South Africa has limited options to stimulate its troubled economy through Covid-19 and the collapse in oil prices. One of the most critical challenges remains the 29% unemployment rate with a fiscally constrained public sector. The government has vowed to improve the economy via infrastructure projects, but the lack of investment across the economy has pressured the South African Rand to the downside. Eskom is at the center of problems. The GBP/ZAR spiked to a new 2020 high before enduring a profit-taking sell-off.

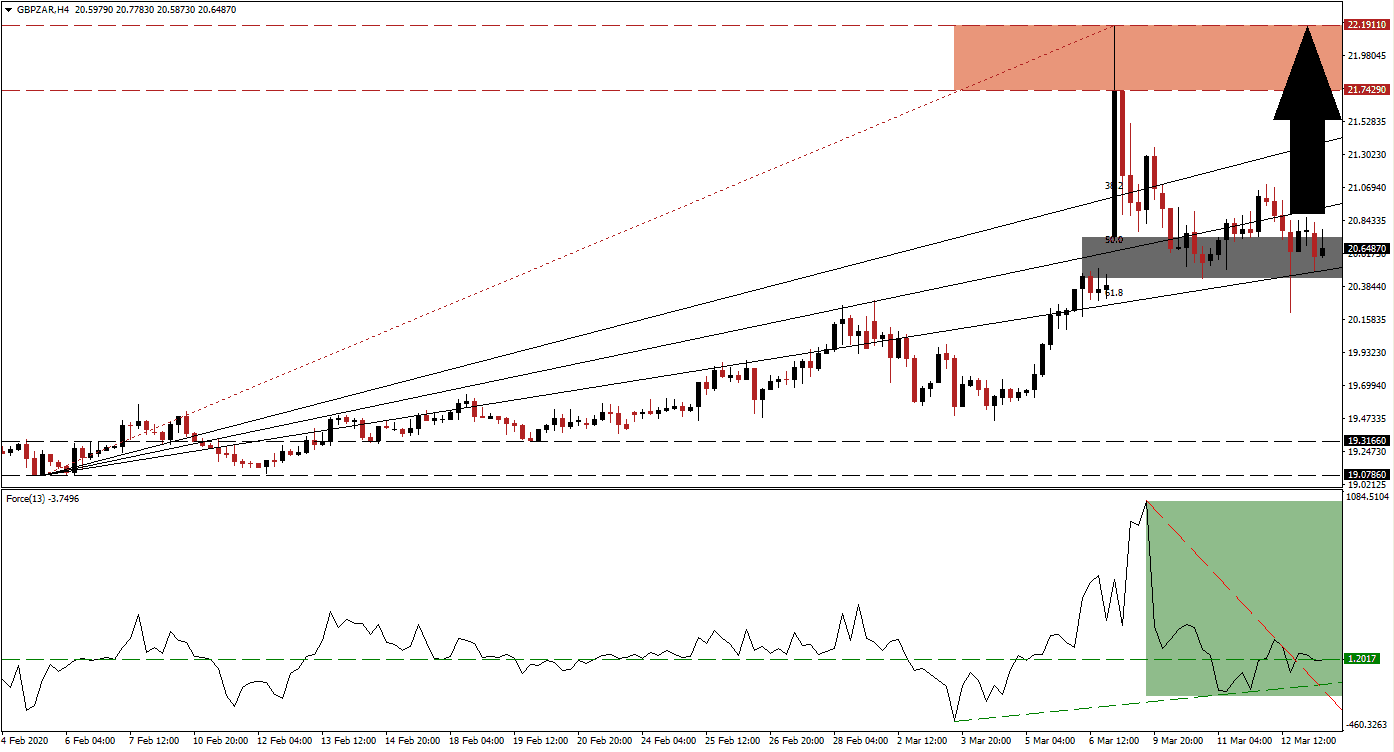

The Force Index, a next-generation technical indicator, points towards a steady increase in bullish momentum, evident by its ascending support level. It halted a contraction off of a fresh 2020 peak and pushed the Force Index back above its horizontal support level. It additionally resulted in a breakout above its steep descending resistance level, as marked by the green rectangle. This technical indicator is now expected to hand control of the GBP/ZAR to bulls with a crossover above the 0 center-line.

This currency pair has paused the reversal inside of its short-term support zone, which is enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level, maintaining the bullish trend. This zone is located between 20.44080 and 20.72600, as marked by the grey rectangle. The GBP/ZAR briefly pierced through it before recovering, after the Bank of England announced an interest rate cut unusually. The Fibonacci Retracement Fan sequence is anticipated to guide price action further to the upside.

Forex traders are advised to monitor the intra-day high of 21.09440, the peak before the GBP/ZAR was forced into a breakdown due to the interest rate cut by the British central bank. A breakout above this level is favored to result in the net addition of new buy orders in this currency pair. It will also provide the necessary fuel to drive price action into its resistance zone located between 21.74290 and 22.19110, as marked by the red rectangle. You can learn more about a breakout here.

GBP/ZAR Technical Trading Set-Up - Reversal Scenario

Long Entry @ 20.65000

Take Profit @ 22.00000

Stop Loss @ 20.30000

Upside Potential: 13,500 pips

Downside Risk: 3,500 pips

Risk/Reward Ratio: 3.86

A contraction in the Force Index below its ascending support level is likely to pressure the GBP/ZAR into a breakdown attempt. With the dominant bullish fundamental outlook for this currency pair, Forex traders are recommended to take advantage of any temporary breakdown with buy orders. The next support zone awaits price action between 19.07860 and 19.31660 from where more downside remains unlikely.

GBP/ZAR Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 20.15000

Take Profit @ 19.30000

Stop Loss @ 20.50000

Downside Potential: 8,500 pips

Upside Risk: 3,500 pips

Risk/Reward Ratio: 2.43