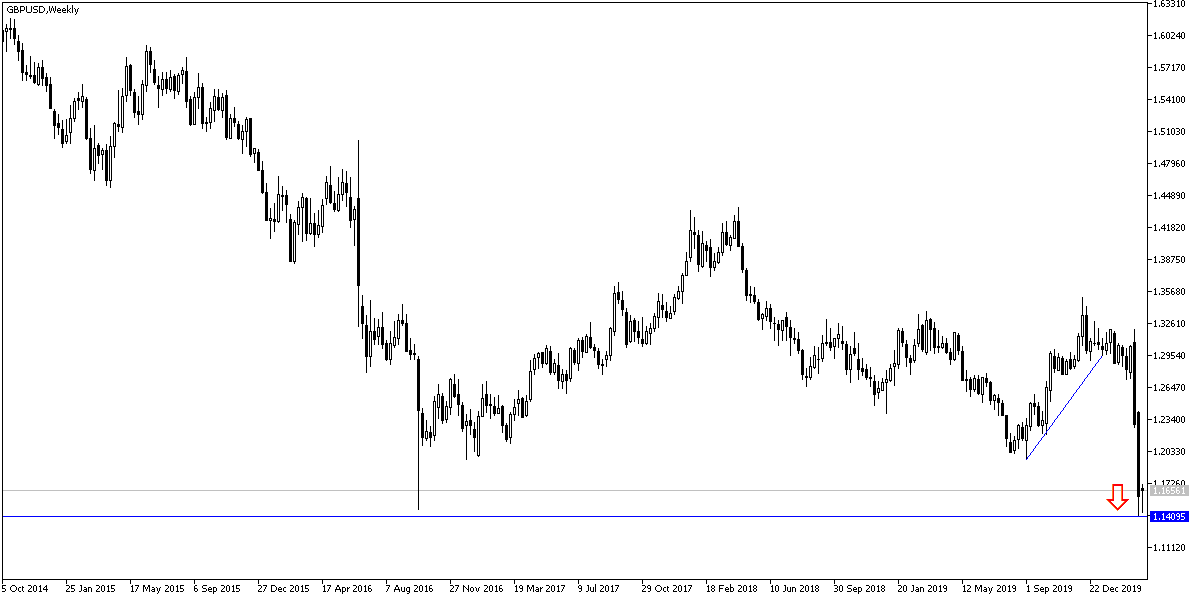

The US dollar remains the strongest against most other major currencies, as investors buy the American currency amid large efforts by the US central bank to stimulate the American economy and American markets, which have suffered greatly in recent times from huge losses and a liquidity crisis amid fears of the spread of the Corona pandemic, its threat to the American economy and the global economy as a whole. The GBP/USD is still around its lowest level in 35 years and the pair did not have a strong opportunity for an upward correction after it collapsed to the 1.1409 support, the pair stabilized around the 1.1650 level at the time of writing. In the beginning of this week’s trading, the dollar’s gains were temporarily suspended after the announcement of a set of initiatives by the US Federal Reserve Board to support the American economy, the main measure of which was to introduce an unlimited program of quantitative easing.

The dollar fell and global equity markets recovered after the Federal Reserve abandoned its self-imposed $700 billion asset purchase limit under the quantitative easing program and said it would pump as much money as possible into the economy. The Federal Reserve will now begin making open quantitative easing - as the Bank of Japan currently does - in the Treasury and MBS markets, and the recent strength of the US dollar has helped ease the liquidity crisis in US dollars in global markets that saw a currency appreciation in the first half of last week.

The US dollar has become the most desired cash instrument by investors and bypassed traditional safe havens such as US Treasury bonds and even gold.

The recent moves by the Federal Reserve confirm that the world's most important central bank is now controlling the financial turmoil that financial markets have suffered since they feared the rapid spread of the coronary virus epidemic in late February. Last week, the US dollar was lower after the Federal Reserve extended currency swap agreements to nine other central banks in a clear attempt to contain a dollar rally that was so severe that it could pose an additional threat to a global economy already collapsing amid the shock of the coronary virus.

What is the currency swap?

Foreign currency swap is an agreement to buy one currency (dollars) with another currency outside the market and then sell it again to the counterparty on a prior date at a pre-agreed price. These transactions will enable other central banks to sell large amounts of dollars in the open market and buy back their local currencies, and raise the value of local currencies against the dollar in the process. Doing so enables these central banks to confront the threats of inflation and growth posed by the devaluation of the currency without burning their foreign currency reserves.

According to the technical analysis of the pair: The pound is still weak in the face of the dollar, as the British economy will suffer from the darkening expectations regarding relations between the European Union and Britain in the future, in addition to the human and material losses from the spread of the deadly Corona pandemic. Therefore, all attempts by the GBP/USD pair to correct higher will be selling opportunities again, and there is no point for technical indicators to reach strong oversold areas. The nearest targets of the bears are now 1.1580, 1.1490 and 1.1380 respectively. And there will be no chance for bulls to reverse without moving above the 1.2000 resistance as a first stage.

As for the economic calendar data today: The purchasing managers index for the industrial and services sectors in Britain will be announced first, and during the American session, the industrial and services PMI will be announced, then the new homes sales.