After four consecutive trading sessions, in which the GBP/USD pair witnessed a bullish correction crowned by the move towards the 1.3051 resistance, its highest in three weeks, in light of the US dollar general strong bearish trend due to the beginning of the fatal Corona outbreak in the United States in a worrying manner that the largest economy in the world will be exposed to what happened in China, the source of the epidemic, and if that in fact happened, then it will inevitably support the global economic recession. In the beginning of this week’s trading, the pair moved up to reach the 1.3124 resistance before settling around the 1.3070 level at the time of writing. However, it should be borne in mind that sterling's gains were temporary no matter how high, as the first round of negotiations between the European Union and Britain did not come out with optimism of a smooth path between them in agreeing to the broad lines of trade relations in the post-Brexit phase, which was formally done on January 31. 2020.

The pound received support from recent indications that the Bank of England would not rush to cut interest rates, along with constructive comments from the European Union in the wake of the first round of trade negotiations between the European Union and the United Kingdom, as European Union chief negotiator Michel Barnier confirmed, in a press conference, that the talks started in a "very constructive" manner. Barnier added: “This first round was an opportunity to share, compare and clarify our positions. There are points of convergence and divergence, which is completely normal for the first round of negotiations. ”

There was no surprising early fracture between the two sides, which bodes well for the immediate set of negotiations, Barnier said: “This negotiation is about building or rebuilding an ambitious partnership with this great country that will remain a neighbor, friend and an ally after Brexit, but we must build everything on a different legal basis due to Brexit”

Barnier said that the UK has "confirmed" that they will not back down from the Northern Ireland protocol. For his part, UK chief negotiator David Frost said, "The UK will honor all of its legal obligations and is a condition for the confidence we need now to build our future partnership on good basis.”

In his speech to the press, Barnier noted that "many serious differences" had come out. Some of the controversial points remain, which is the UK’s unwillingness to follow European Union rules to maintain a level playing field. Moreover, the UK has made it clear that it does not wish to formally commit to continuing to implement the European Human Rights Convention”.

The GBP/USD ignored the announcement of better-than-expected US jobs’ numbers for February 2020, as the report marked new jobs, higher average hourly wages, and the US unemployment rate at its lowest level in 50 years.

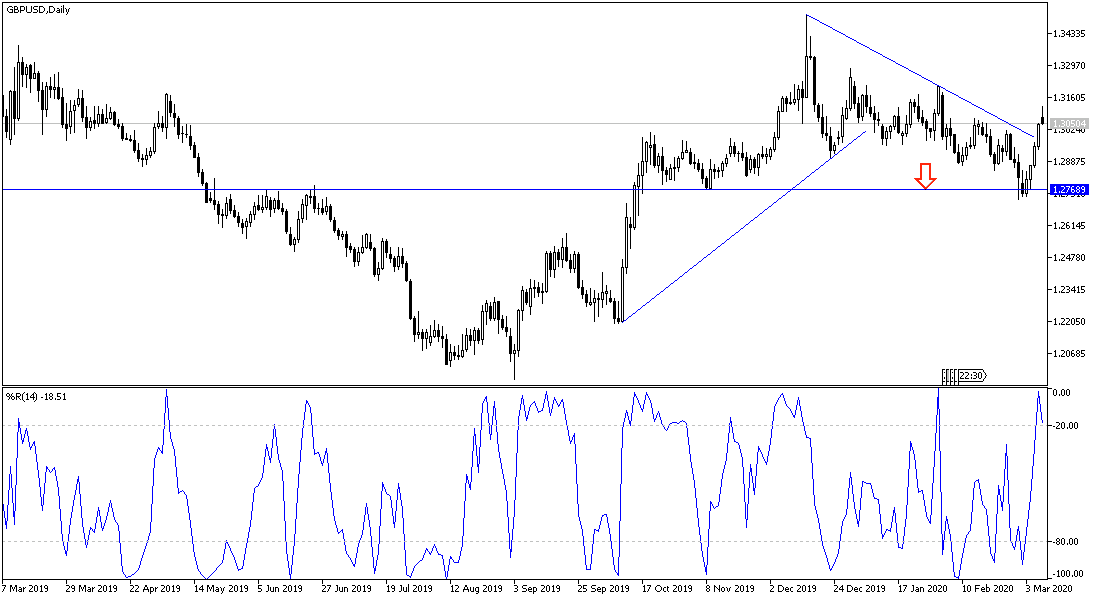

According to the technical analysis of the pair: On the daily chart of the GBP/USD pair below, it seems clear that the downtrend has been broken by moving through the 1.3000 psychological resistance, but the pair will still need to test higher resistance levels to confirm the breach, and the resistance levels at 1.3085, 1.3120 and 1.3200 might be the most important to confirm the expected reversal. At the same time, gains will remain under constant threat of any worrying signals to the path of negotiations between the European Union and Britain. On the downside, a return to 1.2900 support will bring the bears back in control. Today, the pair does not expect any important economic data, whether from Britain or from the United States.