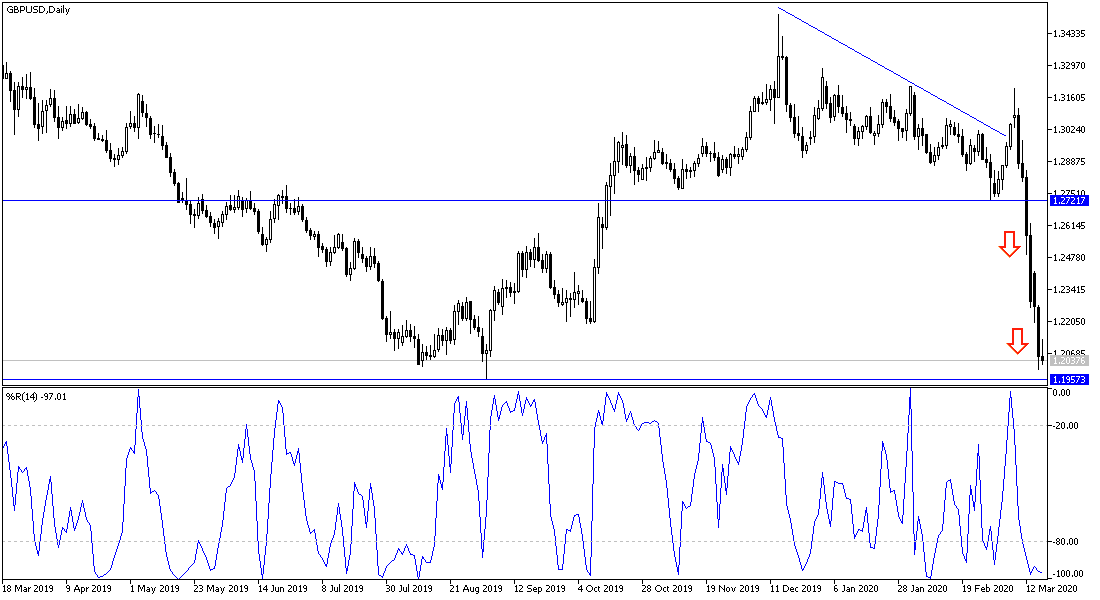

For 6 consecutive trading sessions, the GBP/USD pair has been in a free fall pushing it towards the 1.2000 psychological support during yesterday's trading, the lowest in more than six months before trying to recover to the 1.2120 level at the time of writing. Successive US plans, whether by the Federal Reserve or the US government under Trump's administration, to counter the negative effects facing the US and global economy from the deadly Corona pandemic, supported stronger gains for the US dollar against most other major currencies. Europe is still more affected by the epidemic than the United States, and the United Kingdom is in the depth of the new focus of the disease, as Europe has become a hotbed for the deadly Coronavirus since sense it broke out of the Chinese boarders.

American companies, large and small, were suffering from closures, cancellations and public fear of the virus, as the number of cases rose nationwide. After the latest stimulus measures, US stocks rose on Wall Street on Tuesday, one day after falling to their worst losses in more than three decades.

For his part, US Treasury Secretary Steve Mnuchin, the administration's chief negotiator with the Congress, said tax returns might be delayed and he vowed that exchanges would remain open but their working hours could be shortened. The president pledged to preserve the integrity of the election as voters in three states turned to the polls on Tuesday, even as Ohio postponed primary elections. Officials said that assistance could be provided to airlines, hotels and aircraft manufacturers.

On the British side. Data released by the Office for National Statistics showed that British employment rose to a record high and the unemployment rate rose even before the economy faced the impact of the coronavirus. The employment rate rose 0.3 percentage points from the previous quarter to a combined record level of 76.5 percent in the three months to January. The number of employed people rose to a record high of 32.99 million, as job creation increased by 184,000 from the previous quarter.

However, the British unemployment rate rose 0.2 percentage points from the previous quarter to 3.9 percent. The office said that the rate has not changed significantly from the previous year. This was higher than the 3.8% forecast. During the period from November to January, approximately 1.34 million people were unemployed. Average weekly wages, with and without bonus, increased by 3.1 percent each, on an annual basis. Economists had expected total wages to grow 3 percent and regular wages to rise 3.2 percent.

According to technical analysis of the pair: Bear's control over the GBP/USD pair has been confirmed by the move towards the 1.2000 psychological level. By reaching there, the technical indicators tested strong oversold areas. Forex traders may start thinking about buying to gain a bounce even if with close targets before the pair completes its losses. Currently, the buying level can be from the 1.2030, 1.1945 and 1.1890 support, respectively. And there will be no chance for the bulls to control the performance again without returning to the 1.3000 psychological level and this will take a lot of time, or the occurrence of what is surprising. For the time being, the US dollar is still supported by investor appetite for it, with continued stimulus from the consequences of the Corona pandemic.

As for the economic calendar data: All focus is on the release of US building permits, housing starts, and oil stocks data.