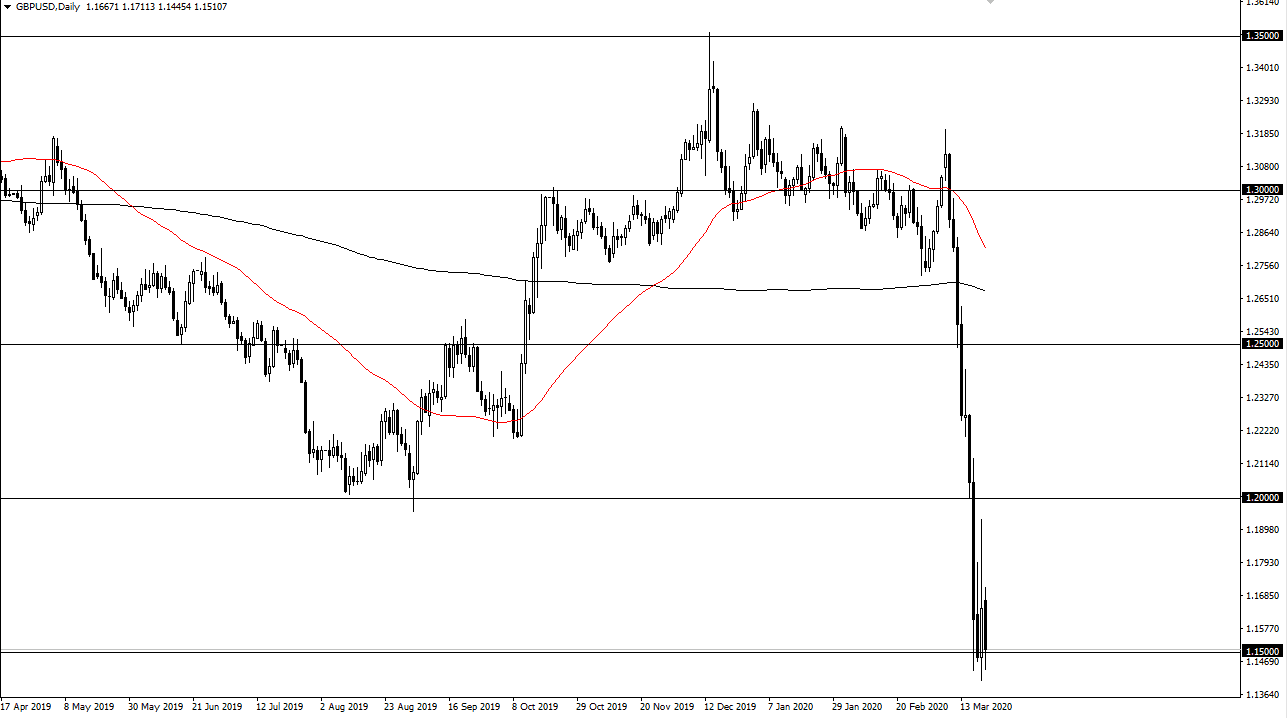

The British pound initially tried to rally during the trading session on Monday but then fell apart as the market reached towards the 1.15 handle. The fact that we have printed a 1.14 handle a couple of times now is quite remarkable, as it is such a historically low price. However, there is talk of the United Kingdom locking down due to the coronavirus outbreak, and that of course will crush the economy, which is already fragile to say the least.

Furthermore, the United States dollar continues to be in high demand by players around the world, especially emerging markets. While this doesn’t necessarily affect the United Kingdom directly, the fact that the US dollar is one of the strongest currency’s right now is something that has a bit of a “knock on effect” in this currency pair. With that being the case, it’s very likely that the market will continue to see a lot of volatility going forward, as the market has seen a lot of conflicting headlines and of course issues globally when it comes to a multitude of problems.

Looking at the candlestick, it isn’t exactly reassuring for the British pound. That being said, if we break down below the lows of Friday, we could reach towards the 1.1250 level underneath, possibly even the 1.10 level given enough time. Ultimately, if the 1.15 level can hold then it’s possible that we try to build some type of base. That being said, we need to see the US dollar selloff on a systematic level, which with the Federal Reserve coming in and doing quantitative easing one would think that could be possible. However, we have not seen that so far so it’s a bit difficult to think it’s going to happen in the short term. It is a possibility though and something that needs to be monitored. The British pound of course is oversold but quite frankly the markets are trading on emotion and not necessarily technicals or even fundamentals at this point. Keep an eye on that low from Friday for a selling signal, and some type of supportive daily candlestick or break above the highs from the trading session on Monday as a potential short-term bounce that you can sell closer to the 1.19 handle, maybe even as high as 1.20 level after that. I have no interest in buying the British pound against the greenback.