As was the performance with other major currencies, the pound succeeded in making some gains, taking advantage of the weakening dollar. Therefore, the British pound rose against the dollar to 1.1799 before settling around the 1.1826 level at the time of writing. Investors sold the US dollar and bought other currencies after China said it would left the "closure" of Hubei Province, and at a time when some European countries announced a second consecutive decline in new corona cases despite increasing tests, which gives markets hope that the virus is controlled in some of the worst affected areas.

With the start of this week’s trading, the US central bank announced that it will purchase an unlimited amount of US government bonds in an attempt to support the economy by imposing low returns, and in this process, facilitate borrowing for all. The bank will also buy corporate bonds for the first time, and it has provided large sums of new money to lend to families and creditworthy companies, although unlimited quantitative easing is the most important for the dollar.

The unlimited quantitative easing program will crush government bond yields, which reduces the attractiveness of the US currency to investors, while radically increasing the supply available in the market. This offer could be increased in the coming weeks by the Federal Reserve’s decision on Thursday to extend dollar swap lines to nine other central banks, supply them with up to $60 billion that can be loaned to companies or sold on the open market to support their domestic currencies.

On the economic side. A survey showed that the UK private sector recorded a record decline in commercial activity during the month of March amid emergency public health measures to contain the spread of coronavirus. The Composite PMI - which groups manufacturing and services together - fell to 37.1 in March from 53.0 in February. The reading was also below expectations of 45.1. This was the fastest decline in private sector business since the chain began in January 1998 and was the worst since the 2008-2009 global financial crisis.

British service activity fell to its lowest level since the chain started in July 1996. The Services PMI fell to 35.7 from 53.2 a month ago. The expected reading was 45.0. British manufacturing production fell at the fastest pace since July 2012.

Commenting on the results, Chris Williamson, chief economist at IHS Markit, said: “The surveys highlight how the COVID-19 outbreak actually affected the British economy with a major initial hit bigger than was seen at the height of the global financial crisis.” Williamson noted that the March survey reading is consistent with a 1.5-2.0 percent quarterly GDP drop, a drop large enough to push the economy into contraction in the first quarter of this year.

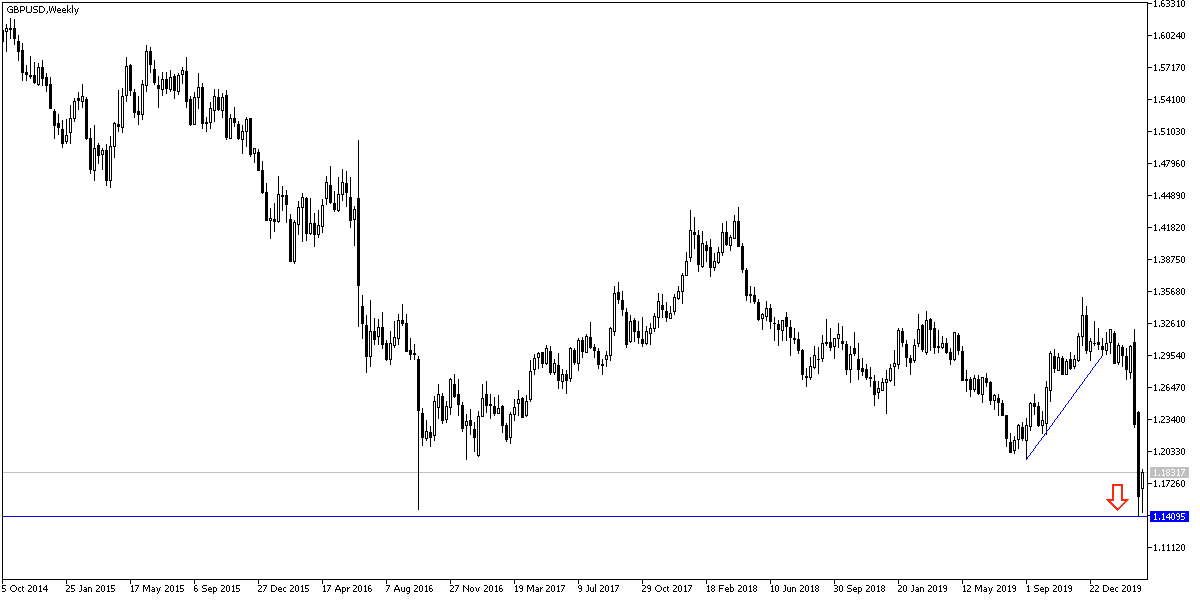

According to the technical analysis of the pair: The recent GBP/USD gains did not reach to the stage of reversing the general trend, which is still bearish and there will be no chance for the pair to correct upwards as a first stage without stability above the 1.2000 resistance. I still prefer to sell the pair from every ascending level, with American stimulus, strict measures to contain the deadly Corona pandemic, and the pound sterling facing stronger pressures from the epidemic along with anxiety about the future of Brexit. Bears may regain control if the pair moves towards the support levels of 1.1690, 1.1580 and 1.1400, respectively.

As for the economic calendar data today: From Britain, the British inflation and producer price index numbers will be announced. During the US session, US durable goods order numbers will be released.