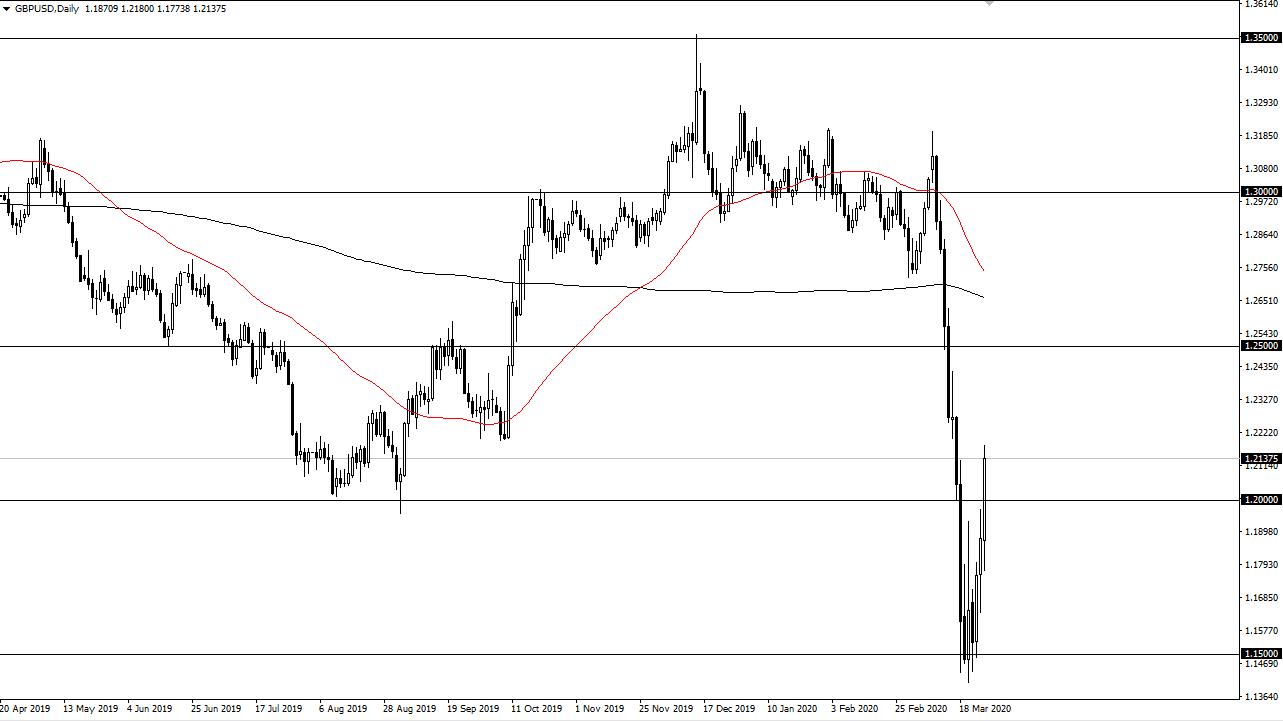

The British pound initially pulled back during trading on Thursday but then shot through the 1.10 level to show signs of a trying to turn things around. The fact that the market has broken above the 1.21 level suggests a little bit of follow-through, so I think that we may get a little bit of a pullback from here, and then perhaps some type of bounce. I believe that the Friday candlestick is going to be crucial, as the market has been sold off quite drastically, and it’s likely that we are going to see a significant amount of choppiness over the next candle or two.

The British pound of course continues to struggle due to the fact that the United Kingdom is most certainly under lockdown, and that will obviously bring down the velocity of money in that country. The economy is a bit of a drag at this point, as people being locked in their homes means that a lot of spending isn’t going on. At this point, like most Western economies, Great Britain relies on massive transmission of money from one person to the next, not on savings. In other words, with the lack of savings that the United Kingdom and the United States have, it’s likely to take much to make things look rather dire.

The candlestick size is rather impressive, but we did give back a bit of the gains early in the session. To the upside, I see the 1.2250 level above as resistance based upon the fact that it is halfway between the two major support and resistance levels the 1.20 and 1.25 above. The British pound is historically cheap, and I think at this point it’s very likely that a pullback comes, before four be a bit of a bottom. From an even longer standpoint, I believe that buying this market instantly holding onto it will make traders quite a bit of money. In fact, believe that this is a “career making trade” just waiting to happen. That being said though, we don’t typically see “V pattern” recoveries like this last for very long. Expect volatility but I think that the latest rally suggests that the British pound is trying to form some type of bottom. That typically means that buyers will come in on dips, with the 1.20 level being very important, and of course the 1.1750 level being important as well.