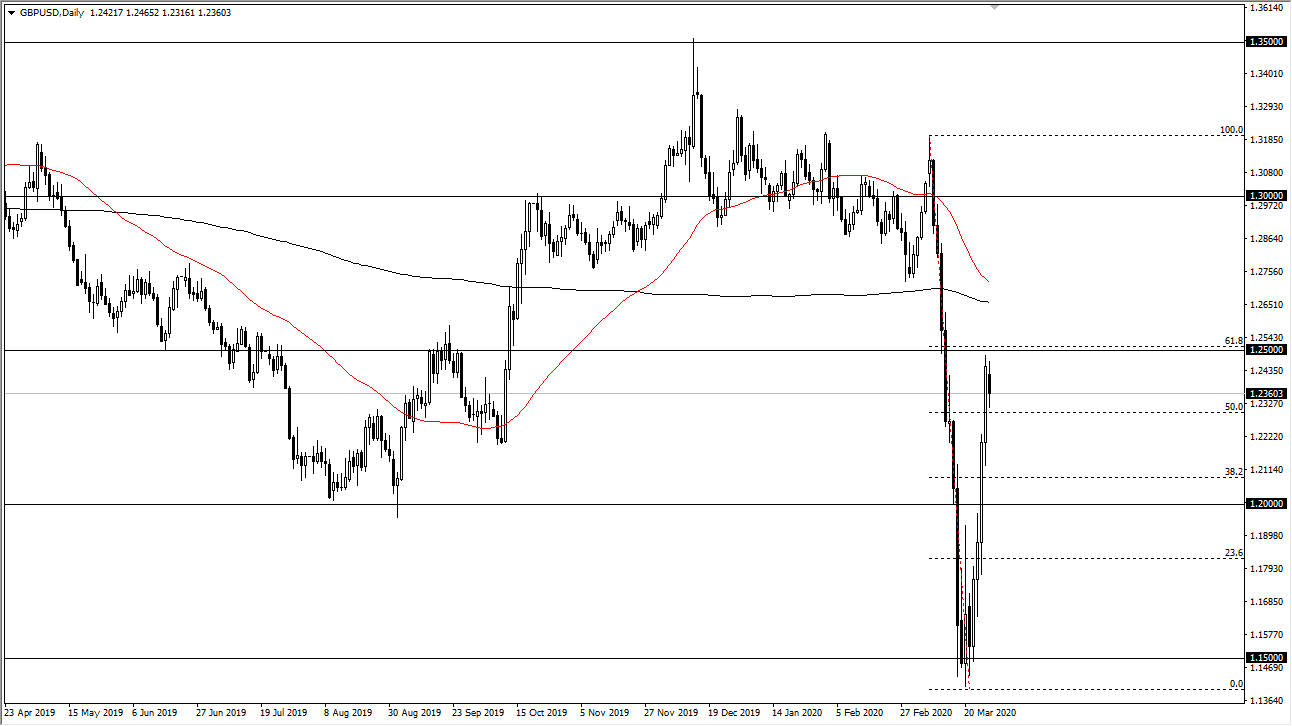

The British pound went back and forth during the trading session on Monday, as we continue to test the 1.25 handle. The market even broke down below the 1.24 handle and reach much lower during the session. However, towards the end of the day we started seeing the market rally a bit, so I think at this point the volatility is going to continue to cause a little bit of trouble, but the 1.25 level above is a big juicy target for traders to look at. There is also the 61.8% Fibonacci retracement level just above that level, so it’s obvious that there will be a lot of interest in this region. Furthermore, the 200 day EMA is sitting just above so that could also cause some issues.

To the downside, if we were to break down below the lows of the session for Monday, then the market will more than likely go looking towards the 1.20 level. I think that is probably a little bit easier of a trade to take then buying, but if we were to break above 1.25 significantly, is very possible that the 200 day EMA will be targeted right afterward. Looking at the chart, you can see that we are overextended, and although there has been a significant move to the upside over the last week or so, the reality is that Great Britain is very likely going to continue to be suffering an economic slowdown while the rest of the world may choose to purchase US dollars in order to find a bit of a safety. That being said, it makes perfect sense to simply wait for some type of move in the market to follow. In this environment, you can get hurt rather quickly if you try to anticipate something.

The shape of the candlestick for the day on Monday is of course a bit lackluster, but as it is so lackluster, it can give us a bit of a “heads up” as to where the market goes next. After all, if we rollover from here then it will show exhaustion that should have some significant follow-through. Otherwise, if we simply pause and then go higher, that could show real strength. Either way, we should have some type of confirmation in the next candle or two on the daily chart. Last week the British pound had one of its best weeks ever.