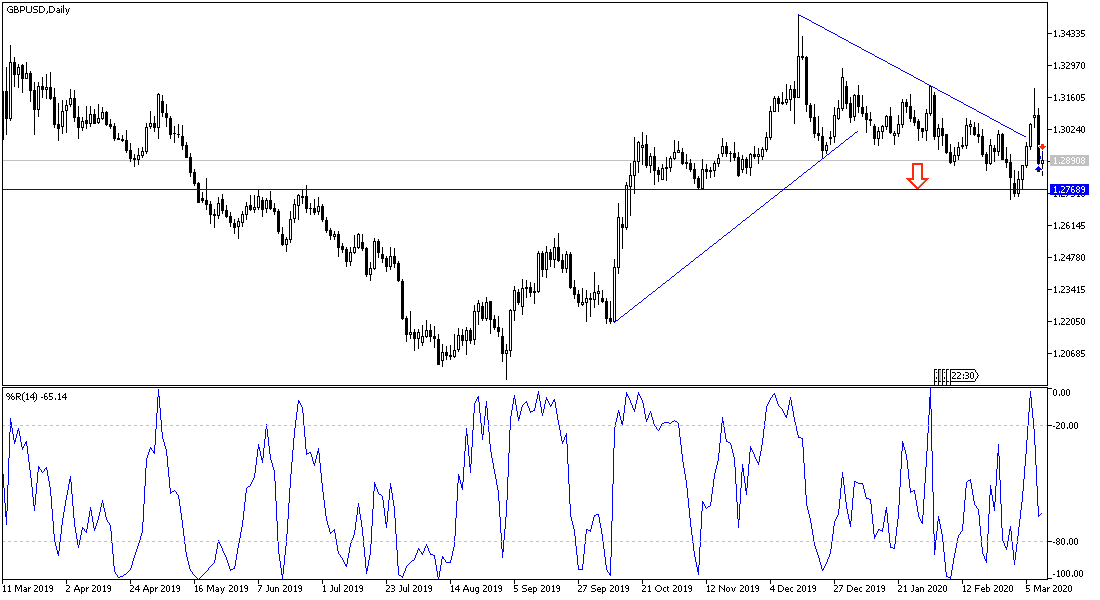

Today will be an interesting and exciting trading session for the British pound against other major currencies, as the details of the British government budget will be announced, with markets expecting the bank to announce stimulus figures to confront the deadly Corona pandemic and support the economy in the post-Brexit era. Prior to this important announcement, we witnessed a correction of the GBP/USD pair to the 1.2858 support, after its gains in the beginning of the week's trading towards the 1.3200 resistance. The pair is stable around the 1.2930 level at the time of writing. The US dollar received support from the American president's suggestion to provide incentive contingency plans to alleviate the burdens due to the spread of the Corona epidemic in the United States. Trumps decision came at a time the US dollar and stock markets are facing significant and historical losses since the virus outbreak in the U.S, the declaration of emergency in a number of states and the sudden announcement of the US central bank to cut interest rates ahead of the scheduled meeting.

As did the global central banks, the Bank of England is expected to surprise the markets and offer a significant rate cut in March and resumption of quantitative easing in April, as part of a global effort to support economic activity and investor sentiment in the face of the economic slowdown associated with the Coronavirus. Expectations are now that BoE will cut interest rates by 50 basis points, bringing the base lending rate to 0.25%. According to Forex rules, when a central bank lowers interest rates - especially when the reduction and its size is a surprise - the associated currency will drop in value.

Currency traders, especially those interested in the British Pound, should be aware of the timing of any action by the BoE. The next meeting is scheduled for March 26, but there is growing speculation that the bank may act as soon as today, Wednesday, in conjunction with the government's announcement of budget details.

Given that the economic impact of the Coronavirus is expected to be on the supply side (i.e. a lack of manufacturing components) and on sentiment (the decrease in consumer spending), there is a concision among economists that the British government will choose the best realistic option to help the economy. This assistance can come in the form of private loans to businessmen, increasing wages, reducing debt, etc. Therefore, any action by the Bank of England today would likely aid government programs, and not necessarily lower interest rates.

According to the technical analysis of the pair: The recent correction was violent and the stability of the GBP/USD pair below the 1.3000 resistance is a threat to bulls continuing control of performance, especially if the pair moved around and below the 1.2800 psychological support, as then control will turn to the bears. Important economic releases today may trigger a strong move for the pair. If the releases were better than expected, the pound may return again, breaking the 1.3200 resistance, which was reached at the beginning of this week’s trading, thus clearing the path to test stronger resistance levels supporting recent bullish channel.

As for today's economic calendar data: From the U.K, attention will be on announcing the government's budget details and any sudden action by the Bank of England. From the United States, CPI numbers will be announced.