Pressures on the US Federal Reserve are rising to deliver a 50 basis point interest rate cut in response to Covid-19 as Chairman Powell opened the door to deploy all tools at his disposal. With the US Dollar under threat by its central bank, UK data continues to surprise to the upside. Adding a layer of uncertainty that is likely to result in volatility was the start of trade talks between the EU and the UK yesterday. The next three months will be critical as the UK noted its willingness to start preparations for a WTO environment if sufficient progress is not made. After descending into its support zone, the GBP/USD is now well-positioned to initiate a new breakout sequence.

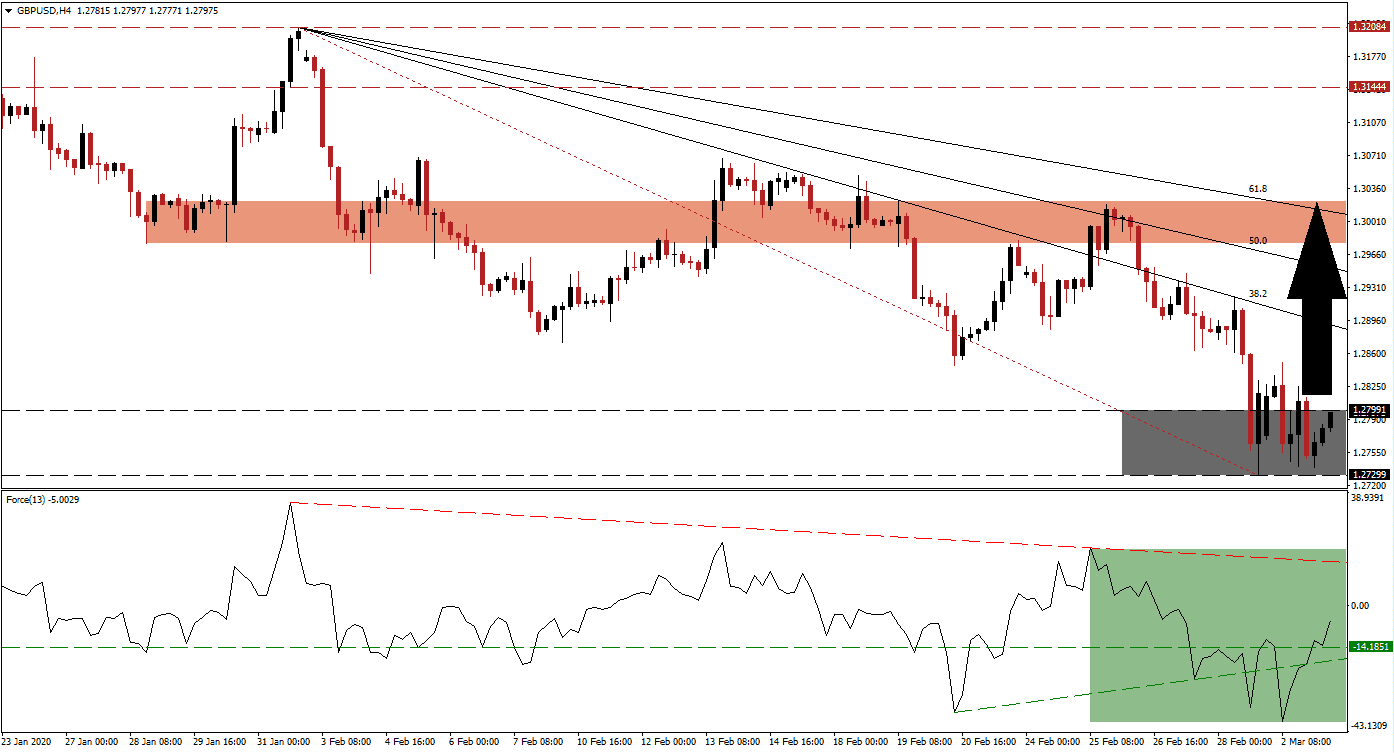

The Force Index, a next-generation technical indicator, recovered from a temporary breakdown below its ascending support level. It has additionally retaken its horizontal support level, as marked by the green rectangle. The Force Index is now expected to advance into its descending resistance level. While bears currently remain in control of the GBP/USD, this technical indicator is on track to push into positive conditions, placing bulls in charge of price action. You can learn more about the Force Index here.

With the increase in bullish momentum, breakout pressures in the GBP/USD increased inside of its support zone located between 1.27299 and 1.27991, as marked by the grey rectangle. The extreme oversold nature of this currency pair makes it ripe for a short-covering rally after a sustained breakout. This should close the gap between price action and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Yesterday’s US ISM Manufacturing Index for February indicated the start of more weakness to come. You can learn more about a short-covering rally here.

Forex traders are recommended to monitor the intra-day high of 1.28504, the peak of a failed breakout in this currency pair. A move above this level is favored to inspire the next wave of buying in the GBP/USD. Price action is anticipated to eclipse its 38.2 Fibonacci Retracement Fan Resistance Level, clearing the path into its short-term resistance zone located between 1.29781 and 1.30299, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is enforcing this zone from where a breakout is increasingly likely.

GBP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.27950

Take Profit @ 1.30300

Stop Loss @ 1.27200

Upside Potential: 235 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 3.13

Should the Force Index correct below its ascending support level, the GBP/USD could attempt a fresh push to the downside. Due to the long-term bullish fundamentals for the British Pound, in conjunction with bearish developments for the US Dollar, any breakdown from current levels will create an excellent buying opportunity for Forex traders to consider. The next support zone is located between 1.25157 and 1.25812.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.26450

Take Profit @ 1.25600

Stop Loss @ 1.26800

Downside Potential: 85 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.43