Although the Corona epidemic broke out strongly in Britain to the point that it infected senior officials and senior royal family members led by Prime Minister Boris Johnson and the Queen's heir, the GBP/USD pair took advantage of the USD drop and moved towards the 1.2485 resistance, the highest level in two weeks, and closed the trading week close to the 1.2425 resistance and settled around that level at the time of writing. The GBP/USD has been on a recovery trend since hitting the bottom at its lowest level in several decades last week. It has now risen to its 61.8% Fibonacci level, recovering by more than 60%.

The coronavirus has caused global devastation. This has affected the global financial markets. This forced the global central banks to cut interest rates to near zero to stimulate the global economy. The latest round of economic data results from Britain and the United States seem to be in favor of the pound sterling. The Industrial Purchasing Managers' Index fell to 35.7, below expectations of 45, and in contrast, the February CPI matched expectations (annually) at 1.7%. By the end of the week, the members of the Bank of England's monetary policy committee voted unanimously to maintain the bank's 0.10% interest policy, and the asset purchase plan, which increased and became 645 billion pounds as they were unchanged while monitoring the country's economic situation, and the extent of the impact of the deadly Corona pandemic on economic activity.

From the United States, the Markit Manufacturing PMI for March exceeded expectations at 42.8 where expectations were at 49.2. However, the Services PMI came in below expectations with a reading of 39.1 versus expectations for a reading of 42. Non-defensive capital goods orders in February missed expectations for a -0.4%, with a reading of -0.8% reading. The claims of the unemployed in the US last week was higher than expected, at 3.283 million, compared to expectations of only a million and a half.

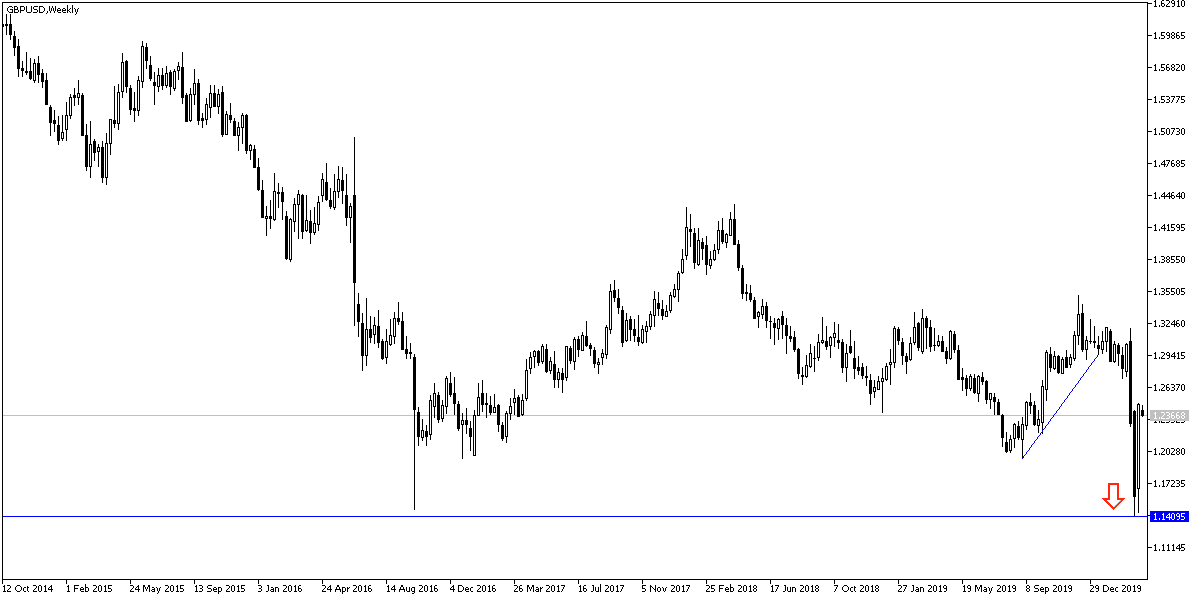

According to the technical analysis of the pair: On the daily chart, it appears that the GBP/USD is trading within a bearish channel. This indicates a long-term bearish bias in market sentiment. The pair recently bounced back aggressively after hitting its lowest level in several decades. Bulls will aim to extend the current recovery towards resistance levels at 1.3000 or higher at 1.3560. On the other hand, the bears will target rebound profits at around 1.1961 or less at 1.1426.

On the short term. The pair started forming a bullish channel that will be strengthened if the pair succeeds in moving towards the resistance levels of 1.2630, 1.2780 and 1.2865 respectively, and I still prefer to sell the pair from each upper level despite the recent bounce.

According to the economic calendar data today: From Britain, the money supply, mortgage approvals and net lending to individuals will be announced. From the United States pending home sales data will be released.