to bearish pressures on its currency, favoring price action to extend its breakout sequence.

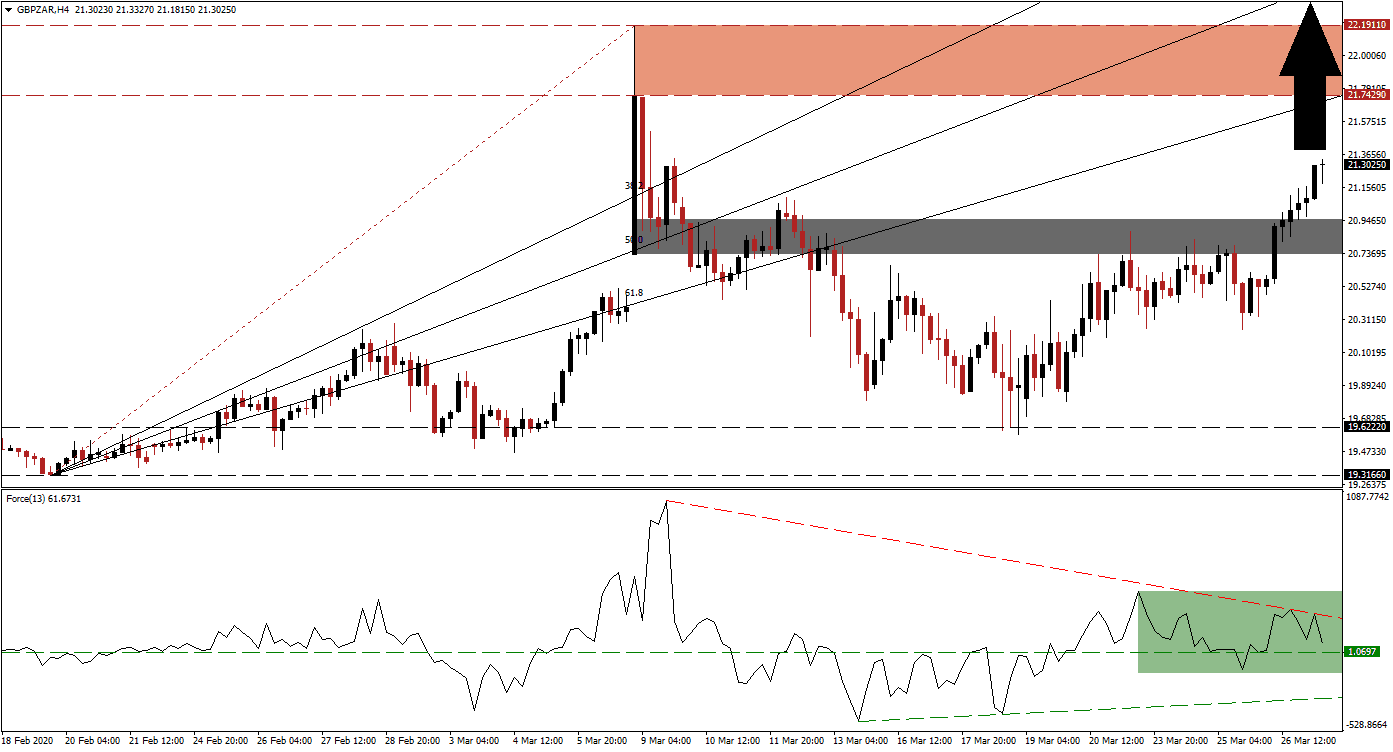

The Force Index, a next-generation technical indicator, remains well off of its 2020 peak. An ascending support level is expected to limit short-term corrections. The Force Index remains above its horizontal support level, but its descending resistance level is applying downside pressure, as marked by the green rectangle. Bulls remain in control of the GBP/ZAR with this technical indicator in positive territory. A sustained pushed above its descending resistance level is anticipated to spike this currency pair higher.

Price action successfully converted its short-term resistance zone into support, delivering a bullish catalyst. This zone is located between 20.72600 and 20.95360, as identified by the grey rectangle. The GBP/ZAR is now on track to close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level. South Africa lacks the financial strength to issue massive rescue packages. A Debt Relief Fund for small businesses, together with twelve economic measures, were announced to cushion the impact of the pandemic.

With the 61.8 Fibonacci Retracement Fan Resistance Level entering the bottom range of its resistance zone located between 21.74290 and 22.19110, as marked by the red rectangle, and the remaining sequence above it, the GBP/ZAR is well-positioned to advance to a new 2020 high. The G-20 expects South Africa to request assistance, after announcing $5 trillion in stimuli. Canada took a lead role in offering global assistance to vulnerable countries. This currency pair carries a distinct bullish bias, given the South African economic and fiscal state. You can learn more about a resistance zone here.

GBP/ZAR Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 21.30000

Take Profit @ 22.30000

Stop Loss @ 21.00000

Upside Potential: 10,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 3.33

A sustained retreat in the Force Index below its ascending support level is likely to pressure the GBP/ZAR into a minor corrective phase. Resulting from the dominant fundamental scenario, enhanced by developing technical conditions, the downside potential is fairly limited. Forex traders are recommended to take advantage of short-term contraction with the addition of new net buy orders. The next long-term support zone is located between 19.31660 and 19.62220.

GBP/ZAR Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 20.30000

Take Profit @ 19.62000

Stop Loss @ 20.62000

Downside Potential: 6,800 pips

Upside Risk: 3,200 pips

Risk/Reward Ratio: 2.13