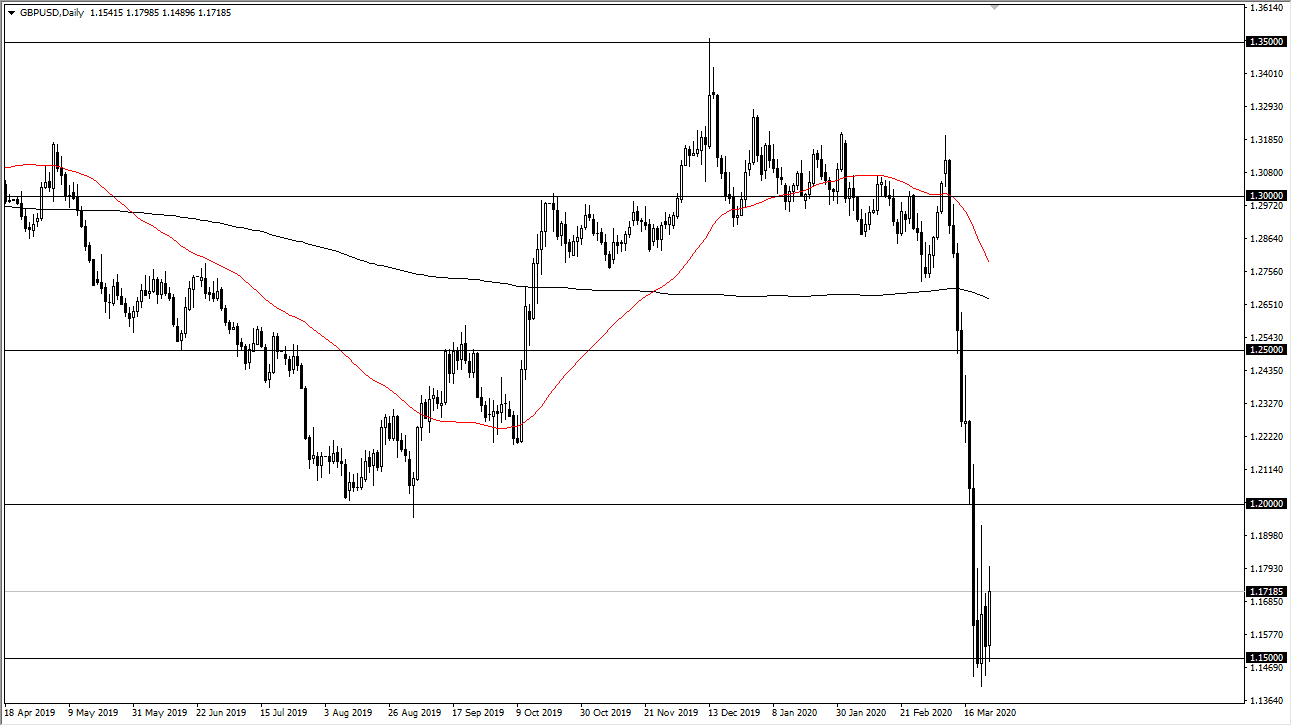

The British pound started out the day just above the 1.15 level but found enough buying to turn things around and reach towards the 1.17 level, even close to the 1.18 handle during trading. The market looks as if it is trying to find its way higher, and it is encouraging considering that the United Kingdom is now on lockdown, and the currency has not fallen even further. This is a pair that is trying to find its bottom, and it is possible that the 1.15 level will be. That being said though, this is a market that has been oversold so a bounce would make quite a bit of sense.

At this point, if we break down below the lows, we could open up the door down to the 1.1250 level, possibly even the 1.10 level after that. I don’t see that happening though, and I think we are more likely going to consolidate overall until we can figure out which direction to go. Remember, the Federal Reserve has unleashed a bazooka of liquidity, and that should eventually work against the value of the US dollar. Ultimately, I do like the idea of buying the British pound on a longer-term trend, because it is so historically cheap. In order to find lower prices than what we are going through right now, you are talking about going back to the 1970s.

Looking at this chart, I could see where the British pound could rally all the way to the 1.20 level without much effort if we get a broad US dollar selloff. Ultimately, that could send this market much higher but obviously we have a lot of issues when it comes to the United Kingdom economy. Nonetheless, the market has priced in Armageddon, so I think it is a bit difficult to understand how the currency could hang out at these extraordinarily low levels for an extended amount of time. At this point, I think we are looking at the market trying to form a little bit of a bottom in order to turn the trend around. We don’t have that quite yet, but I do think we are getting close to that turn around. I will be watching this day by day, but I will say the last couple of days have been somewhat encouraging for the British pound in general.