GBP/USD: Expect more volatility

Yesterday’s signals were not triggered as there was no bullish price action at either 1.2983 or 1.2967.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Short Trade Idea

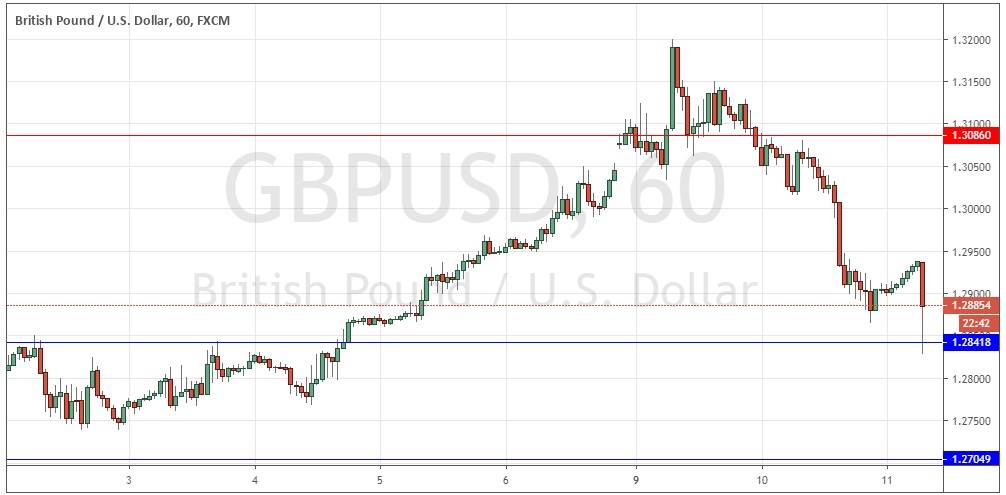

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3086.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2842 or 1.2705.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that this pair was simply not in the market’s focus now and was is mostly just mirroring what the EUR/USD currency pair is doing, so I wanted to avoid trading this currency pair yesterday. I think this was a good call.

This is likely to be a very active and unpredictable day for this currency pair today. The Bank of England just made an emergency rate cut of 0.50% to a new rate of 0.25%, and the British Government will be releasing its annual budget later today. The coronavirus outbreak is also an area of major concern in the U.K. with a member of parliament just announcing that she has tested positive for the virus. The U.S. will release key inflation data later.

The best I can say about this currency pair today is that it seems to be well supported at 1.2842. There is likely to be some resistance at about 1.3000. So, the most likely scenario today is that we see big swings with those levels acting as boundaries. We could well see some very volatile movement. Regarding the GBP, the British Government will release its Annual Budget at 11:30am London time. Concerning the USD, there will be a release of CPI (inflation) data at 12:30pm London time.

Regarding the GBP, the British Government will release its Annual Budget at 11:30am London time. Concerning the USD, there will be a release of CPI (inflation) data at 12:30pm London time.