Wednesday's trading session was the bloodiest for the British pound in the face of the strong USD and the strong demand from investors to buy it. Where the price of the GBP/USD pair fell to the 1.1451 support, the lowest level of since 1985, before settling around the 1.1600 level at the time of writing. The pair lost more than 700 points yesterday only. The price of the pound against the dollar has suffered from the most brutal selling-off since the Brexit referendum, amid sharp USD gains in Forex. Some analysts believe that it could lead to the British currency falling historically down to $1.05.

Investors liquidate their portfolios in a manner rarely seen in the modern era, which explains the recent collapse of assets such as stocks and commodities and a strong move towards safe havens such as government bonds in order to stop capital bleeding. In general, the markets panic benefits US bonds and the dollar at the expense of others, and the price movement of the pair came on Wednesday in a new chaotic trading session where President Donald Trump hinted the use of the Defense Production Act, which enables the White House to do something like redirecting the production facilities of private companies towards efforts of containing coronavirus, and this came after a decision by the UK government to close schools from Friday onwards. These moves exacerbated previous losses, which were already severe.

The decline in the British pound coincided with a decline in London stock markets and the rise in the yields of the ten-year bonds to the country by more than 40%, amid reports that the government plans for a "substantial restriction" to travel to and from London. As is well known, the city of London is home to financial assets worth more than three times the UK's GDP, which may evaporate in the event of a severe imbalance in the city, if it didn’t happen already. This comes at a time of growing concern about the current account.

Asset sales in the UK are rising rapidly at a time of growing concern over the current account deficit and the government is preparing to ask the market whether it can borrow two percent of GDP to help the economy cope with the repercussions of the coronavirus. The current account deficit is often described as impeding to the growth of the United Kingdom, and this means that the British pound depends for a portion of its value on the continuous flows of external capital that may now dry up or simply overshadowed by other external flows. Investors appear to be chasing the US dollar and bonds, while giving up the rest.

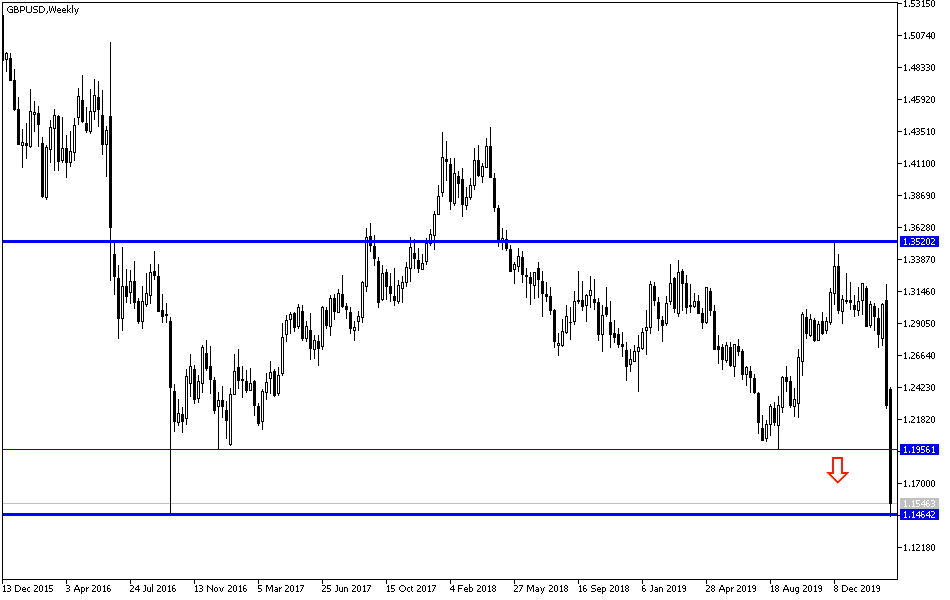

According to technical analysis of the pair: On the daily chart below the GBP/USD is still in a strong downtrend, and may remain as is for a period of time, or increase in special strength if the British economy is subject to closure due to the deadly Corona pandemic. Accordingly, any attempt by the pair to correct higher may be a target for selling. The closest resistance levels currently for the pair are 1.1630, 1.1720 and 1.1900, respectively. Although the technical indicators have reached strong oversold areas, the markets ’anxiety about the Corona epidemic had another say, as the downward trajectory may not have reached its end as long as the dollar’s demand continues.

As for the economic calendar data: All focus will be on the US economic data” the Philadelphia Industrial Index, the unemployed claims, and the current account data.